Unpacking the Microinsurance Standards in South Africa

After several years of regulatory limbo, the implementation of a regulatory framework for microinsurance is expected to lower the regulatory barriers for new entrants and informal players, thereby promoting access to insurance for consumers that are not currently served by existing insurers.

This article summarizes the legislative path that has brought us to this point, and the key prudential and product standards for microinsurance.

How we got here

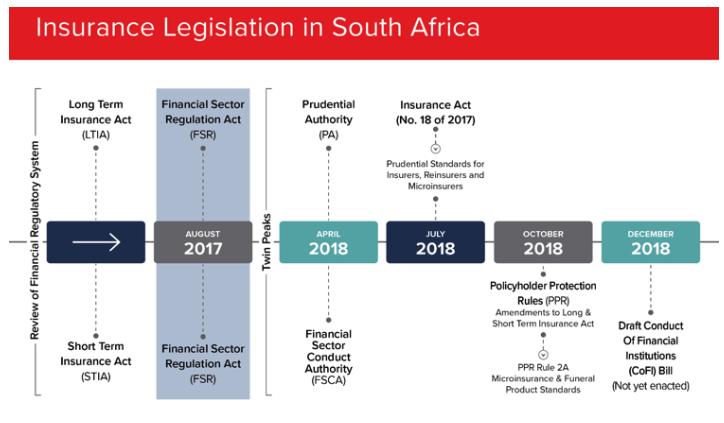

The landscape of insurance legislation in South Africa has undergone a spate of changes over the last couple of years following the passing of the Insurance Bill and Financial Sector Regulation (FSR) Act, which brought to life various aspects of the Twin Peaks regulatory framework.

Some of the changes to the regulatory framework include the establishment of the Prudential Authority (PA) and the Financial Sector Conduct Authority (FSCA). Thereafter, the Insurance Act 2017 - which outlines the prudential standards for insurers, reinsurers and microinsurers - came into effect in July 2018.

This was closely followed by amendments to the Policyholder Protection Rules (PPRs) made under the Long –term (LTIA) and Short- term (STIA) Insurance Act which houses some market conduct standards. In December 2018, the National Treasury published the draft Conduct of Financial Institutions (CoFI) Bill which is intended to replace most of the conduct requirements in existing financial sector laws in an effort to streamline the market conduct framework for all financial sector institutions. The CoFI Bill is anticipated to be tabled in Parliament in the fourth quarter of 2019.

Microinsurance standards

The development of a regulatory framework for Microinsurance in South Africa has come a long way from the initial proposals mooted in Policy document by the National Treasury in 2011, which stipulated a standalone Act for Microinsurance. The key objective of the microinsurance Act was to enhance financial inclusion and expand regulatory reach to informal insurance players. However, the initial proposals were halted in 2013 when the Regulator made the decision to incorporate microinsurance as standards under the Twin Peaks regulatory framework.

The enactment of the Twin Peaks framework gives effect to the Microinsurance standards. The Insurance Act outlines the prudential standards for microinsurers while the product standards (for microinsurance and funeral products) are outlined in Rule 2A of the PPRs.

Prudential standards

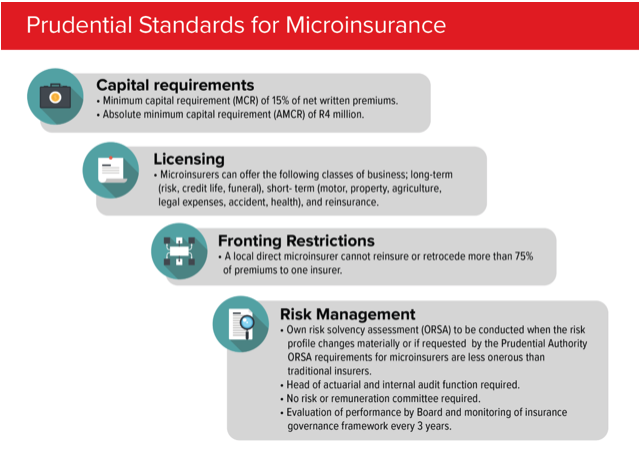

The prudential standards for microinsurers are relatively simpler when compared to the requirements for a traditional insurance license. The minimum capital and reserving requirements are significantly lower while the governance and operational requirements are less stringent. The key aspects of the prudential standards are outlined below.

Product standards

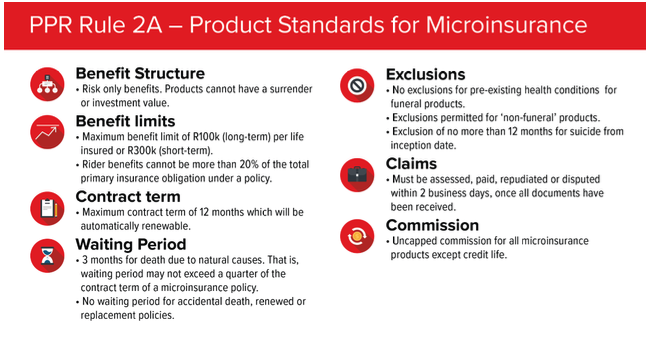

The Microinsurance Product Standards (PPR Rule 2A) stipulates the same standards apply for both microinsurers and traditional insurers who offer funeral policies. The decision to have the same standards was to create a level playing field and ensure that policyholders will be afforded the same protection under the standards.

Conclusion

The implementation of microinsurance regulation has clarified the marketplace for informal players, new entrants and consumers. The microinsurance standards are expected to promote greater financial inclusion and insurance penetration for a large, uninsured population in South Africa. The opportunities as well as the potential impact of these standards on the insurance industry, will be examined in the upcoming Part 2 of this series.