Summary

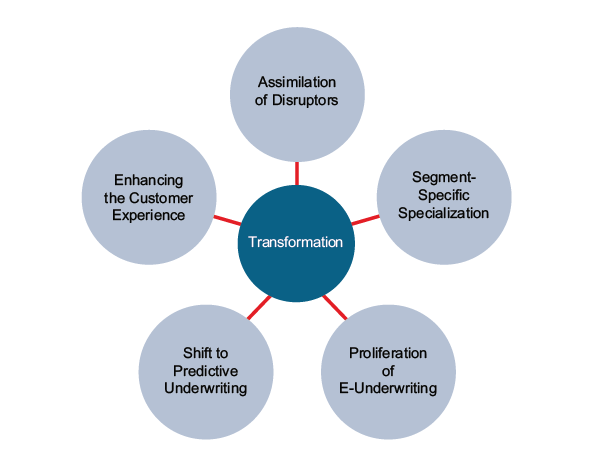

The underwriting of life and health insurance products is entering a transformational phase – one that, for now at least, is being driven more by advances in data, analytics and processing technology than advances in medicine. It is the digital transformation of business processing that will, at last, enable insurers to start transforming the customer’s underwriting journey to one as seamless as the digital apps that will be the primary engagement tools for the next generation of consumers.

RGA’s 2017 Global Life and Health Underwriting Survey findings demonstrate that for 25 leading life and health insurers from around the world, the practice of underwriting is being challenged not just to keep up with these advances, but to play a leading role in the transformation of business processes and the deployment of strategies to grow new business.

For this survey, conducted online from August to September 2017, underwriting leaders from large global, regional and single-market life and health insurance companies were queried about their priorities and challenges in this radically changing function. Survey participants provided their perspectives on the industry, the business environment and their organizational plans for the future.

We found underwriting leaders are currently thinking strategically about their business practices – particularly about the role of underwriting in today’s environment, and the importance of underwriting as part of the response to the persistent forces of increased competition, technological disruption and changing consumer expectations.

It is apparent that transformations in underwriting are actively accelerating across the globe. Even if the degree of formality differs by company and region, key aspects of change, such as predictive underwriting, electronic underwriting, assimilation of disruptors and segment-specific strategies, are being tackled by multinational and large insurers alike. The industry stands to benefit greatly from this transformation, and steps are being taken to capture that value now.

Looking ahead, priorities will shift and expand, and investments will be made that will create opportunities among various approaches. The time to test and learn, however, appears to be now, as insurers reported their investment dollars are already flowing in this direction.

RGA conducts global surveys on several industry topics to provide clients with tools to increase profitability, efficiency and effectiveness. We would like to thank the 25 life and health insurers for their time and effort responding to this survey. We hope you find the analysis and insights informative as you continue to refine your approach to this critical function.

The Timeframe for Transformation Is Now

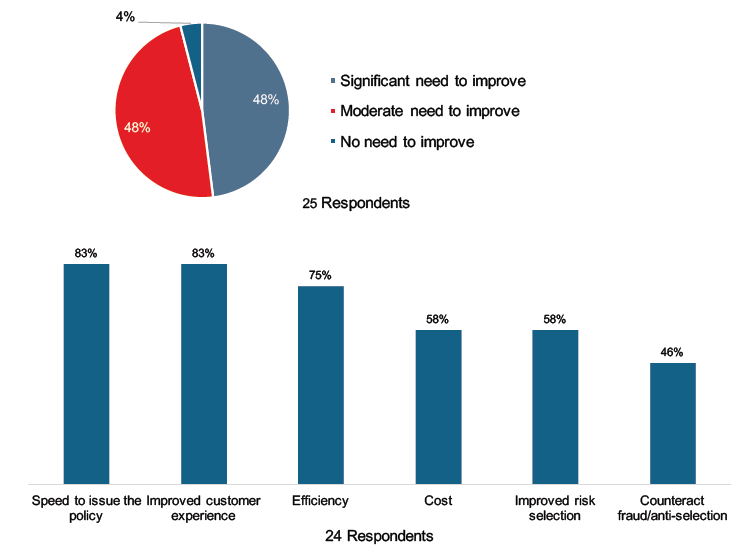

Underwriting leaders globally were nearly unanimous in their assessment that there is a current perceived need in their organizations to change, with 96% indicating a significant or moderate need to improve performance overall. When asked what metrics they would be most focused on improving, top responses included: Policy Turnaround Time (83%); Improved Customer Experience (83%); and Efficiency (75%). Overall Underwriting Cost and Improved Risk Selection rounded out the top five priorities with 58% each.

