Using wearable fitness tech to develop insurance wellness programs has been the subject of an industry-wide discussion for years. And as the technology improves, the conversation grows.

At RGA, we wanted to gather meaningful data and gain experience over theory in our understanding of insurance wellness initiatives.

In 2016, RGA conducted an anonymous study among its employees and their friends and family to explore wearable fitness trackers’ potential application for insurance product development. The study included around 1,000 participants from 23 countries and was conducted over 12 weeks using five tracking devices.

Key insights for insurers included these five takeaways:

1. Accuracy Remains an Issue

Not all devices are created equal. For improved plan performance, insurers should consider mandating high-quality trackers, retrieving data from multiple devices, or limiting member benefits based on the quality of the device, particularly for those plans in which higher activity levels trigger additional benefits.

The study used multiple devices and confirmed our assumption there would be differences among them in consistency of measurements. For example, between the study’s two main devices – both wrist-based – steps recorded on one were, on average, around 8% higher than those recorded by the other. To be fair to their customers, insurers will need to reflect these differences in the activity targets they set.

Although we tested only wrist-based devices, it is notable that one participant recorded approximately 19,000 steps on his smartphone while simultaneously recording approximately 13,000 steps on a wrist-based device. This is a good illustration that the wrist may not be the best place to collect accurate, reliable biometric measurements. In order to obtain an accurate picture of activity, insurers will need to develop multi-device, multi-location solutions.

Our study provided an opportunity to begin investigating how to identify fraudulent activity, such as manufacturing steps by “wiggling your arm.” We found activity to be remarkably consistent in terms of level (steps per minute) and routine (day of week and time of day), and we observed fairly consistent bands of activity levels linked, very broadly, to environment (home, office, outdoors, etc.). Manufactured steps were identifiable as they occurred at activity levels not normally seen and at times of day when activity did not normally occur. This suggests fraudulent individuals will need to be quite sophisticated if they want to hide their “cheating.” However, a rather surprising result was that manufactured steps sometimes raised heart rate to a level above that which would have been expected, so was this cheating at all? Significant further work is required to generate an accurate and robust solution for identifying fraudulent activity, but the initial signs are promising.

Questions the industry should be asking:

- How can insurers easily evaluate the accuracy and reliability of wearable devices?

- How should insurers translate these differences to ensure fairness among customers?

- How do insurers build a multi-device, multi-location solution?

- How can insurers identify and limit fraudulent activity?

2. Style and Comfort Count

Although it is important to evaluate and approve devices based on accuracy and reliability, insurers should also consider allowing participants as much choice as possible in what they wear. The more choices among approved devices, the better the user engagement and persistency.

User experience differed significantly among trackers. Attractiveness, unobtrusiveness, and ease of setup were listed as the most desirable features in a device. Reliability mattered as well; one device produced an unacceptable failure rate of 5-10%. Due to safety issues, this same device is no longer available on the market, which further illustrates the importance for insurers to remain device agnostic and not depend solely on one brand of fitness tracker.

Interestingly, a significant proportion of those who either found wearing their device annoying, or who did not enjoy wearing it at times, were still interested in buying a tracker – just not the one worn during the study. This suggests there may be consumers interested in self-monitoring if they could just get started. Is there an opportunity for insurers to facilitate this initial step and generate a pool of potential wellness customers?

Many participants also found it uncomfortable to sleep wearing their devices. This is significant as future-generation wearable devices are expected to intelligently target when they sample biometric measurements. The data collected during sleep – which is less affected by the ‘noise’ caused by movement – is likely to be important in accurately calculating more sophisticated and informative metrics such as heart waveform and pulse wave velocity.

Key questions to consider moving forward:

- What is the human real estate wearables will eventually claim?

- With the proliferation and wide variety of wearable tech devices, how can insurers both allow for consumer choice and confirm device accuracy?

- Some of the latest devices do address style and comfort concerns. When will these devices be more affordable and widely available?

3. Privacy is a Priority

The increasing popularity of wearables is undeniable, yet many choose to remain non-users, mainly due to lack of interest or privacy concerns. Insurers need to factor this in as they develop wellness plans.

