Additionally, sponsors should be conscious of current macroeconomic conditions, which drastically differ from the environment of the past few years that contributed to the popularity of sidecars. The U.S. economy arguably faces tighter funding conditions, higher return requirements, and greater uncertainty. Given the typical timeline of establishing such vehicles, financial conditions may change markedly between the initiation and execution of the sidecar.

Fundraising for the sidecar can lead to an interesting tug of war as the sponsoring company looks to engage with potential investors without compromising its own financial objectives.

Moving from design to production to make the sidecar a reality is the most challenging part of the process. The right design is certainly a major part of being ready to deploy the capital and operate the vehicle.

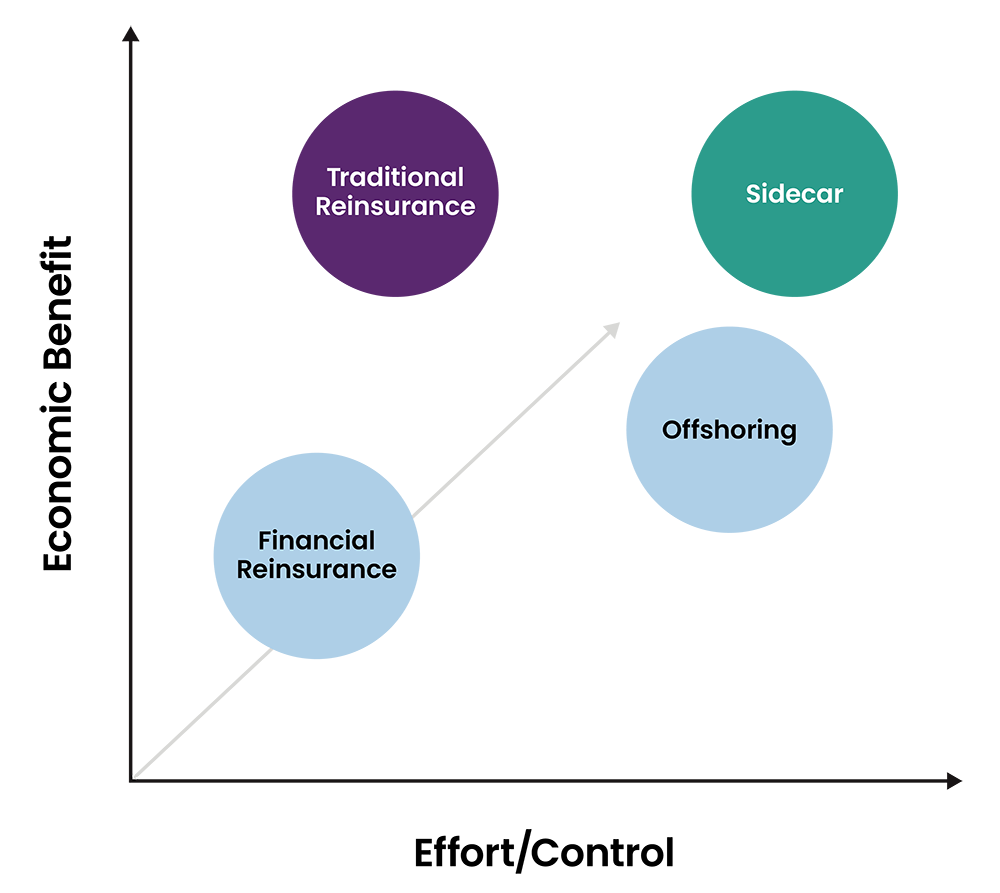

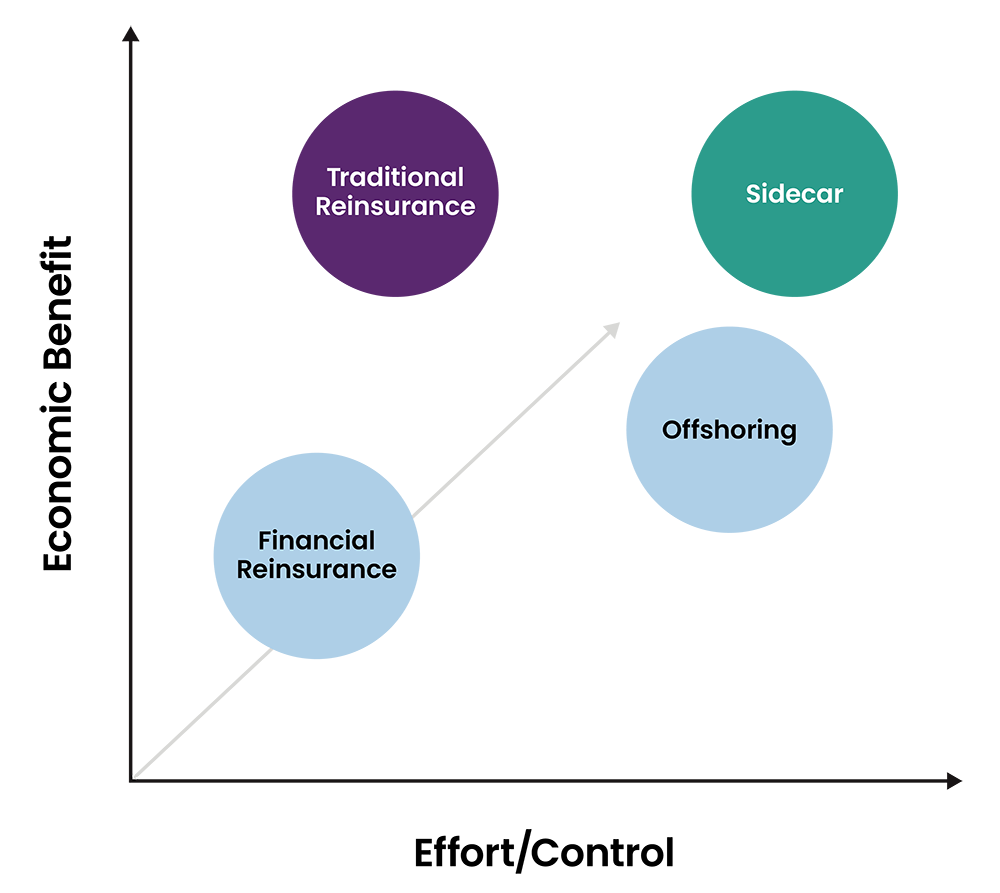

Other reinsurance vehicles: Evaluating trade-offs

A sidecar can be viewed as just a variation of other forms of reinsurance, such as a traditional full risk-transfer treaty with an unaffiliated, established reinsurer. The market for traditional reinsurance is both wide and deep with established players offering competitive solutions that often can access the same benefits and features provided by sidecars. While both sidecars and traditional reinsurance can be designed to cover the same risks using similar structures, the effort, economics, execution risk, and expertise involved can be quite different for each.

Effort: Which vehicle will require the least effort to set up and manage?

Winner: Traditional third-party reinsurance

| Sidecar | Traditional third-party reinsurance |

| Major undertaking to launch, typically requiring at least 18 months from strategy to execution. In addition to ongoing management efforts, it may be difficult to change the course as conditions and needs evolve over time. | Once the strategic decision is made to move forward, a well-defined process for finding a reinsurance counterparty follows that can be done in three to six months. |

Economics: Which vehicle is most economical?

Winner: To be determined; both likely can achieve similar structural advantages and risk coverage, so the implementation details will drive relative economic advantages.

| Sidecar | Traditional third-party reinsurance |

| Expect high investor interest but also pressure to maximize returns for outside investors. Economic analysis should consider the role of fees and counterparty credit risk, which may offset pricing leverage. | Established players with leading capabilities and risk appetite can translate into favorable economics for the cedant. |

Expertise: Which vehicle can best utilize partners with complementary capabilities?

Winner: Sidecar

| Sidecar | Traditional third-party reinsurance |

