Fraud costs the insurance industry billions of dollars every year.

The Coalition Against Insurance Fraud estimates that U.S. insurers lose $80 billion annually to fraud, across all lines of business.1 However, the true cost of fraud is not quantifiable – it extends beyond payment of inappropriate claims and costs to establish fraud prevention and detection units; fraud stifles innovation and fraud costs consumers money and convenience.

To better understand the challenges fraud presents, RGA has reached out to life insurers: We surveyed insurance companies,2 conducted informational interviews, held discussions at the 2016 RGA Annual Fraud Conference,3 and conducted our own internal research of claims experience.

Types

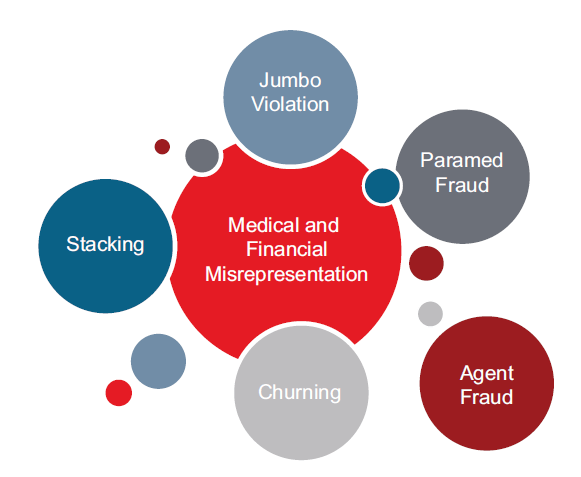

An important first step in understanding fraud is to define it. In this analysis, we are using a broad definition4. Fraud in this context is not limited to criminal activity, but is expanded to include misrepresentations and omissions, whether malicious or less than complete disclosure.

