We all have habits. Good or bad, conscious or unconscious, they permeate our private and work lives, and claim examiners are no different. The tasks they perform repeatedly day in and day out while managing claims can often turn into habits. Numerous factors drive these habits and behaviors, such as:

- The company’s internal processes

- Client service expectations

- Caseloads

- The type of files they handle

- Their own personal biases

Of course, some claim examiner habits can be advantageous, as they produce positive results and outcomes. However, good habits can be tough to build and even more difficult to maintain because there are plenty of distractions that can lead examiners off track and right back into their old ways.

Habits: Framework

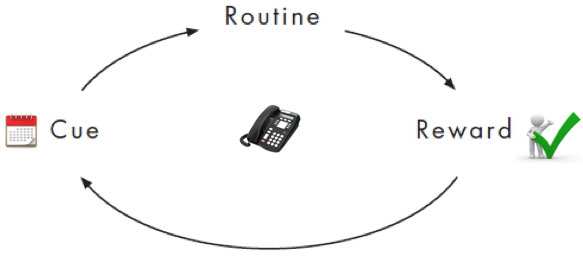

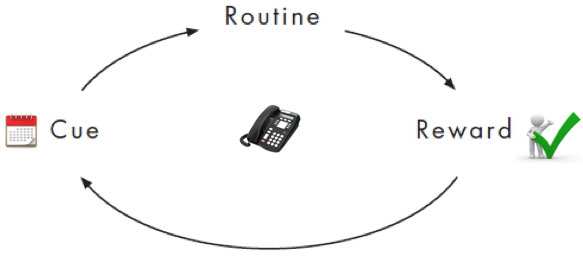

In order to foster positive habits and transform bad habits into good ones, it is necessary to first understand habits. In his bestselling book, The Power of Habit, Pulitzer Prize winner Charles Dunigg breaks down a habit into three components:

- Cue (trigger)

- Routine (behavior)

- Reward (result)

Let’s apply these components to my habit of having coffee in the afternoon. Every afternoon, when 2 p.m. hits, I get up from my desk, go down to the cafeteria and get myself a latté (extra foamy, no sugar please).

- Cue is the time – 2 p.m.

- Routine is to leave my desk, walk down and order my coffee.

- Reward is the actual taste of the latté – my coffee fix – ahhh!

Common Habits in Claim Management

When insurers put processes in place, their goal is to create a structure around tasks and activities to produce a desired and consistent result or outcome. Consciously or unconsciously, they provide a framework for habits to be developed by the claim examiner.

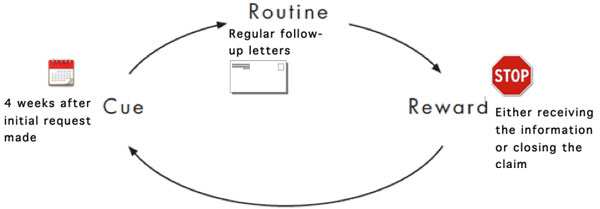

For example, here is a process that might be included in a claims guideline:

“Medical follow-ups: Requests for information should be followed up on 4 weeks after the request for information has been sent. This includes sending a letter to the physician that you wrote to and a note to the claimant advising him/her that the company has not received the requested information but has followed up and encourages him/her to do the same to avoid an interruption in benefits. If the company has followed up twice by letter and has not received a response, then the claim examiner will send out 1 final warning letter to the claimant indicating that if the outstanding document(s) are not received within 30 days from the date of the letter, then the company will assume that he/she no longer wishes to pursue his/her claim for benefits and his/her claim will be closed.”

If we accept the notion that habits are driven by positive and negative reinforcements, we can expect that the same behaviors will show up again and again when exposed to the same triggers.

If we accept the notion that habits are driven by positive and negative reinforcements, we can expect that the same behaviors will show up again and again when exposed to the same triggers.

Other examples of common habits in claims;

- Consistent data entry processes for new claims:

- Action plans completed in every file

- The same telephone interview summary template for all claims

- All letters are sent using the company’s templates to ensure consistency

- Follow-ups to various stakeholders are managed according to internal procedures

We all can agree that these are common claim process habits that most companies wish to achieve and maintain, but what impact do these habits have on claim management? What are the rewards (results) from an examiner’s perspective? Are the goals of the examiner aligned with the company’s goals? How can we shape desired behaviors to achieve positive results for both the examiner and company?

The claim examiner is essentially a pragmatic species: The examiner does what works. His or her claim management is often guided by past experiences and he or she will focus on finding the best way to produce the best results, but best result for whom? The examiner? The company? Both?

Here is the same example of the four-week medical follow-up process and analyze the habit loop from a claim examiner’s perspective:

- Cue (trigger): four weeks after the initial request to physician

- Routine (behavior): Conduct regular follow-ups with the physician and claimant by e-mail and letter

- Reward (result): Following guidelines (good audit score); moving claims forward in the examiner’s caseload

Is the reward for the company the same as the reward for the claim examiner? After all, the company also has its reward – the examiner is following the guidelines. While this may be true, insurers need to ask themselves if the habits they encourage in their claim examiners really give them the rewards they want.

I thought the reward for my afternoon break was the actual taste of a fine latté, but recently I realized that I wasn’t even finishing my coffee. Had I got my reward all wrong? Was it the taste of coffee, the caffeine fix, or simply taking a break from my desk that was really the reward?

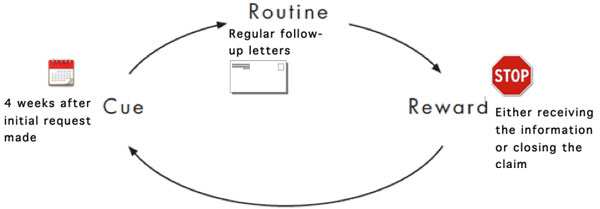

Now here is the same medical follow-up example used above, but with a few adjustments:

- Cue: four weeks after the initial request

- Routine: call the physician rather than send a letter (schedule a peer-to-peer discussion if the physician does not have time to write a report)

- Reward: faster update on the claimant’s condition, which will enable the examiner to develop appropriate action plans and possibly reduce claim duration

By shaping a new behavior or routine both the examiner and the company realized a common reward.

Below are some common claim management habits to avoid:

- Lack of strategic planning: To quote President Dwight Eisenhower: “Plans are worthless, but planning is everything.” Bad decisions or no decisions often come from a lack of preparation and planning. Assessors need to anticipate future and unexpected events and have alternative plans ready.

- Reactive vs. proactive: In the absence of planning, decision-making is often reactive. When an examiner proactively manages a claim, he is better able to drive the claim to a positive outcome rather than simply reacting to unforeseen circumstances.

- Inertia: This often occurs when the examiner fails to check all the facts of a claim and instead relies on her assumptions, or when an examiner does things because “we’ve always done it this way” or “I’m following the company’s guidelines,” without applying critical thinking skills.

- Remaining locked in the past: Remember that every file is different, with a different set of facts and nuances. The claims examiner assessor cannot assume that because one case had a certain outcome or fact, a similar case will follow the same pattern.

Forewarned Is Forearmed

For claim processes, habits can be a good thing and are necessary for consistency across the claims organization. In claim management, however, habits, especially bad ones, can be counterproductive and even costly for the company. The key is to know how to identify bad habits and turn them into good habits.

Now it’s 2 p.m., and time for my … walk!

If we accept the notion that habits are driven by positive and negative reinforcements, we can expect that the same behaviors will show up again and again when exposed to the same triggers.

If we accept the notion that habits are driven by positive and negative reinforcements, we can expect that the same behaviors will show up again and again when exposed to the same triggers.