The Health Cash Shake-up

Jared Godwin

Business Development Actuary

RGA South Africa

RGA South Africa prides itself on being specialists in the Hospital Cash (or Health Cash) product market, and with a large reinsured book we have gained invaluable insights that we are able to offer to our clients. These span key areas such as product design, policy wording, pricing and claims – a critical success factor to Hospital Cash.

It’s been a little over two and a half years since the Demarcation Regulations (“the Regulations”) were promulgated in South Africa, and although that may not be a very long time in the Long-Term insurance space, there have been some surprising trends already emerging in the Hospital Cash market since this shake up.

It is useful to remind ourselves of some of the main changes that the Regulations implemented for Hospital Cash products. I have chosen the following three as the most notable in terms of having an impact on the trends we are now starting to see emerge:

- The 12-month Condition-specific Waiting Period was adopted from the Medical Schemes Act; this was arguably the most significant change proposed by the Regulations

- The minimum duration stay in hospital before a claim can be admitted (the “deferred period”) was limited to a maximum of three days

- The period from inception of the policy during which no claim can be submitted (the “general waiting period”) was restricted to maximum of three months

With the above changes coming into effect 1 April 2017, the market had to realign their products to comply with the Regulations. This realignment was expected to impact the sales process and claims experience, both incidence and decline rates as well as claims causes, of the health cash policies.

Sales process

The Regulations allow for the insurer to ask about any medical conditions afflicting the policyholder at onboarding stage, rather than allowing for a blanket pre-existing conditions exclusion clause at claims stage. This is ultimately a good thing since it creates greater clarity for the customer at sales stage who now understands what they are covered for and, more importantly, those conditions they are not covered for should a claim arise.

The limitation the industry encountered was that the sales process has always strived to be as quick and efficient as possible. With no upfront underwriting, the process is not conducive to lengthy application forms which would allow the policyholder to explain any current medical conditions they may have. As an innovative workaround to this, RGA looked towards its vast past claims data and created a list of specific conditions which we have seen to be the most commonly claimed for conditions during the previous general pre-existing conditions exclusion period. These conditions can then be disclosed upfront to the policyholder, making it easier for them to understand what is covered during the first 12 months of the policy. Of course, medical terms can be technical and it’s important for the listed conditions to be explained at sales stage in a way that the applicant can understand.

This also limits the risk of anti-selective behavior by reducing the number of policyholders who purchase the product knowing they are ill. In turn, this reduces the cost to policyholders, improves customer experience at sales and claims stage, and removes opaqueness in the product design.

Incidence and repudiation rates

The combination of limiting the deferred period and general waiting period created the expectation that the incidence rates would be higher in the period following Regulation implementation, as claims would be coming onto the books earlier than previously experienced – many insurers’ products had 6 month or 12 month waiting periods previously. However, in reality we experienced a decline in incidence rates and suspect that the market may have been dissuaded at sales stage with the more objective and clearly specified conditions on the waiting period list, or perhaps policyholders did not submit claims that were likely to be declined.

We did see a jump in the repudiation rates in the initial 12 months policy duration, as policyholders who took out the policy with an existing ailment and the expectation to claim were being declined. This is ultimately a good thing as it protects the book against anti-selective behaviour and offers protective value to long term policyholders. After this initial and short-lived jump in repudiation rates, the rates have since dropped to levels below even the pre-Regulation averages and it seems the market has settled into this new lower norm. This is beneficial to the market offering more value through greater clarity to the end customer.

Incidence rates have seen a slow increase over time as the majority of the weight of the in force books moves past the 12 month duration and therefore out of the condition-specific waiting period. We expect this trend to persist and even steepen.

