As children we learned that how we asked a question had a lot to do with the type of answer we received. We might not have realized it, but we were already on our way to becoming behavioral economists!

The principles of Behavioral Economics (BE) are becoming a regular part of our industry’s marketing and actuarial efforts. While other companies may be trying to apply it to gain operational efficiencies, RGA in Asia is focusing on using BE in solution design. One of the ways we are doing this is studying how applying these principles to customer questionnaires, surveys and applications may generate more, and better qualified, responses.

The results have been interesting. We are seeing that the way a question is asked, and the number of answer options available, appears to play a role – perhaps subconsciously – in eliciting greater participation and more accurate disclosure.

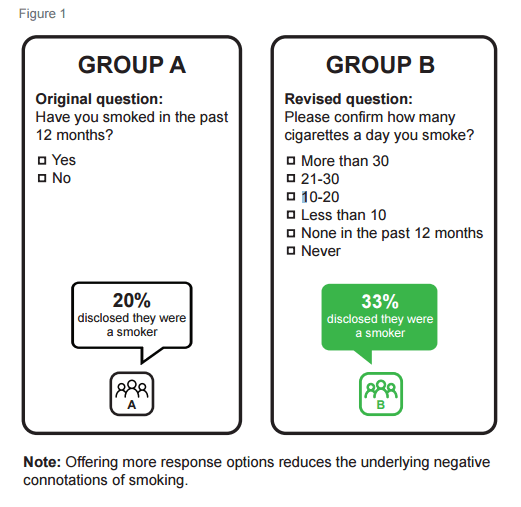

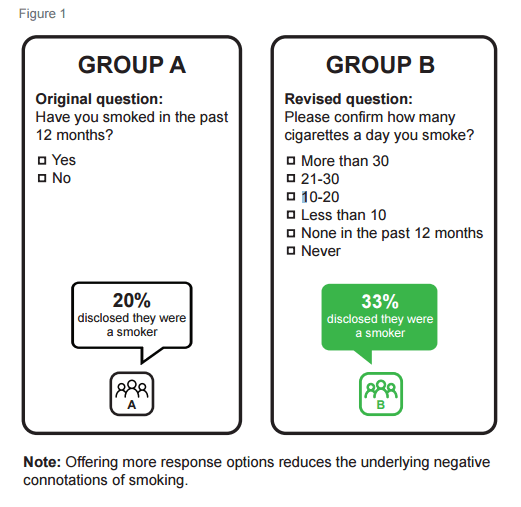

For example, you’d think that on insurance applications the smoker/non-smoker question is binary: either you smoke or you don’t. However, being a smoker has subconscious and conscious negative connotations for applicants. Reflexively, a smoker may feel defensive about the question. Consciously, too, they are aware that being a smoker is going to raise their premium. Both reactions may bring a deceptive response, or non-disclosure. BE, however, suggests that re-positioning the question and offering more response options reduces the underlying negative connotations of smoking.

In testing, we found that a binary smoker / non-smoker question produced a disclosure in 20% of the cases. We re-designed the question and incorporated a number of changes (Figure 1):

- The question ‘normalizes’ being a smoker by assuming the applicant smokes

- The response options have been increased so that our significant cut-off is disguised

- The options were reversed so that ‘Never’ is the last option

This resulted in a 33% disclosure rate with, interestingly, the main increase in disclosure from those who smoke less than 10 per day.

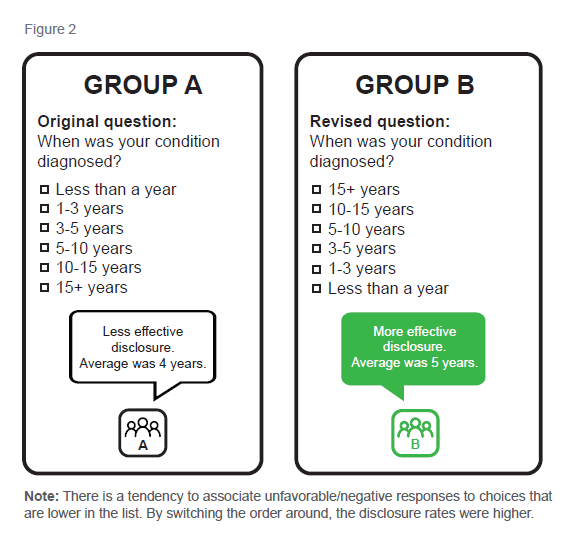

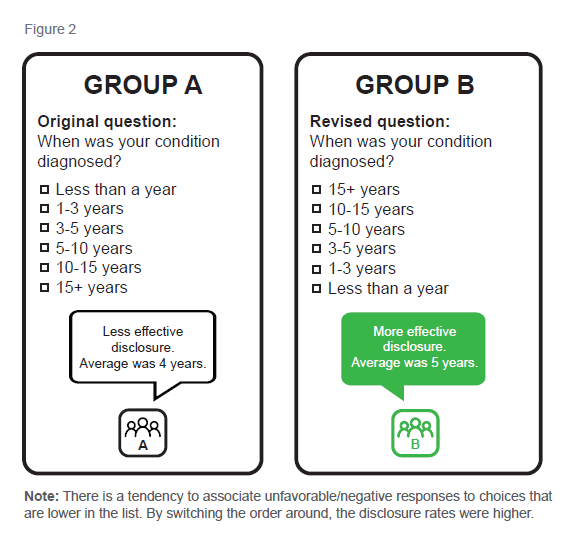

In another case, as part of an online diabetes research questionnaire, we saw that the order in which choices were presented also influenced the rate of response. When diabetics and “3-High” – those with raised blood pressure/cholesterol/Body Mass Index (BMI) – participants were asked how long since they were initially diagnosed, the disclosure rate was higher when the timeframes started in the distant past (Figure 2). The longer durations, of course, are what we are most interested in identifying, and the ones most prone to non- or under-disclosure.

How we test

We see strong evidence that BE improves the quality of the information we receive, which in turn improves our decision-making. RGA is committed to a more comprehensive rollout of this approach in Asia. To that end we are working with behavioral scientists in Asia and applying effective research methodology to continuously test the new designs. Our approach is characterized by a streamlined process which allows us to do more testing in less time and at less expense.

This capability is a value-add service for our customers, enabling greater insights and more effective client engagement, giving RGA and our customers an underwriting and marketing advantage.

Using these insights allows RGA to continue tailoring services and products, which ultimately promotes and encourages our customers to make the right product choice and develop healthier behaviour and lifestyle habits.

Asking better questions means getting better answers!