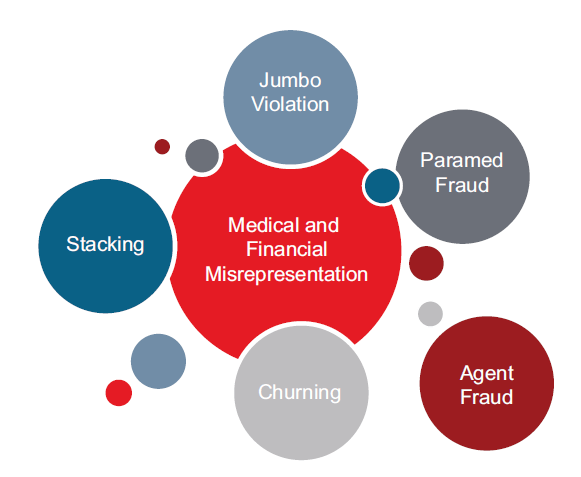

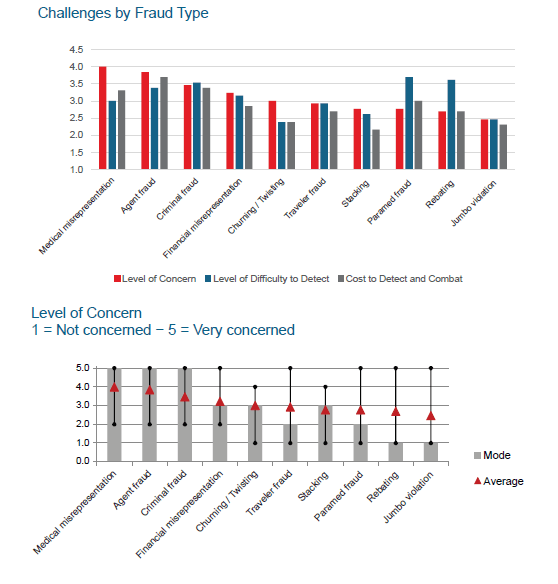

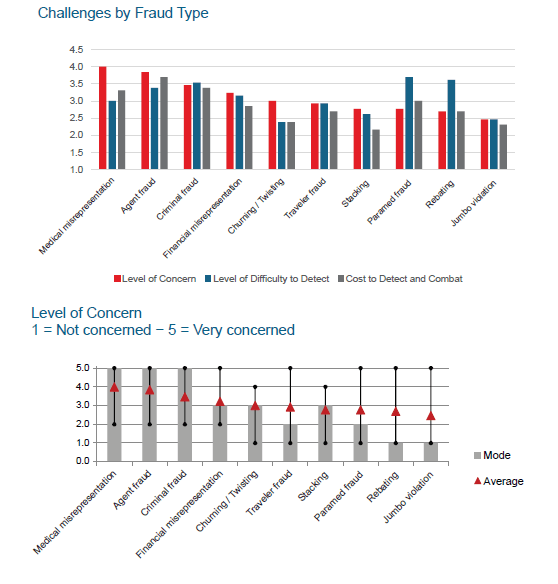

We discussed the types of fraud with insurers and the associated costs and challenges in detection. Although there was a wide range in responses, medical misrepresentation, agent fraud and criminal fraud were identified as the most concerning types of fraud. Paramed fraud and rebating were identified as the most difficult types of fraud to detect.

Survey respondents were asked to rate their level of concern, difficulty to detect and cost to detect various types of fraud on a scale from 1 to 5, with 5 representing a high level. While insurers indicated the highest level of concern with medical misrepresentation, agent fraud and criminal fraud, there was considerable variation in responses.

Fraud Prevention and Detection

Insurers have practices in place to detect and limit the impact of fraud, often with dedicated teams in place that take advantage of fraud prevention tools and technological advances.

Team

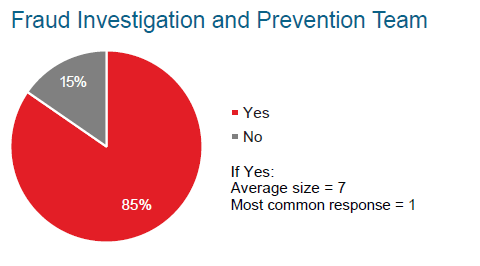

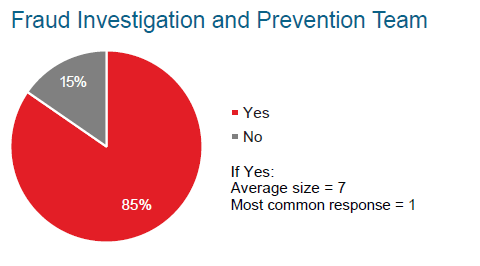

Life insurers tend to have small special investigation units in addition to underwriters and claims staff dedicated to fraud prevention and detection. However, there is significant variation in the size and sophistication of these internal investigation units. The most common response from insurers we surveyed was to have a single person dedicated to fraud investigation and prevention.

Q: Does your company have designated individuals to investigate and prevent fraud?

“We have individuals who investigate...this is often only a portion of what they do – not a full-time activity.”

“We use a multi-tiered approach to investigations.”

“We have less than a handful of people in our Special Investigation Unit.”