Dimension 1: Assimilation of Disruptors

It is easy to forget that only relatively recently has talk of disruption within the life and health insurance industry gone mainstream. Amid much fanfare, tech players and new market entrants, backed by new disruptive technologies, are expected to reinvent the insurance model, which could displace established incumbents. Subtly, the focus of conversations appears to be changing, with established incumbents now thinking about how to assimilate disruptive innovations into their strategies to further their enterprises’ strategic growth objectives. The underwriting function is a key focus within this shift.

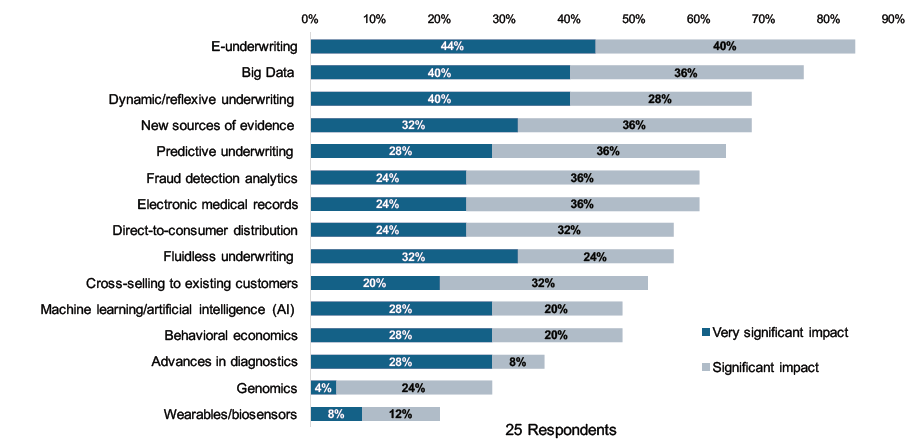

We asked underwriting leaders which innovations would have the most significant impact on the life and health underwriting function over the next three-to-five years: Electronic underwriting topped the list with 84%, indicating a Significant or Very Significant impact. Big Data was indicated by 76% of respondents, Dynamic (or Reflexive) Underwriting by 68%, New Evidence Sources by 68%, and Predictive Underwriting by 64%.

Figure 4:

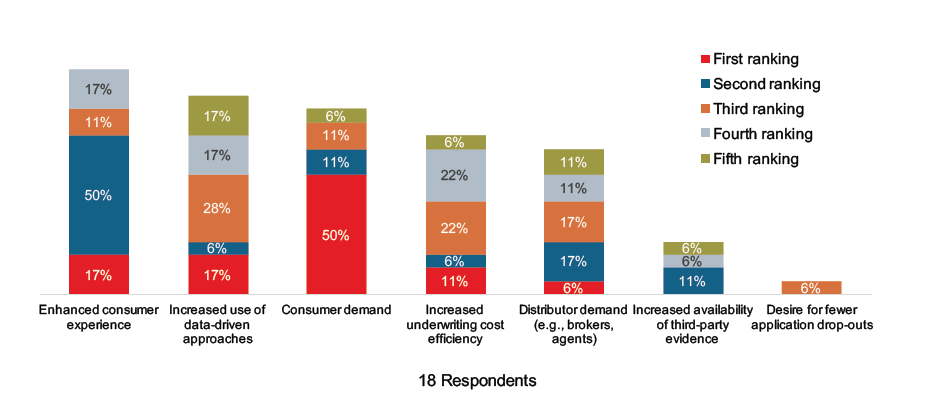

Dimension 2: Enhancing the Customer Experience

A growing number of life and health insurers recognize that providing a strong customer experience is not just about building goodwill, but can also be a tool to create magnetism with an insurer’s customer base and differentiate it from competitors. In fact, many of the insurers surveyed have “Customer Centricity” or some variant as a key pillar in their strategic roadmaps. Incrementally, as distribution shifts (in some markets more towards direct approaches), more of the customer experience is being shouldered by the insurer (versus intermediaries). Underwriting is often one of the entry points to a long-term customer relationship and that first impression – if done right – can be the cornerstone of a high lifetime value connection.