Although a certain amount of participation in the RGA study may be attributable to employees wanting to help their employer, the response rate is still notable. Our initial goal of 500 participants was exceeded less than 24 hours after issuing the request for volunteers. We then expanded the study to include 1000 people. This enthusiastic response rate, coupled with the rapid growth in sales of wearable tech (expected to reach $34 billion by 20201), underlines the general popularity of health tracking devices.

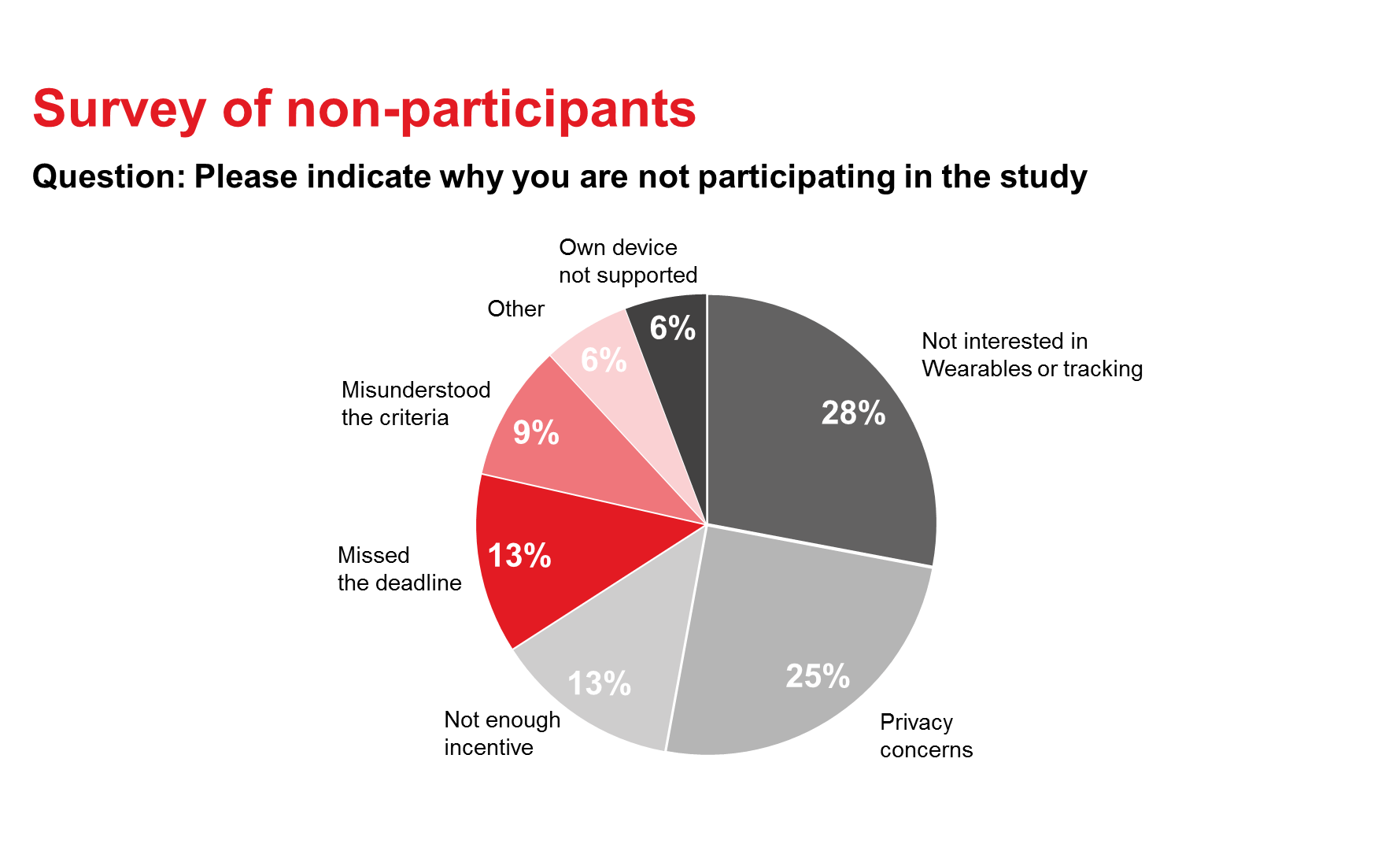

Nevertheless, significant segments of people remain uninterested or uncomfortable with wearables. Our survey of non-participants, which also received hundreds of responses, provided insight into reasons why. In the chart below, the segments shaded grey represent the genuine objections. Note the significant privacy concerns – even in the context of an anonymous trial.

