“While there are several chronic diseases more destructive to life than cancer, none is more feared.” — Charles Mayo1

The development of new and innovative products is a key success factor for insurers. Various stakeholders across different disciplines are involved throughout the product development cycle, the culmination of which can be the introduction of a novel indemnity offering. There are several considerations throughout the process, but from the consumer’s perspective in order for there to be sufficient traction, there has to be a tangible need for the specific protection being offered. One such product is Cancer Reimbursement insurance. This article will address aspects of this product’s development journey.

Background

Critical illness insurance, now well-entrenched in most insurance markets, is a product that meets an increasingly prevalent consumer need: a lump sum payment upon diagnosis of a condition that can impact life expectancy and quality of life, so as to ease the threat of financial loss. This cover is and will remain popular, but its current complexities, which have evolved over its past three-plus decades of existence, can overwhelm an average consumer at the point of sale.

Medical and hospital reimbursement insurance products are complex as well, and significant coverage gaps can exist in both private and state-provided reimbursement cover.

A solution? The simple yet elegant, contained yet comprehensive, niche indemnity solution known as Cancer Reimbursement (CR) insurance. Essentially a tailored hybrid product, CR provides comprehensive cover for the diagnosis, management, and ancillary care expenses incurred upon diagnosis of a defined incident cancer or a cancer in situ.

Public awareness of the threat of cancer is increasing, which is driving interest in targeted insurance protection.

CR as a product was first conceived of and launched in Asia towards the end of 2012. To date, its growth has averaged 25% per year – not unexpected as Asia accounts for 60% of the world population and half the global burden of cancer.2 Lifestyle factors, sociocultural norms and ethnic heterogeneity contribute to this significant cancer burden. Smoking prevalence among males in Indonesia, China, Malaysia, and Korea, for example, is about twice that of males in the U.S. Dietary habits, outdoor air pollution and the burden of cancer-related chronic infections also offer some explanations for this prevalence.

Cancer’s reach is widespread, its effects significant and its associated burdens well understood, especially by those who receive the diagnosis, their families and communities. As medical science’s understanding of the many cancer conditions advances, doctors are increasingly able to provide clear explanations of its risks, the etiologies and prognoses of different cancers, and the newer, more effective personalized testing and treatment options that are available.

Still, although survival has improved – the current five-year average survival rate is approximately 65% – cancer remains a significant diagnosis. Cancer Reimbursement cover aims to protect against some of the impact associated with such a life-changing finding.

Cancer Reimbursement – product features

The cancer care continuum involves highly specialized, multi-disciplinary, empathetic, attentive, and personalized care. CR products generally have a per-cancer and overall lifetime maximum payment limit, and cover up to three incidences. A histopathologically distinct subsequent cancer is paid only if diagnosed one year after the preceding cancer occurrence.

Covered treatments include comprehensive medical care in and out of hospital settings, cancer surgery (including reconstructive surgery), home nursing care, assistive medical appliance expenses, rehabilitation and palliative care. Allied medical services and supportive counseling are also reimbursed. Chiropractor consultations are also generally covered, but with limited per-visit payouts. Products can also cover complementary therapeutic modalities specific to a region’s diverse sociocultural traditions, such as in- and outpatient Chinese medicine consultations and treatment. In addition, CR can cover donor expenses for transplantation costs, second medical opinion referral services and a hospital companion bed for an accompanying spouse or family member. Finally, the product pays a small compassionate death benefit upon the death of the insured.