The fully underwritten process has been singled out as one of the traditional consumer hassles. Application processes can be time-consuming and confusing, and it can take weeks for a policy to be issued. This is increasingly dissatisfactory to consumers who are now familiar with the point-click-buy models of online retailers like Amazon and Alibaba.com.

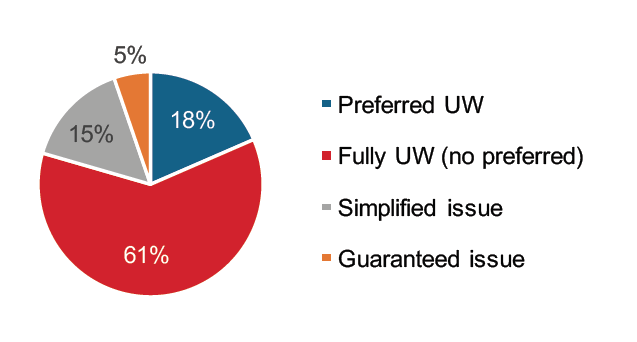

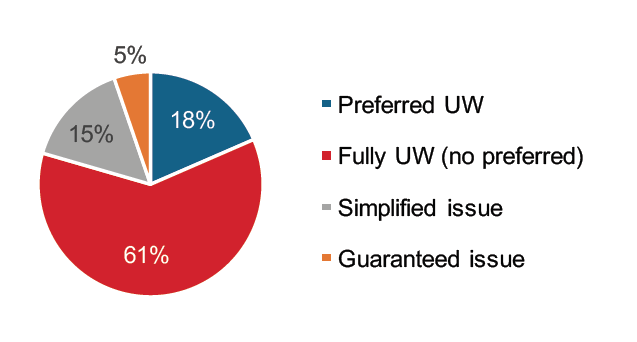

Survey respondents indicated that 61% of new business in 2016 was fully underwritten. Preferred approaches (i.e., segmentation of the standard pool to isolate and offer lower rates to those lives that are expected to perform better than standard mortality) are more prominent in markets such as the United States and Canada.

Figure 5:

Percentage of New Business Revenue by Underwriting Method

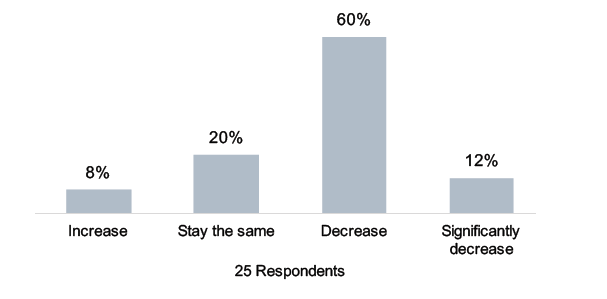

RGA observed that there is a widespread belief that to compete, insurers will have to rely less on fully underwritten approaches and, increasingly, on more customer-friendly and efficient underwriting options to win business. Seventy-one percent of underwriting leaders reported that they expect the percentage of new business premium that is fully underwritten to decrease or significantly decrease within the next five years (as shown in Figure 6).

Figure 6:

Dimension 3: Shift to Predictive vs. Reactive Underwriting

The use of advanced data techniques in property and casualty insurance underwriting has been well established for years. The common consensus has been, however, that predictive approaches have been evolving at a slower pace in the life and health space. Results from our 2017 survey are challenging that belief, as RGA observed an acceleration in the shift towards the use of predictive approaches.

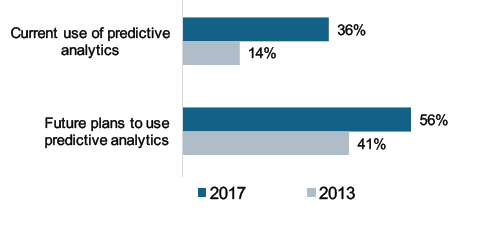

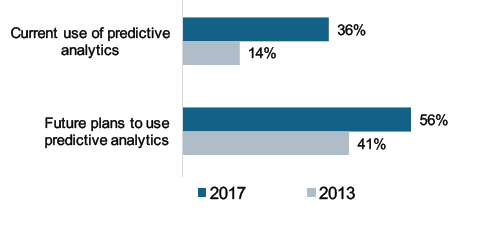

Thirty-six percent of insurers surveyed are using predictive analytics and tools in their underwriting processes (compared to 14% in RGA’s 2013 Global Underwriting Survey), indicating that predictive approaches are taking root within an increasing number of insurers. Most interestingly, for those not currently using predictive approaches, more than half (56% of respondents) reported that they plan to use them in the next three to five years (as compared to 41% of survey respondents from the 2013 RGA Survey).