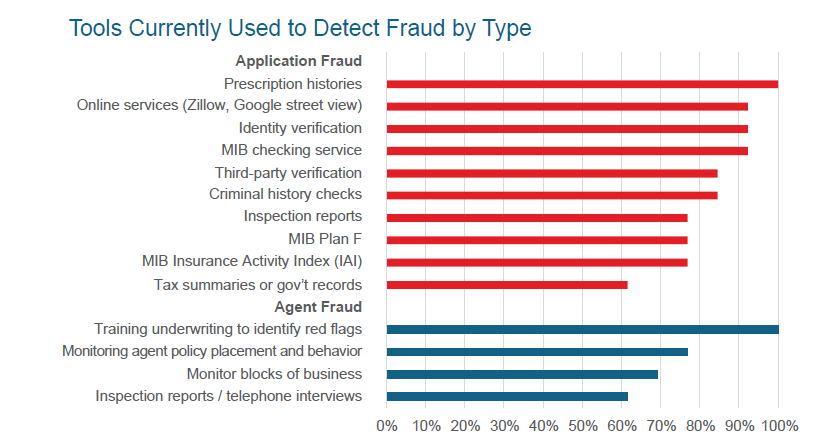

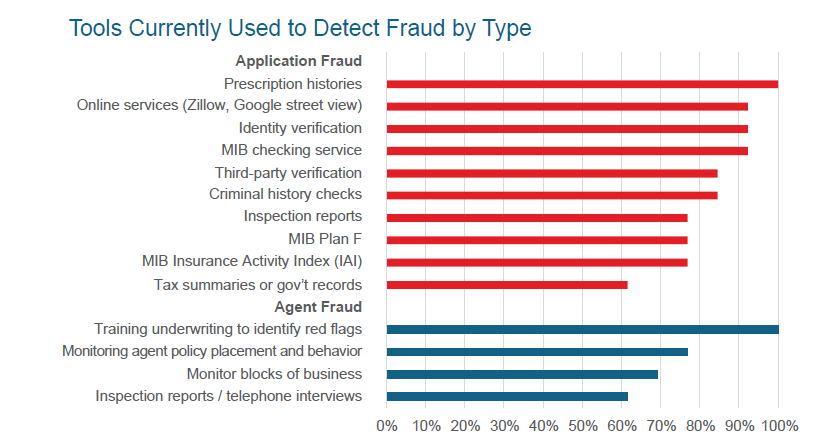

Tools

Usage of tools varies; however, many insurers indicated interest in new tools to combat fraud.

Q: Is the life insurance industry keeping pace with tools to combat fraud? How can this be improved?

- "No. There is a need is for an industry database for suspected and proven fraud claims within the life insurance industry similar to the ISO database that exists within the P&C world.”

- “No. We need more tools to help us combat fraud on the front end before case is ever issued.”

- “For the most part-yes. But improvements are needed as we move to more simplified and non-verifiable processes.”

- “We need more cooperation with insurance departments.”

- “We are always looking for better tools…there are red flags periodically on the applications, but there are not a lot of tools to help with detection.”

Technology

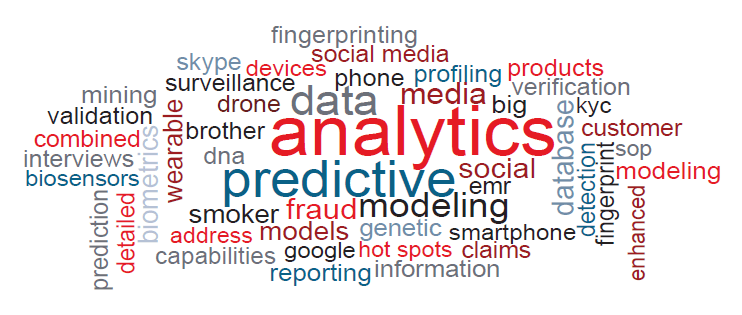

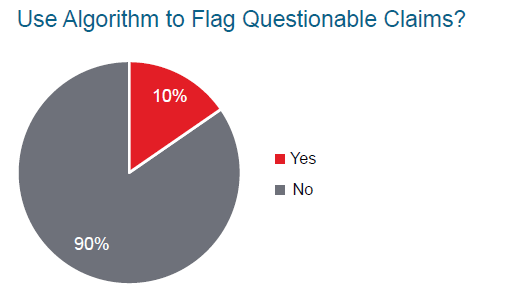

Technology has enabled companies to leverage data and build predictive models. Companies generally do not have an algorithm in place to identify and flag questionable claims; however, many have plans to implement a program.

We asked insurers, on a scale of 1 to 5, how interested would you be in using modeling to detect fraudulent claims? (1= not interested through 5= very interested)

Level of Interest in Modeling to Detect Fraudulent Claims

| Min. | Average | Max | Mode |

|---|

| 1.0 | 3.6 | 5.0 | 4.0 |

|---|

Q: Are there any underwriting red flags your company would like to consider but lack data to investigate?

- “New immigrants – visa verification.”