| Potential sidecar investors may have complementary capabilities on the liability, asset, or structuring side. The sidecar can be conducive to such arrangements as there is mutual interest in performance, but the impact on fees and control must be considered. | Leverages the expertise of the reinsurer for the treaty’s design and fulfillment. Experienced reinsurers can further enhance partnership via a lead role in ongoing product design and management, sharing an interest in maintaining the policyholder base with the ceding company. |

Execution: Which vehicle offers certainty and simplicity in execution?

Winner: Traditional third-party reinsurance

| Sidecar | Traditional third-party reinsurance |

| While there are examples of sidecar launches, execution risk persists across the sidecar lifecycle, stemming from a range of areas, such as stakeholder alignment, investor exit options, and regulatory oversight. | Execution risk is typically lower, given a shorter time frame, bilateral (in lieu of multilateral) negotiations, and certainty of coverage. |

Buyer's Guide

A sidecar might be a good addition to the holistic reinsurance and capital management strategy of a company that:

- Has a sizable balance sheet

- Has a sophisticated capital management team and solid relationships in the capital markets

- Is able to divert several senior leaders from their “day jobs” to the sidecar project for at least 18 months

- Is willing to give investors an asset management mandate to achieve targets for specific asset classes and has the ability to perform due diligence

- Has a seed block that fits the liability profile of the sidecar

- Is prepared to make a long-term commitment to cede liability flows

On the other hand, seeking a tailored reinsurance solution can be the prudent choice for a company that:

- Has a near-term need to free up capital

- Desires high flexibility in managing capital and risk retention

- Values the counterparty strength of a diversified, experienced reinsurance company

- Seeks to leverage an asset-intensive reinsurer’s expertise to improve the economics in a more defined arrangement

- Would prefer not to warehouse liabilities on the balance sheet for the 18 months or more it will take to stand up a sidecar

- Seeks product expertise and the flexibility to shift product emphasis to address distribution needs, evolving buyer preferences, and market conditions

Quick Recap

While sidecars can deliver significant value under the right circumstances, the costs – whether in terms of time, resources, capital, or other elements – and execution challenges should be thoughtfully and realistically considered prior to pursuing.

Early prioritization of objectives is essential in the development of the third-party capital strategy. This will inform the assessment of the notable trade-offs in pursuing the sidecar vs. other alternatives, such as traditional asset-intensive reinsurance.

Following this process will ensure that you select the right car to get to your desired destination.

RGA's understanding of each client's specific capital and investment needs, as well as extensive knowledge of local markets and global best practices, uniquely positions our Global Financial Solutions (GFS) teams to help clients improve capital efficiency and promote long-term stability and growth. Learn more about the services and solutions available in your market: