There are few industries in the world where behavioral science can have more positive impact than the life and health insurance industry.

But how do you get started?

Two approaches provide opportunities:

- Enhance existing solutions. This is the equivalent role of that of a mechanic, looking for ways to improve, repair or make more efficient. The focus here is on incremental change.

- Design and create behaviorally optimized solutions from scratch. Here behavioral science acts more like a mechanical engineer, embedded into product and system development so the focus is on transformational change.

Both approaches are valid and bring benefits. You likely know the famous Henry Ford quote: “If I had asked people what they wanted, they would have said faster horses.” The advantage of behavioral science is that it can be used both to make faster horses and to design completely new forms of transport.

The danger is in trying to be a mechanic when the existing solution is fundamentally flawed. Just as a mechanic cannot fix a car with no engine, behavioral science cannot fix an idea that is based on faulty assumptions about human behavior.

The best way to use behavioral science in your organisation is to follow the following 4-step model.

Step 1: Identify behaviors that impact business goals

This is the most important step and where behavior change programs often go wrong. Rather than focus on core behavior that needs changing, we jump straight to trying to enact the solution we assume (and hope) is the answer.

For example, a business may decide it wants to improve customer loyalty: it knows that some customers are loyal but others are not, so it wants to understand why and how to change this. But the business is asking the wrong question – the behavior it really wants to understand and change is customer retention. Retention may result from loyalty but it also results from influences such as the status quo bias, the sunk cost bias and even simple rational economic logic (providing the best product at the best price). By assuming retention is driven by loyalty alone, the business may focus its efforts on only one part of the equation.

This error can occur when trying to improve the accuracy of insurance application disclosures. Insurers often assume that inaccurate disclosures result from dishonesty motivated by a desire to ensure coverage or reduce premiums. In truth, an individual may make an inaccurate disclosure for many reasons. Rather than financial gain, it may be for psychological gain – often people do not want to admit how much they drink, smoke or weigh because it makes them feel ashamed. Inaccuracies may also be due to simple mistakes, lack of knowledge or mis-remembering. If we don’t identify all behaviors we need to change, we will never achieve our business goals.

It is here where data science and behavioral science often work in tandem. Data science can help identify ”what” behaviors need to be changed, while behavioral science focuses on ”how” to change them. As data scientists pinpoint the most important or newly emerging mortality risk drivers, for example, behavioural scientists can focus on promoting healthy behaviors in response.

Step 2: Apply behavioral science to understand drivers of behaviors

Once you have identified the behavior (or non-behavior) to be changed, the next step is understanding what is driving it. This requires an analysis of decision-making factors, both the mental heuristics at work and the contextual influences such as incentives and environmental factors.

While the human brain has hardly changed for millennia, our understanding of it has grown rapidly in the last few years. An increasing number of heuristics and biases are being codified in an attempt to explain behaviors. Various taxonomies and codices can be used as starting point to help explain the behavior you are trying to change (click here for a commonly used codex).

It is important to note that behaviors in different contexts may often be explained by the same heuristics and biases. For example, many similarities exist between health and financial behaviors in that both require sacrificing immediate pleasure for long-term benefit.

Step 3: Develop potential solutions to impact behavior

A number of models have been developed to help practitioners create behavior change solutions. EAST, created by the Behavioral Insights Team, and MINDSPACE, created by the U.K.’s Institute for Government, are among the most commonly used.

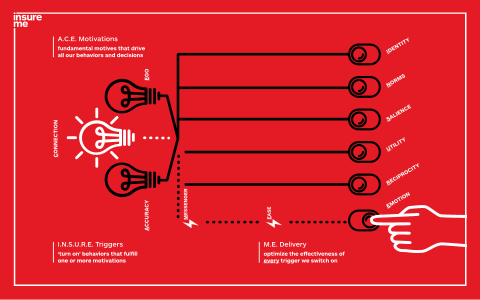

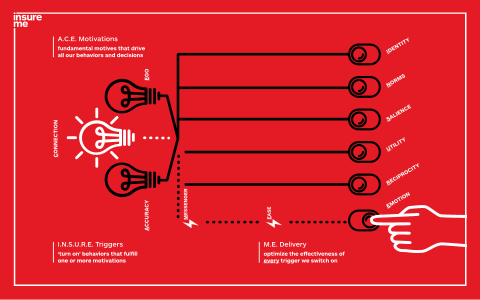

RGA has created its own model specific to the life and health industry: INSURE ME. It brings together what we believe are the eight key behavioral insights that influence thinking across the entire value chain. The model is by no means an exhaustive list but acts as a toolbox or a checklist to help evaluate the most powerful factors influencing insurance buying decisions.

Step 4: Test and learn

Rarely will behavioral science provide a single solution to a problem, so different possibilities must be tested against each other and against the status quo. Often we want to determine which of two or more interventions is the most effective for obtaining a specific, measurable outcome.

Randomized Controlled Trials (RCTs) are usually seen as the gold standard in behavioral science – as they are in medicine and a growing number of fields. What distinguishes RCTs is the use of a randomly assigned control group, which enables measurement of the impact of a behavioral solution against what would have happened if nothing had changed.

With the right planning, RCTs can be much cheaper and easier to run than commonly thought. Most forms of digital testing – A/B tests for example – are RCTs. Used well, they can facilitate low-cost, low-risk and agile testing to inform important business decisions.

Continuous improvement

Following this four-step approach can help drive behavior change and may even help solve our industry’s greatest challenges.

It is important to note, however, that the model may not always be linear. Often the completion of Step 4 will take us back to Step 1 as the success of one intervention enables us to focus on new or related challenges.

With so much potential for the application of behavioral science, the journey ahead can seem daunting. But if we take it one step at a time, we will make our way as an industry down the path to progress.