CAT Cover: A Defense Against the Sleeping Giant

Tamer Saher

Director, Business Development

RGA Middle East

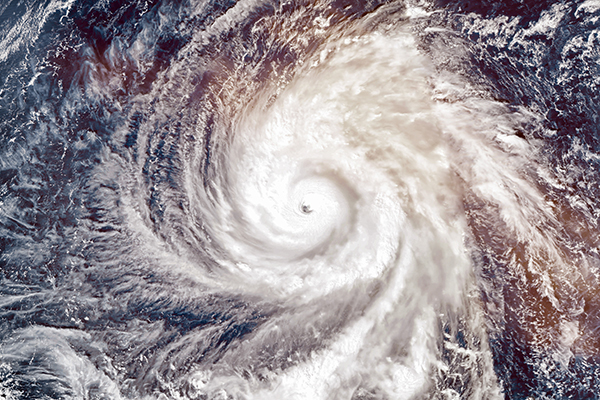

Over the past 40 years, catastrophe losses resulting from natural disasters such as hurricanes, cyclones, and earthquakes, as well as other types of events such as industrial accidents or even traffic accidents, have been rising steadily. This has resulted in hundreds and even thousands of deaths, depending on the magnitude of the event, impacting both insurance company financial statements and insurer capacity to fulfill policyholder obligations.

Every block of life business, without exception, contains unpredictable risk exposures – sleeping giants – with the potential for significant and unexpected mortality impact. One of the principal hidden risks is that of accumulated mortality risks under group business. This occurs due to the concentrations of employees in locations such as company headquarters or branch offices. Some companies even provide transportation and/or accommodation at external worksites, which extends the accumulation of risk. In addition, many of the same employees covered by group policies also hold individual life policies. These employees, who are frequently prospected directly by agents for individual cover, could be doubling an insurer’s exposure to accumulation risk without any insurer awareness.

Clearly, this hidden accumulation risk is a growing issue for the Middle East region’s life insurers, and one very difficult to track or to calculate upon for risk pricing. And the risk is not just due to job sites: the Middle East is at the juncture of Arabian, African, and Eurasian tectonic plates, which places approximately 20% of the region’s population at elevated mortality risk. With the explosion of real estate construction in the region, especially of high-rise buildings, companies and insurers must consider mortality accumulation.

With the remarkable growth of the region’s life insurance market over the past decade, there are three main questions insurers need to ask when valuing portfolios:

- Do you have a clear view of your portfolios’ probable maximum loss? Although Middle East insurers are generally aware of their exposures to property-casualty CAT risks due to drought, floods, windstorms, and earthquakes, they are far less aware of their mortality risk accumulation. This is due to a lack of details about their hidden accumulation of risk and probable maximum loss exposure for mortality, which leaves insurers without the knowledge necessary to evaluate and incorporate this risk into their pricing.

- What is your retained risk accumulation? With the positive financial performance of Middle East-domiciled life insurers for the past several years, many insurers are electing to retain more risk. Some are retaining an unprecedented 100% on certain benefits, which is increasing the accumulation of exposure to unanticipated or unknown risks.

- Will your balance sheet and solvency be impacted by unexpected loss? What is your plan to mitigate such exposure? Regulators and rating agencies in the Middle East have both become stricter regarding solvency ratio's requirements and how insurers protect their balance sheets against unexpected events.

Catastrophic (CAT) cover can be a highly effective way for insurers to cover their hidden mortality risk accumulated under retention. The basic retained risk calculation uses actuarial models that factor in capital, solvency ratio, risk appetite, and sometimes regulatory requirements, but these models do not usually consider unexpected major loss events, or losses that might result from irregular events. The role of excess-of-loss catastrophe reinsurance (CAT XL) for life insurers is to protect this retained mortality risk.

Insuring group and individual life portfolios with CAT XL can bridge coverage gaps for Middle East life insurers, as CAT XL is generally not linked to a specific catastrophe or event. Rather, it mitigates risk from unknown and unexpected events – events where one might not be aware of the potential for accumulation of risk. This adds to the financial strength of the insurers and that of the region’s insurance market by limiting mortality losses. Just because such events might not have yet happened does not mean portfolios are protected!

At RGA Middle East, we are committed to help our clients better understand their exposures and risk accumulations, and provide them with the most suitable solution that will ultimately protect their balance sheets against exceptional and unexpected loss.