Figure 8:

Current and Future Usage of Predictive Analytics

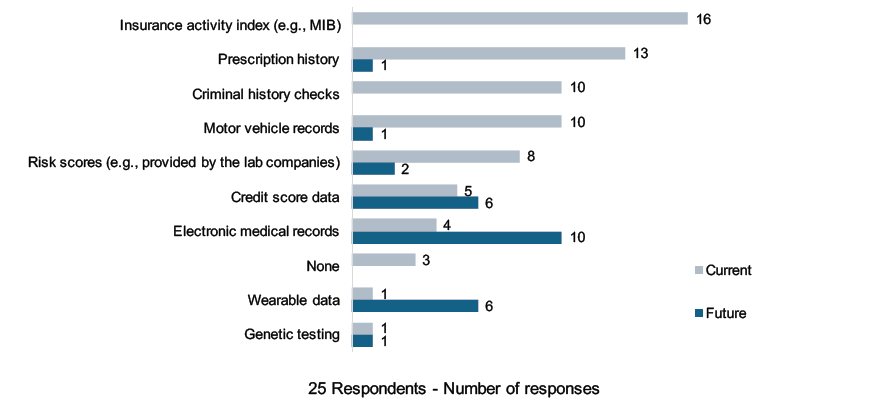

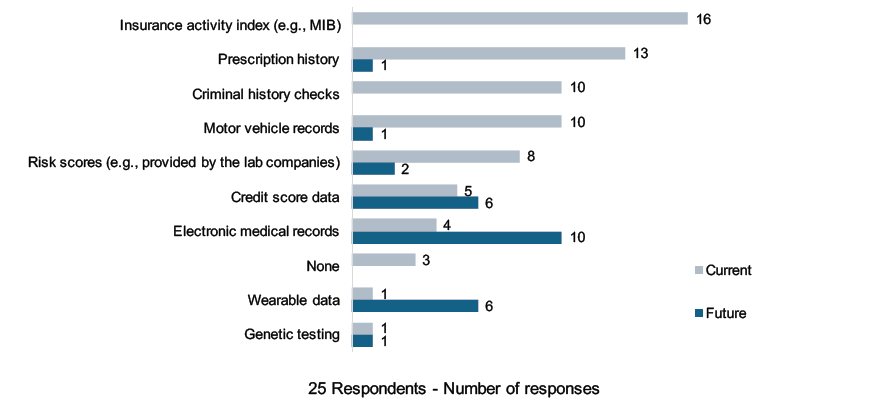

Driving the shift to predictive approaches is the increased availability of alternative evidence sources with complementary data (see Figure 9, below). As expected, insurers are predominantly using trusted resources, such as Insurance Activity Indices (MIB) and Prescription Drug History, with 16 and 13 responses respectively, followed by Criminal History and Motor Vehicle Records with 10 responses each. However, in the future, underwriting leaders indicated that Electronic Medical Records, Credit Scores and Wearable Data represent “the next big things” for incorporation into their approaches. Of those survey respondents not using those alternative evidence sources today, many indicated plans to use them within the next five years.

Figure 9:

