What a ride it has been, and the journey is just beginning.

In a landmark ruling, South Africa’s top court has unanimously ruled that the private use of cannabis (marijuana) is legal. The nation is just the latest in a string of countries, provinces and municipalities to decriminalise some (or all) uses of the drug. South Africa also presents an important test case for how insurers might navigate a world with more open use of "weed."

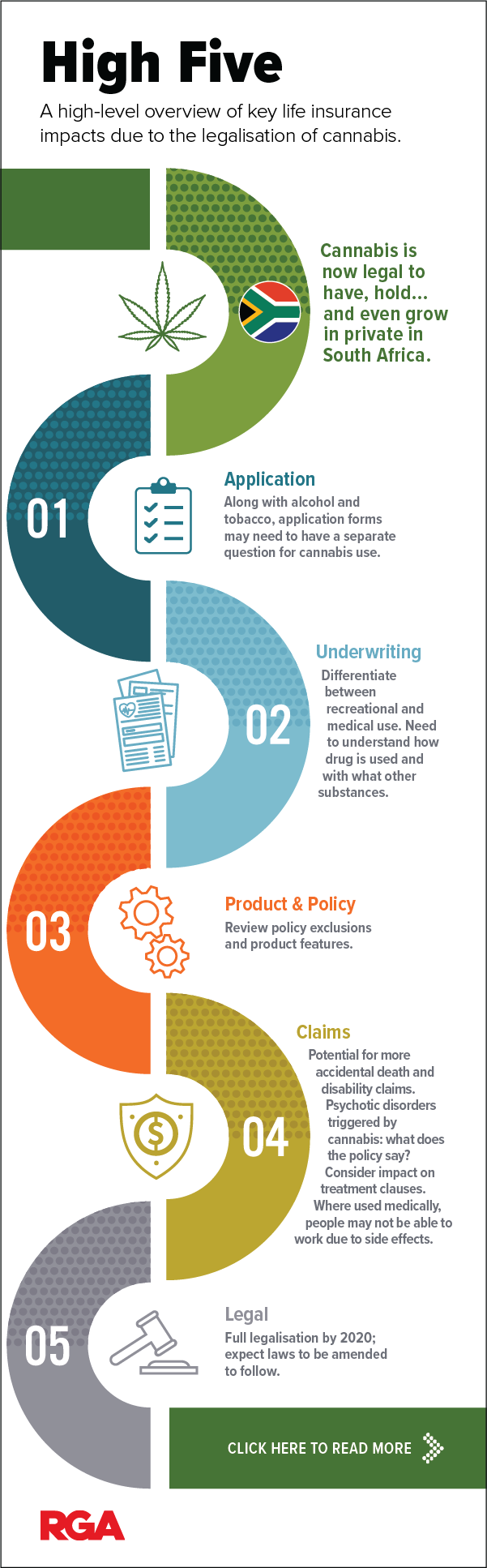

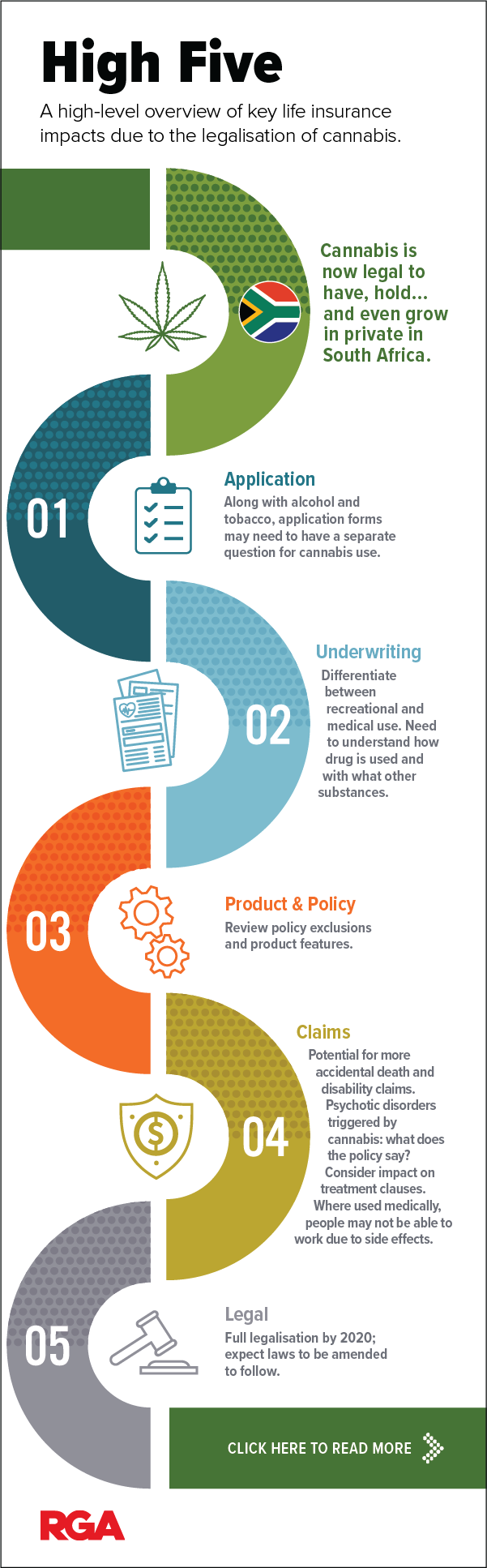

The following infographic from RGA South Africa maps out five key risk considerations in the market, and offers lessons for insurers far beyond South Africa's borders.

What do insurers need to know, and do, in the wake of cannabis legalisation? Keep these five key areas in focus:

1. The Application:

Application forms will need to split out cannabis use from the use of other illicit or illegal drugs. This serves to reduce non-disclosure (i.e., cannabis is no longer illegal). Further, keep in mind that, although some companies may choose to view cannabis as a form of smoking, separate data will enable future analysis.

2. Underwriting:

- Medical use of cannabis (typically oil) is unlikely to attract underwriting loadings by itself. Rather, this indicates the presence of a potentially serious health condition that needs to be understood.

- As with alcohol, the impact of recreational cannabis use depends on context and behaviour (e.g., the age of the applicant, frequency of use and quantity used).

- A particular concern centers around cannabis use in conjunction with other drugs or alcohol. In these cases, we must consider the underwriting impact across both substances, given associations with co-morbidities and psychiatric conditions.

3. Product and Policy:

- Policy language will need to be reviewed. Consuming cannabis is no longer a criminal act, and insurers will need to separate out cannabis use where it is included with illegal substances. In particular, drug and self-inflicted injury exclusions will need to be considered.

- Cannabis use is linked to increased accidental injury and death. This could affect pricing and product terms when providing accidental cover or issued on a simplified basis.

4. Claims:

