By Martyn Gilling, Vice President, Business Development, RGA Canada1

Concerns about policy lapses and the associated anti-selective mortality experience are generating frequent conversations among actuaries in North America and Australia.

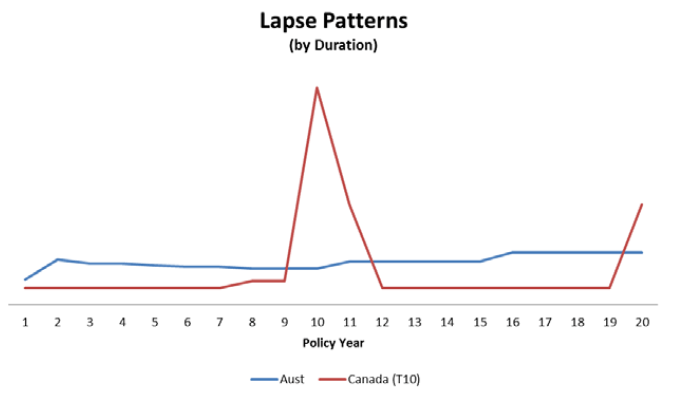

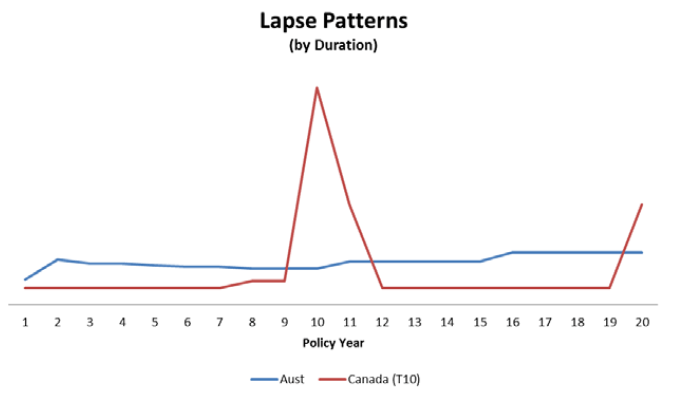

Australia’s advisor-driven term market consists almost entirely of yearly renewable term (YRT) policies, some of which are bundled with acceleration riders covering total and permanent disability (TPD) or critical illness. The market is experiencing 14% to 15% annual lapse rates, due to a variety of factors – primarily 12%-15% YRT premium increases and a combination of first-year advisor commissions of 100% to 110%, short responsibility periods and significant industry competition on product features encouraging advisors to consider alternatives. These high lapse rates can lead to an anti-selective lapse effect (i.e., healthy lives lapsing while impaired lives renew) and difficulties recovering deferred acquisition costs, all putting pressure on industry profitability.

Canada’s main term life product is level premium term, with T10 being the most frequently selected duration. These policies renew into another level premium term period (unlike U.S. products, where post-level term renewals are generally YRT) with a significant increase in renewal premiums at the term’s expiration.

Canada’s main term life product is level premium term, with T10 being the most frequently selected duration. These policies renew into another level premium term period (unlike U.S. products, where post-level term renewals are generally YRT) with a significant increase in renewal premiums at the term’s expiration.

A recent study by RGA Reinsurance Company, sponsored by The Society of Actuaries (U.S.)2, found a high correlation in the post level term period between premium increases, resultant lapse rates and mortality experience. Reliable experience is also emerging in Canada that is showing very similar results and impacting term life product profitability.

Solutions to Reduce Lapses

Direct writers in Australia are considering how best to increase policy retention. Some firms have established retention teams to which all client requests to lapse are automatically directed. These teams then work with clients to identify the reason for each lapsing decision and develop a solution that might prevent the lapse.

Suggestions include:

- Turning off automatic indexation

- Reducing the sum assured

- Lapsing only the riders (leading to critical illness and TPD riders having lapse rates 30% higher than those of the underlying mortality policies)

In addition, Australia’s direct writers are considering changing product design aspects that are seen to be contributing to the high lapse rates. There is much interest in the North American level term model due to its lower lapse rates. The significant lapse spike and anti-selective mortality at the end of the level term period is, however, of concern, and design modifications are being considered.

Other activities are focused on the advisor’s role in the distribution process. Australia’s recent “Future of Financial Advice”3 legislation, which focuses on advisor remuneration, conflicts of interest and quality of advice, may stem some of the lapses. Australia’s government4 has also proposed cutting upfront payouts to 60% by 2018 and limiting ongoing commissions to 20% by January 2016 while one direct writer5 has already reduced upfront YRT commissions for its tied advisers to 80%, ongoing commissions to 20% and limited advisor access to year-one commissions once in every five years.

My early observations on the market here are that Canadian insurers are considering product design approaches and retention initiatives similar to Australia’s that might reduce the impact of the post level premium term lapse spike, and the focus on such development is likely to increase going forward. One company has already introduced a policy option aimed at reducing the post level term premium increase and resultant lapses. It is interesting to see that the CLHIA is also discussing the impact of advisors and what should be done in this area.

Summary

Although half a world apart, with significant differences in underlying term product design and resultant lapse rates, there are certain similarities in the retention issues and trends facing the term insurance markets in Canada and Australia. Could design modifications and regulatory change being considered in each market benefit the other? We will no doubt know soon.

Canada’s main term life product is level premium term, with T10 being the most frequently selected duration. These policies renew into another level premium term period (unlike U.S. products, where post-level term renewals are generally YRT) with a significant increase in renewal premiums at the term’s expiration.

Canada’s main term life product is level premium term, with T10 being the most frequently selected duration. These policies renew into another level premium term period (unlike U.S. products, where post-level term renewals are generally YRT) with a significant increase in renewal premiums at the term’s expiration.