Most CR policies exclude conditions diagnosed within the five years preceding policy inception unless the specific impairment was fully disclosed and accepted at underwriting stage. Some exclusions that currently apply include, but are not limited to, the following:

- Any treatments, tests, services or supplies that are not medically necessary, or any charges that are in excess of what is deemed reasonable and customary

- Non-medical services, such as guest meals, medical report charges

- Any experimental, unproven or unconventional medical technology, such as stem-cell therapy, and / or any procedure, therapy, drugs or medicines not yet approved by the government, relevant authorities and/or recognized medical association in the country or region where the treatment is sought

- Genetic testing undertaken to determine a genetic predisposition

- Over-the-counter medicines and nutrient supplements

- Vaccinations and immunizations received by an insured to prevent a covered cancer

Underwriting guidelines – cancer risk assessment under the microscope

The unique risk assessment needs of cancers necessitated the development of product-specific underwriting guidelines for CR. Simply adapting the critical illness guidelines for a targeted cancer product would not work, as each specific cancer risk and its cost of care must be isolated and rated accordingly.

Broadly, the underwriting approach separates disclosed medical conditions into two groups: impairments for which a clear and established cancer risk exists; and impairments that do not have any associated cancer risk. Additional premium loadings or exclusions appropriate for an applicant’s relative cancer risk are most commonly used for the first group of impairments. For example, chronic hepatitis B carriers might receive an additional loading for the associated hepatocellular carcinoma risk unless there is additional information available that can allow for an alternative decision. Other impairments where no appreciable cancer link exists can, for the most part, be accepted at standard rates.

Many common impairments are encountered at underwriting for which a slightly higher overall relative risk of cancer exists but where it might be arguable that this risk is not significant enough to be assigned an extra premium. At the same time, comorbidities need to be weighed and properly assessed, and the potential for any occupational exposure must be considered. The guidelines would also have to accommodate an early-stage carcinoma in situ diagnosis as a claim trigger. Underwriting philosophies are company-specific, and pricing assumptions are important too, but ultimately evidence should drive the underwriting decision and rating.

Specific cancer risk, however, cannot always be separated out. For example: How might an applicant with Type 2 diabetes be underwritten for CR cover? This increasingly common impairment presents various challenges at the risk assessment stage, particularly for rider benefits. Most diabetes’ critical illness risk is related to its well-known macro- and microvascular outcomes.

Epidemiologic evidence is conflicting for overall cancer risk in diabetes, but consistently points to excess risk for site-specific cancers.3 (Most study populations have only included Type 2 diabetics due to the relative prevalence of this type.) Meta-analyses show an increased risk for cancer in diabetics. Similar evidence exists for individuals who have metabolic syndrome and those considered prediabetic.

The complex pathophysiology of diabetes encompasses a range of chronic hormonal abnormalities, chronic inflammation and oxidative stress. This milieu, together with a genetic susceptibility, can initiate carcinogenesis. The association may also be due to the risk factors shared by cancer and diabetes, which include aging, obesity, diet, smoking and physical inactivity. Some of this overlap is accommodated in the base ratings, but the synergism remains an important risk assessment consideration.

Interestingly, evidence suggests diabetes might have a protective effect on prostate cancer incidence. As prostate cancer is not prevalent in men in Asia, this might explain the finding of a lower “all cancer” risk in men in some studies.4 Hepatocellular carcinoma risk, however, is about two to three times higher for diabetics. Since most epidemiologic studies indicate such increases in relative risk of hepatocellular carcinomas in diabetics, it must be questioned whether diabetes is a direct risk factor or whether diabetes-related diseases such as obesity and nonalcoholic fatty liver disease (steatosis) might also be implicated.

Hepatitis B and C infections have also been shown to be more frequent in diabetic patients. Ultimately the exact mechanism of this association remains unclear but as hepatocellular carcinoma is more prevalent in Asia, it requires due consideration in a product intended for this region. Hepatitis B and C also increase the relative risk for cancers of the pancreas, kidney, endometrium, colon, and rectum and bladder.5 In a comparison of overall survival rates in cancer patients with and without diabetes, a systematic review and metaanalysis showed that those cancer patients with pre-existing diabetes are at increased risk for long-term, all-cause mortality compared with those without diabetes.6

The presence of rheumatic conditions is another example of where benefit assessment for a cancer-only product requires a considered, research-based risk assessment approach. Evidence points to overall increased cancer risk for some of these conditions.7 An international multi-site cohort study of cancer risk for individuals with systemic lupus erythematosus8 found evidence that suggests a standardized incidence rate for these individuals of 1.14 for all cancers, with higher rates for lymphomas and leukemias.