More research is needed to understand the full impact of cannabis on mortality and health. Vehicle and pedestrian accidents are a particular concern as research suggests an increase following marijuana legislation in the United States1. Alternatively, studies indicate that opioid-related deaths (overdoses) could decline2 where medical cannabis is substituted for more traditional painkillers.

A working paper3 in the United States found an 11% increase in the propensity to claim disability insurance following the legalisation of cannabis.

It's complex: some conditions could see reduced claim duration where marijuana supports treatment, while recreational use could extend claim duration.

5. Legal considerations: Cannabis use has been decriminalised in South Africa, with so-called full legislation going into effect by September 2020. This change introduces a range of legal considerations that are instructive both within the country and worldwide:

- The Traffic Act will need to be updated, with a maximum level of THC (the psychoactive part of cannabis) permitted while driving, much like alcohol. Testing for THC is difficult as the substance remains in the bloodstream for a long period of time, even if the user is no longer intoxicated. This could contribute to legal disputes.

- Although cannabis use is legal, insurers can still exclude it from policies. Exclusion considerations will need to be balanced against cases of medical use.

- In South Africa, cannabis cannot be consumed in public or smoked in front of children. the ramifications of which will need to be investigated.

Insurers may need to review policy wording to conform to these changes. Expect law amendments to follow.

It is critical to shed myths.

- About 9% of cannabis users become clinically dependent.4

- It is hard to overdose. However, heavy use remains risky; users can experience panic attacks and loss of judgement6, increasing the danger of accidental injury or death. Research suggests exposure to high levels of THC increases the risk of developing long-term psychosis5.

- Along with alcohol and tobacco, cannabis represents a potential source of tax revenue.

- It is not simply a substance to smoke; insurers should expect to see a range of cannabis-infused products, including gum, candy, cookies and fizzy drinks.

- Perhaps the biggest myth surrounding cannabis is that it is completely safe. Like any substance, there are negative side effects (see our Cannabody infographic).