Current and Future Usage of Alternative Evidence

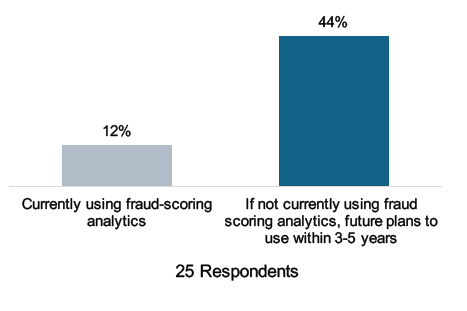

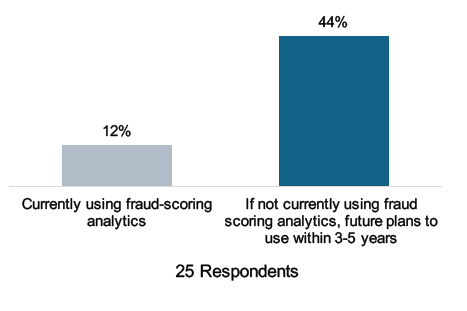

Fraud-scoring analytics is an area of specialization within the field of predictive underwriting where the survey found accelerated expectations for adoption. In this area of focus, insurers use data and analytics to flag individuals at high risk for fraudulent behavior. Survey results, as seen in Figure 10, found that only 12% of organizations are currently using fraud-scoring analytics in their application process, and 44% of the remaining organizations plan to do so in the next three to five years.

Insurers remain mindful of the risks inherent in new predictive approaches, and are seeking assistance to provide new approaches as well as validate in-house solutions. All of the survey respondents reported seeking reinsurer advice when incorporating third-party evidence into their underwriting processes, and 40% indicated that they seek help from consulting firms.

Figure 10:

Utilization of Fraud Scoring Analytics

Dimension 4: Deployment of Electronic Underwriting

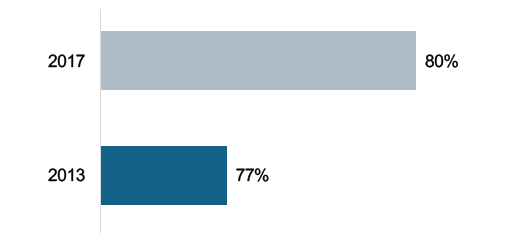

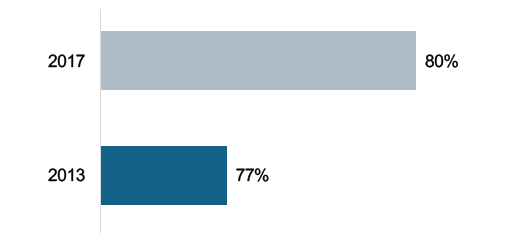

Automation of underwriting (e-underwriting) is not a new concept; indeed, it has been a growing part of new business processing for more than two decades. This survey noted a continuing trend of strong interest and focus on expanding the role and rate of business processing through e-underwriting solutions. Eighty percent of respondents said they have deployed an e-underwriting system in at least one business line or local country office, compared with 77% of respondents in 2013. E-underwriting systems, once viewed as a critical enabler of efficiency, cost savings, and enhanced customer experience, are now increasingly being used as vehicles for deploying predictive models into the underwriting process. They have also effectively become a foundation for broader business processing “ecosystems,” through which insurers are delivering an expanded array of data-driven predictive, preferred, fluidless1, and simplified decisions.

Figure 11: Deployment of e-Underwriting

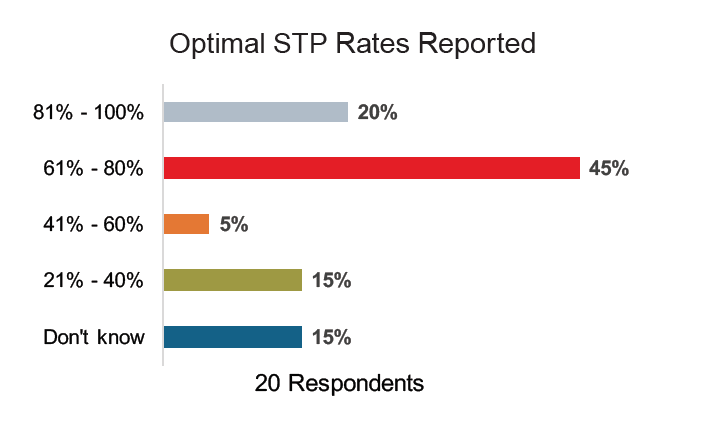

When asked what attributes of an e-underwriting system they see as important for driving future growth, respondents cited Straight-Through Processing (STP) rates as the most common area of focus. The survey delved further into underwriter expectations for their e-underwriting platforms and found that 65% of insurers expected a STP rate greater than 60% as an optimal level.

Figure 12:

Other underwriting leaders, however, were quick to point out their belief that an experienced underwriter cannot be replaced by an e-underwriting system, and that strategies incorporating e-underwriting should be balanced in the use of human and electronic approaches to optimize outcomes.