These results elicited two clear questions:

- How can insurers generate interest among those apathetic toward wearable tech?

- What can be done to allay privacy concerns?

Answering these questions will require building trust among potential consumers, identifying individual needs, and communicating how wearables and wellness plans can meet those needs. Wellness plans will only work in the long term for those who are intrinsically motivated to participate.

4. Demographics Bring Differences

When designing wellness plans, it is important for insurers to identify demographic differentiators and consider support and incentives to appeal to each.

Not surprisingly, the study found that different demographic characteristics affected participation in different ways. The specific impact of certain characteristics, however, did generate some notable results.

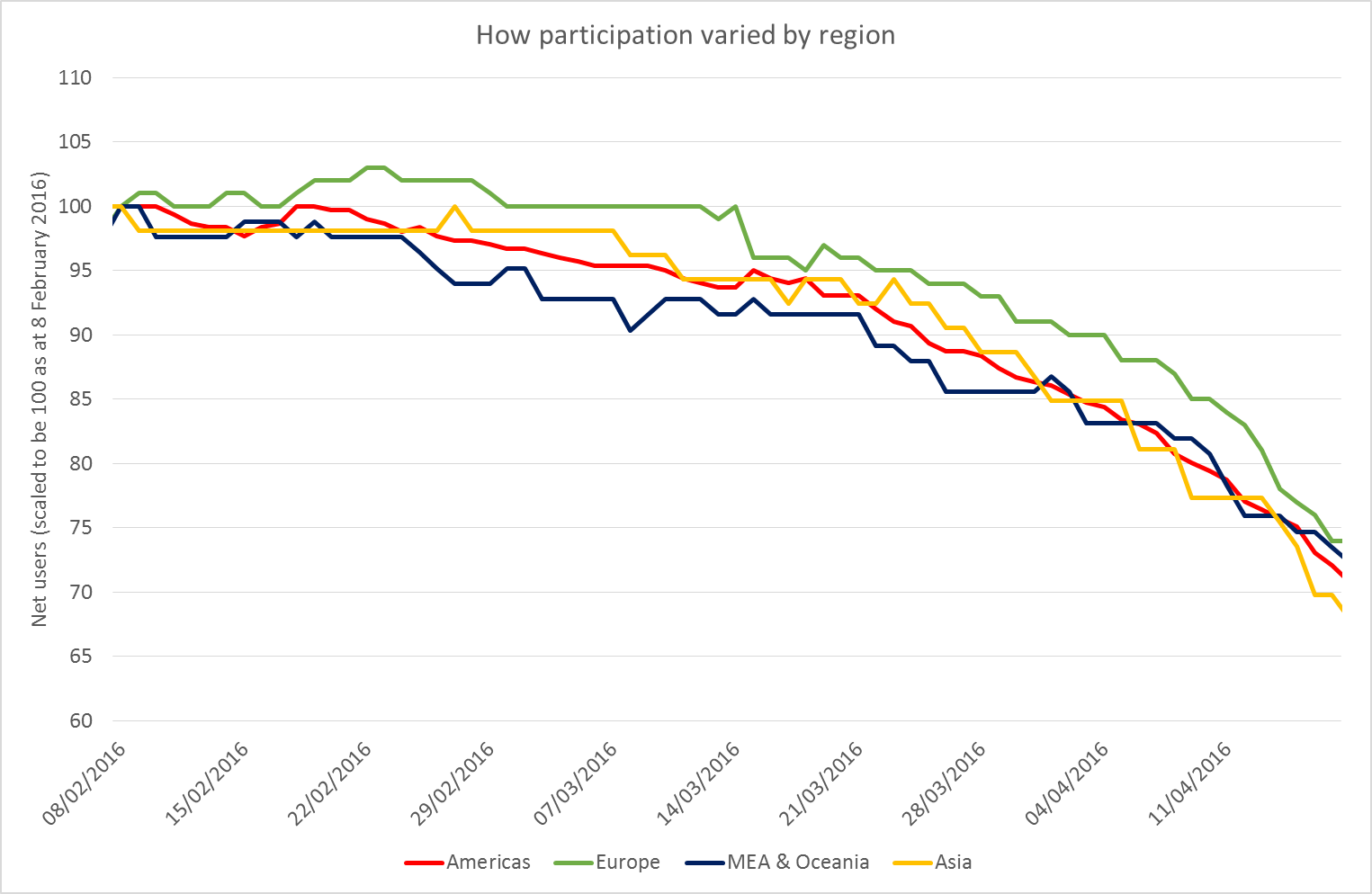

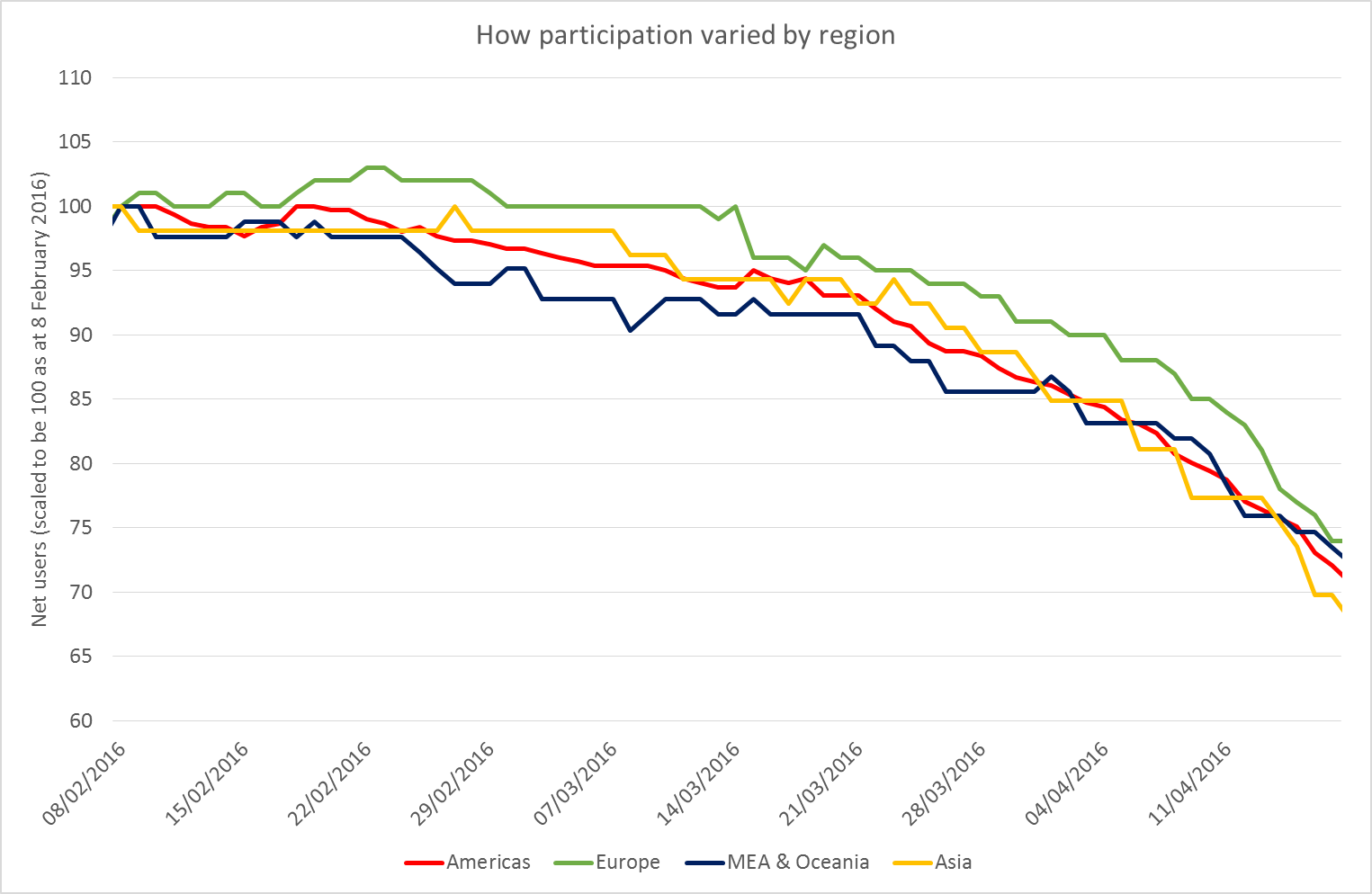

When analyzing participation by region, for example, we found very little variation, as illustrated in the following chart. (To aid comparison, participation levels have been scaled to be 100 at February 8, 2016, by which time most participants had been onboarded.)