- “All kinds of fraud – faked death claims, gaming the two-year contestability period, etc.”

- “Yes, to make up for a lack of boots on the ground for investigations.”

- “It would be helpful to be able to prove fraudulent activity.”

- “Current tools to investigate criminal history are inadequate.”

Costs

We asked attendees at the 2016 RGA Fraud Conference the question, “How much do you think fraud costs the life insurance industry?” The majority of attendees estimated that fraud costs the life insurance industry $10-20 billion each year. To better understand the cost of fraud to the industry, we investigated inappropriate claim payments, costs associated with fraud prevention and detection, as well as opportunity costs created by the potential of fraud.

Claims

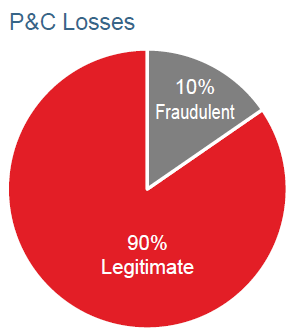

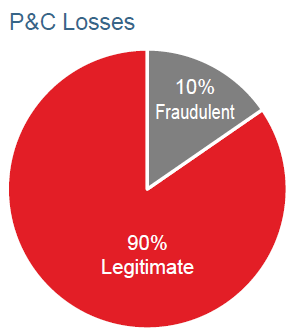

The Insurance Information Institute estimates that 10% of all claims paid by property and casualty (P&C) insurers are fraudulent.5 In our survey of life insurance companies, respondents indicated that approximately 1-3% of claims are investigated for fraud or misrepresentation or denied.

The Insurance Information Institute estimates that 10% of all claims paid by property and casualty (P&C) insurers are fraudulent.5 In our survey of life insurance companies, respondents indicated that approximately 1-3% of claims are investigated for fraud or misrepresentation or denied.

The contestability period, the time in which an insurer can deny a claim for material misrepresentation and fraud, varies by state, but is generally one to two years. Based on internal RGA claims experience, during the contestability period, roughly 20% of life insurance claims are rescinded. The rate is higher for simplified issue policies and those issued to younger insureds.6

Rescissions erode consumer confidence in the integrity of insurance companies.

At the same time, payment of inappropriate claims made after the contestability period creates excessive losses for insurers, which can be considered a “fraud premium” paid by consumers. It is clear that insurance fraud is harmful to consumers as well as insurers.

Investigation, Prevention, Detection

Fraud costs the insurance industry billions of dollars each year, and prevention provides protective value to insurers. MIB states that its checking service saves the industry $1 billion per year from errors, omissions, misrepresentations and potential fraud.7 When asked to estimate the amount of money their company has saved using fraud detection and prevention for life insurance business, all insurers reported a savings relative to spending, though there was a wide range in responses. The minimum ratio of savings to spending was 3:1 and the highest was 100:1. The overall average was just over $30 saved for every dollar spent on prevention and detection.

Opportunity Cost

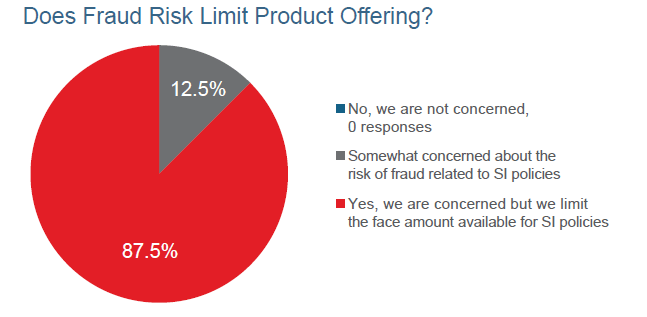

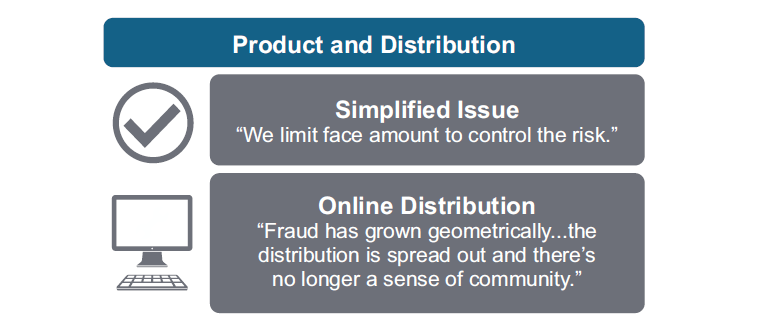

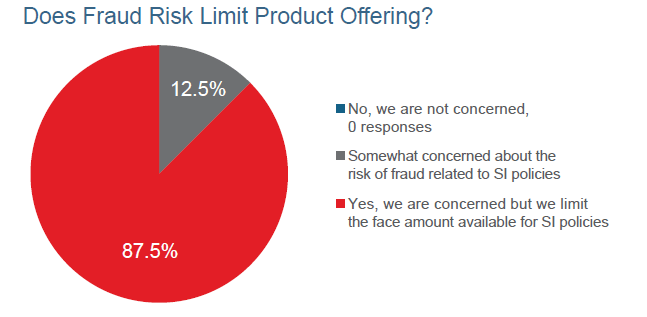

The risk of fraud limits insurers’ ability to innovate, resulting in an opportunity cost to the industry.

The insurer survey asked companies if the threat of fraud limited the number of simplified issue policies and/or the face amounts they were willing to issue. Of the companies offering simplified Issue products, 87.5% said they limit the face amount on these products, and all reported some level of concern with products that have less underwriting scrutiny.

Outlook

We asked Fraud Conference attendees, “What innovations in fraud detection or prevention for life insurance do you see in the next 5 years?”

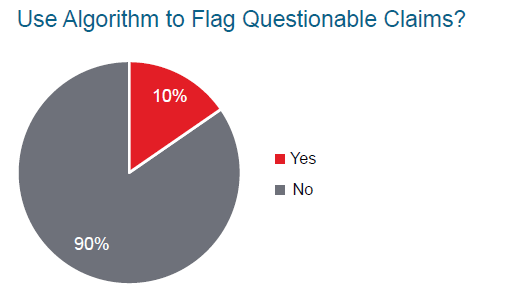

While data and analytics were top of mind for many attendees, our survey respondents indicated that 90% do not currently use algorithms to flag questionable claims or other modeling methods. However, most of the respondents also indicated that they are interested in using modeling to predict fraudulent claims.

Q: What innovations in fraud detection or prevention for life insurance do you see in the next 5 years?

- “More modeling, data use.”

- “Advancements in using analytics, in particular for new business fraud detection.”

- “Needs to be easy and quick.”

- “Big data analytics.”

- “There are areas of fraud that will occur that we haven't and can't even think of. By the time we figure it out it's potentially too late.”

There are many challenges to creating a solution to reduce the incidence of life insurance fraud. Most solutions will require data usage, but insurers may have privacy and security concerns regarding the use of this data outside of its traditional uses. Additionally, insurance data is often technically difficult to obtain from fragmented internal administration systems.

Fraud, including fraud that is unknown to and undetected by insurers, is a costly and challenging problem facing the industry. Insurance innovations that focus on data solutions may indirectly result in a lower incidence of fraud. The motivation for these advancements is more likely to stem from the development of fluidless underwriting solutions, improved tools to serve customers or improved online distribution capabilities. The solution to the problem of fraud lies in creating tools, using data, and developing products that enhance trust and transparency among all parties involved in the insurance transaction.

The Insurance Information Institute estimates that 10% of all claims paid by property and casualty (P&C) insurers are fraudulent.5 In our survey of life insurance companies, respondents indicated that approximately 1-3% of claims are investigated for fraud or misrepresentation or denied.

The Insurance Information Institute estimates that 10% of all claims paid by property and casualty (P&C) insurers are fraudulent.5 In our survey of life insurance companies, respondents indicated that approximately 1-3% of claims are investigated for fraud or misrepresentation or denied.