Claims by cause and cost

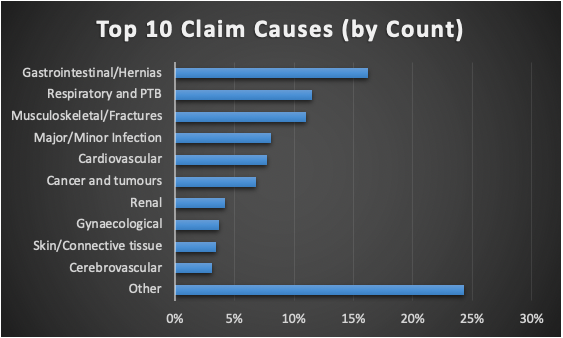

When designing the list for the conditions specific waiting period, we used our extensive past claims history – we continually refine this list as we notice new trends in claims. Since the Regulations came into effect, we see the highest number of claims (on a count basis) coming from gastrointestinal conditions such as gastroenteritis, followed closely by respiratory conditions such as upper and lower respiratory tract infections, and musculoskeletal conditions such as fractures.

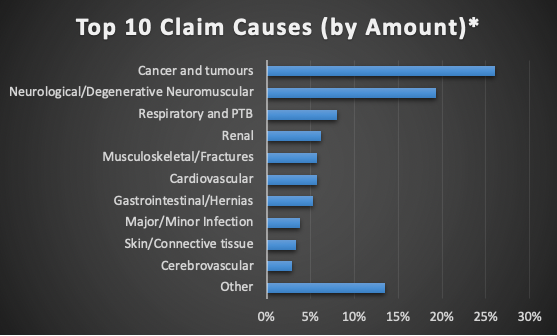

However, things look a little different when we look at the claims by claim amount instead: we see that the top two claims conditions by some margin are Cancer and Tumours, and Neurological Disorders (Multiple Sclerosis and Parkinson’s disease). These categories are classified as chronic conditions and therefore associated with regular or more frequent hospital visits, with generally longer stays per visit. Cancer and neurological claims also have high average claim amounts greater than R75,000 and are often associated with higher sums assured, possibly indicating anti-selective behaviour.

However, things look a little different when we look at the claims by claim amount instead: we see that the top two claims conditions by some margin are Cancer and Tumours, and Neurological Disorders (Multiple Sclerosis and Parkinson’s disease). These categories are classified as chronic conditions and therefore associated with regular or more frequent hospital visits, with generally longer stays per visit. Cancer and neurological claims also have high average claim amounts greater than R75,000 and are often associated with higher sums assured, possibly indicating anti-selective behaviour.

*This excludes claim categories with fewer than 10 claims

*This excludes claim categories with fewer than 10 claims

Fraud

No article on Hospital Cash would be complete without at least broaching the topic of fraud – an unfortunate side-effect of offering a life insurance product with minimal to no upfront underwriting. The RGA claims team has seen its fair share of strange claims – ranging from intentional burns to gynaecologists admitting head trauma patients!

With a skilled and experienced claims team these claims are almost all repudiated. However, the sheer number of claims our clients face on a daily basis (the market leaders see upwards of 50 claims per day) makes this process increasingly difficult and costly.

To help solve this challenge, while maintaining proper risk management protocols, RGA SA has developed the RGA Objective Suspicion Index (or “ROSI”) tool to assist clients in triaging their hospital cash claims.

ROSI

The tool was built in collaboration with a partner who has access to over four million medical aid records – a lot of data points to use for calibration! The tool’s main purpose is to identify which claims are more likely to be associated with fraudulent behaviour and abuse and therefore warrant further investigation.

ROSI allocates a score to each claim, with substantiating reasons, allowing the assessor to quickly identify which parts of the claim needs further investigation or additional information. Alternatively, the low score claims can be quickly processed and admitted with very little intervention from the assessor, provided they are valid (i.e. up to date with premiums and outside the waiting period). For the claimant, this introduces more consistency, speed and efficiency in claims decisions, resulting in a better overall client experience. For the insurer, ROSI will result in more efficient use of claims resources and hence lower claims costs allowing the claims assessor to direct their focus on more complex cases or claims on other products.

Although the Demarcation Regulations had a significant impact on the hospital cash market, we believe they were ultimately a good thing for the policyholder. RGA will continue to support our clients in innovative ways as we collectively grow this market in South Africa.