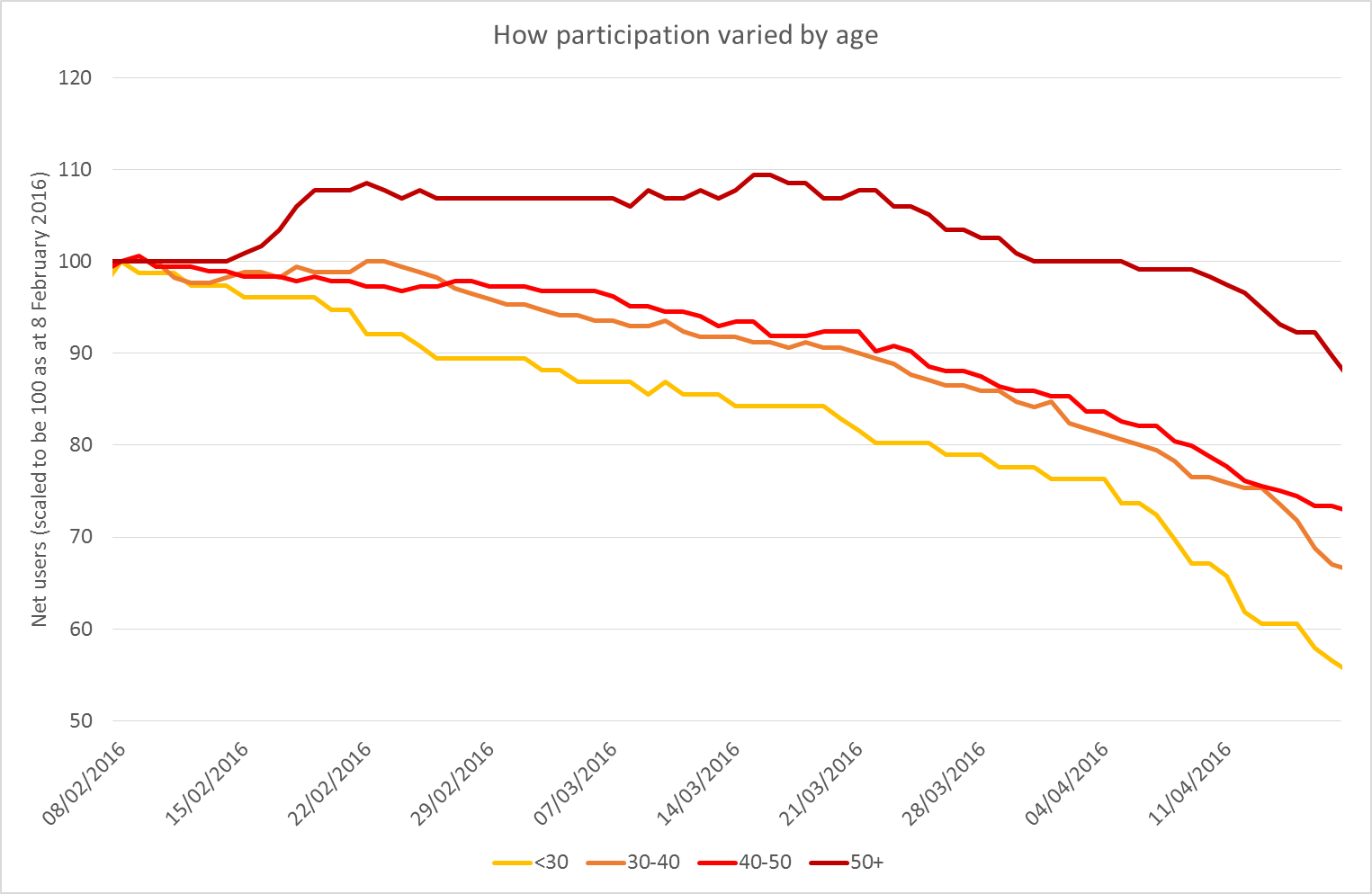

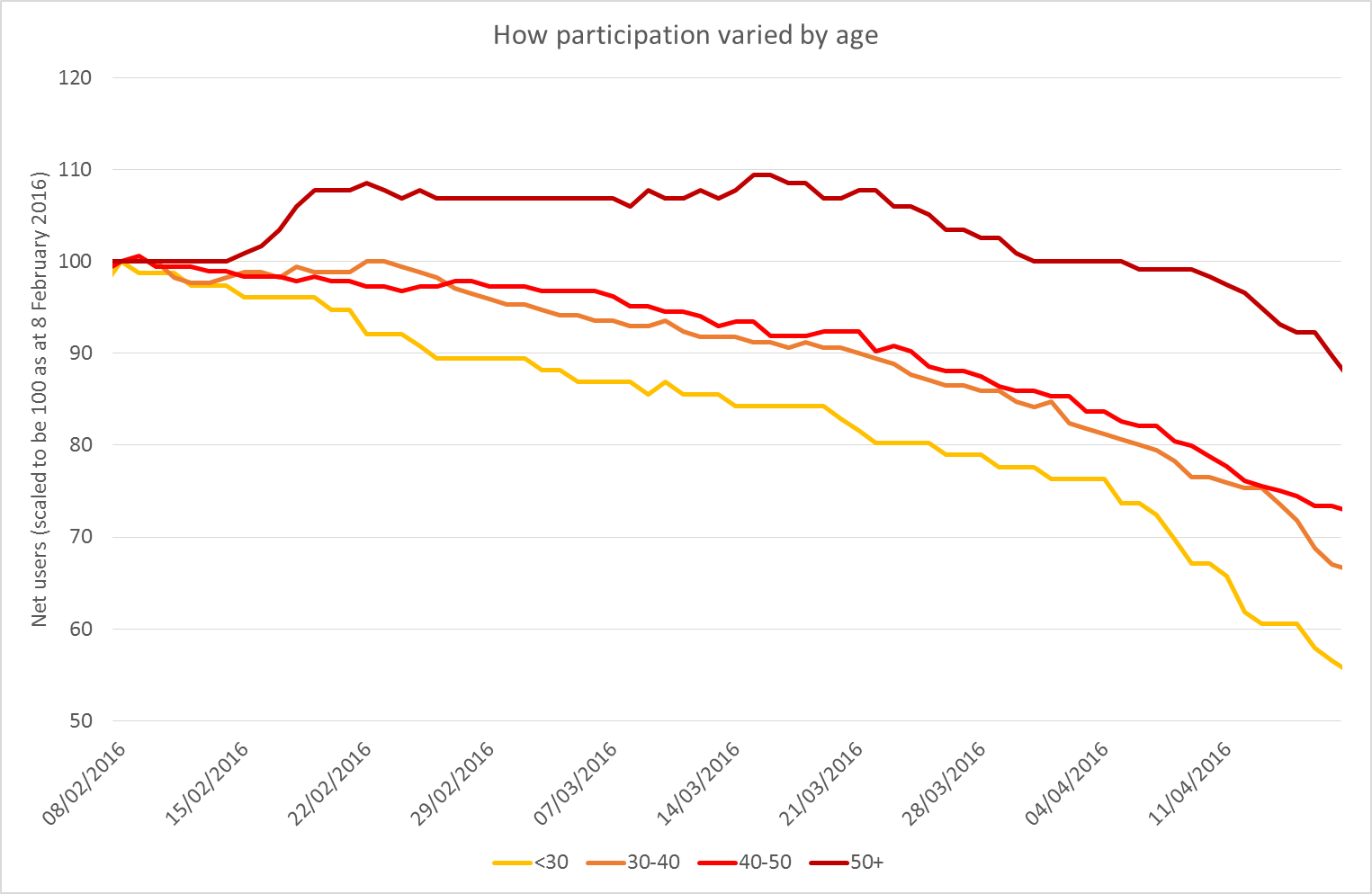

On the contrary, participation levels by age did show significant differences. The over-50 age group had the highest participation level and the under-30 group the lowest. (Again, participation levels have been scaled to be 100 at February 8, 2016.)