Dimension 5: Segment-Specific Specialization

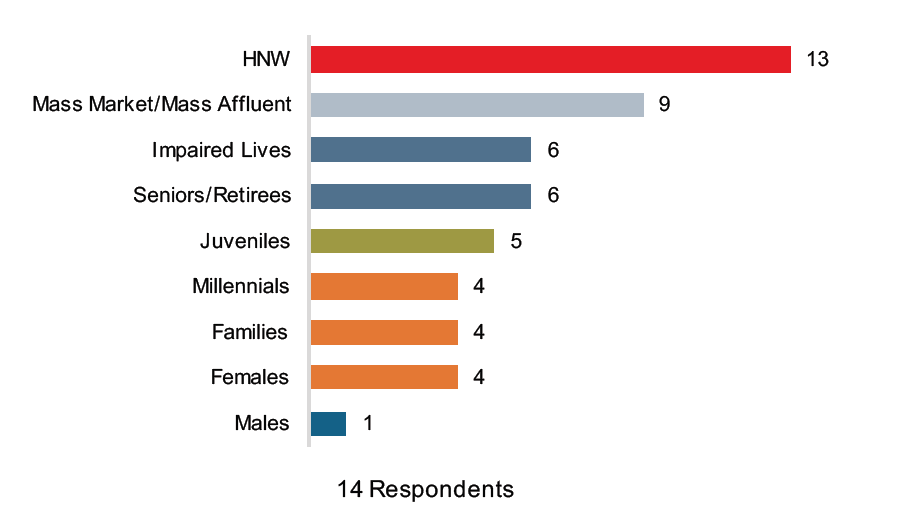

As many insurers shift towards a consumer-centric approach, a theme that has emerged globally is less reliance on “one-size-fits-all” products and a renewed focus on more segment-specific strategies. Survey results indicated insurers are currently developing or plan to develop targeted strategies to cater to specific socioeconomic segments. The high net worth (HNW) segment garnered the most attention, with 13 respondents indicating they already had or planned to have a formal program in place within the next two years. The mass market/mass affluent segment is supported by nine insurers.

Six respondents indicated they are either currently creating or plan to create dedicated underwriting strategies for individuals with impairments and seniors/retirees. Five companies reported an underwriting focus on the juvenile segment, while four respondents respectively, indicate support for the following segments: millennials, families, and females. There was one response for the male segment. We were curious to understand whether underwriting units were keeping pace with the segment-specific focuses of their parents – and from the responses collected (see Figure 13, below), it appears segment specificity is or will become top of mind.

Figure 13:

Looking Ahead

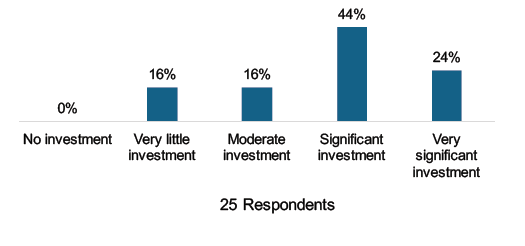

The five dimensions of underwriting transformation are under way. RGA noted an expected shift in processes and resources from our 2013 survey. Although the investments and speed at which they will evolve will vary from company to company, the RGA 2017 survey results showed that undeniably insurers are allocating more mindshare to these evolutions and are beginning to implement strategies in one form or another.

The findings demonstrate that now is a great time to evaluate underwriting approaches and take steps to begin building for 2020, 2030 and beyond. Conducting a review of strengths and weaknesses through the lens of these dimensions can help determine which are most important to your organization, and dictate where you plant flags sooner versus later.

RGA would like to sincerely thank all participants for their time in responding to this survey. We hope you find the analysis and insights informative as you continue to refine your approach to this critical function.

Survey findings revealed that change is already underway, with many respondents indicating they are either currently or intending to make significant investments in underwriting transformation. This transformation is occurring across five key dimensions, and survey responses indicated that now, more than ever, leadership across each is required to keep pace with the future strategies that hold promise to grow new business.

Survey findings revealed that change is already underway, with many respondents indicating they are either currently or intending to make significant investments in underwriting transformation. This transformation is occurring across five key dimensions, and survey responses indicated that now, more than ever, leadership across each is required to keep pace with the future strategies that hold promise to grow new business.

5d8a64c4-40be-43b0-a692-a38f20063213.png?sfvrsn=c848acc3_3)