While participation rates varied little by geography, activity levels showed significant regional differences. The Americas had the lowest level of activity, but showed a fairly consistent increase throughout the study, possibly as the more sedentary participants dropped out. MEA (Middle East and Africa) and Australia had the highest activity levels, and participants in these regions were more active in the earlier weeks (possibly a “Hawthorne effect,” i.e., behaviour changed when participants started being observed, but then returned to normal). A similar but stronger effect was also observed in Asia. In Europe, activity levels were fairly even throughout the study with a slight dip in activity during one week, which we attribute to an increase in vacation days due to mid-term school holidays.

Key Takeaway: Tailor to the Target Market

What works in one region for one demographic is unlikely to be directly transferrable to other regions and other demographics. Addressing this will require effective behavioural segmentation to classify participants by health and activity characteristics across different geographies. (As a global reinsurer, RGA is ideally positioned to help insurers accomplish this. Contact us to learn more.)

5. Data is the Driver

The wearables study was RGA’s first step at gaining experience over theory and provides a starting platform from which we can advise our clients and launch deeper, more interesting work. We have initiated a program of gathering more hard data to support meaningful conclusions in the wellness space and are now working on additional pilot projects and seeking partners with more sophisticated metrics and modelling frameworks. After all…

“Without data you’re just another person with an opinion.” - Andreas Schleicher

The Insurance Opportunity

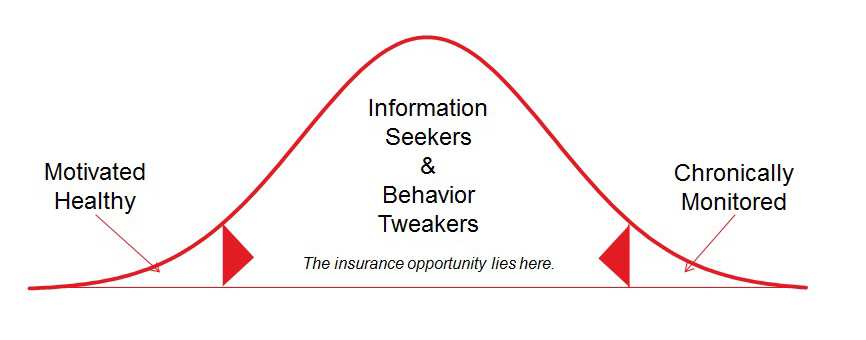

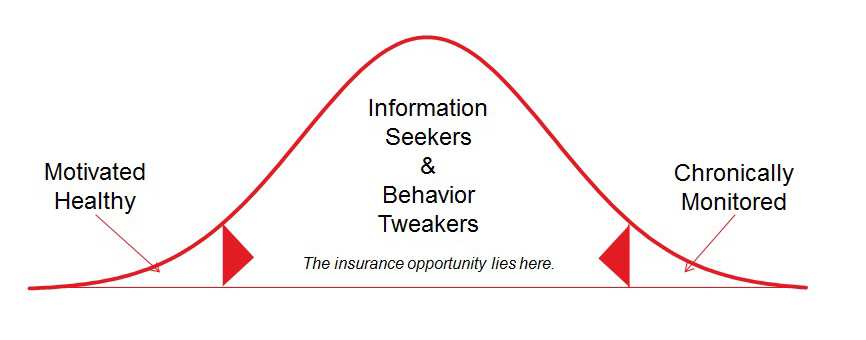

Early consumer adopters of wearable technology mostly have included individuals on both extremes of the health spectrum: motivated, active people and chronically ill people under medical monitoring. Each of these ends of the adoption curve is pushing toward less extreme consumers in the middle.2 As activity tracking becomes more mainstream and as increasing numbers of late adopters become interested information seekers and behavior tweakers, wellness becomes a greater insurance opportunity.

Insurers should avoid waiting too long to answer the many questions surrounding wearable tech or shoehorning old methods into new vehicles. Winners will be those providers who are proactive, execute for the right reasons, and seek to innovate in the tech space.