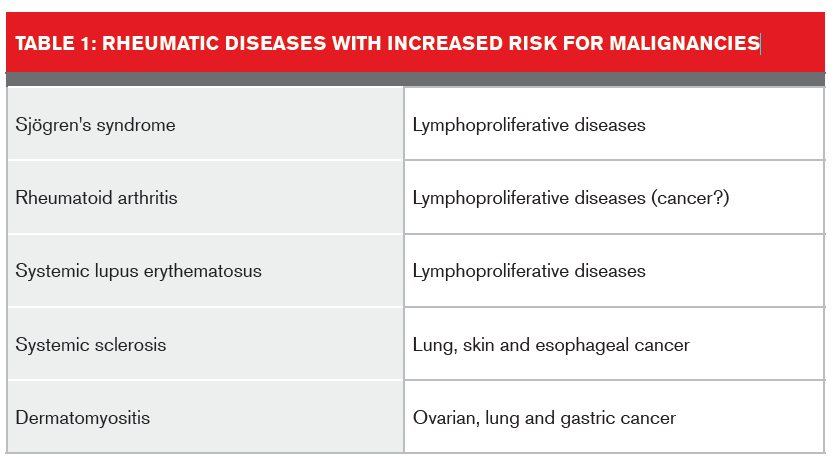

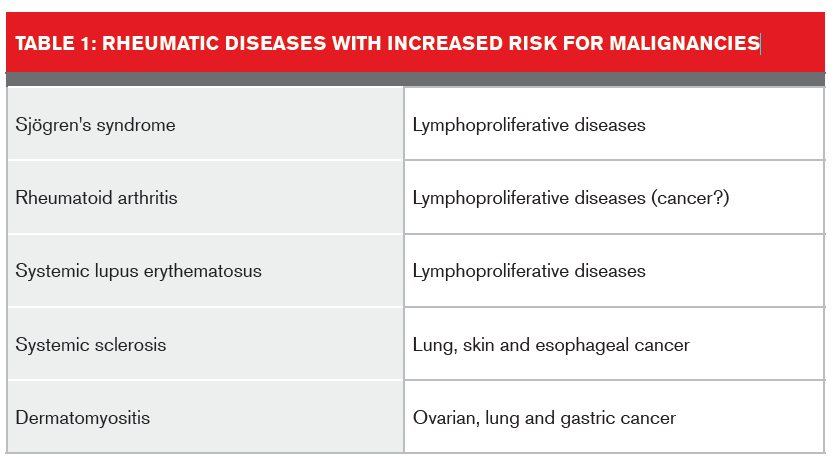

In a mini-review of malignancies in autoimmune rheumatic diseases,9 Szekanecz and colleagues summarized some of the rheumatic diseases associated with an increased risk for cancer.

Caution must be exercised when underwriting cases where the absolute cancer risk might be negligible but the overall mortality risk is significant. This situation should raise certain ethical considerations in terms of the relative need for cancer coverage. CR product applicants with impairments that might have precluded them from obtaining life cover will need to be individually considered, and with great care. For example, this product might seem to meet the need of an applicant with multiple cardiovascular risk factors or adverse associated health outcomes that would otherwise attract very substandard terms. Such applicants might need to be referred for additional consideration. Of course, the risk of anti-selection also exists and must be investigated and mitigated wherever possible.

Claim considerations

Cancer Reimbursement products need to state explicitly which cancers as well as pre-cancerous conditions are and are not covered. The products would do well to maintain consumer friendliness, but need to be strictly aligned medically as well. This is particularly important given the rapid ongoing advances in medicine and accompanying new understanding and even re-classification of certain neoplastic entities. The advances are enabling better categorization, prognostication, and treatment of cancer, but clarity is needed in order to accommodate improvements in both diagnosis and outcomes.

Ongoing feedback from claims assessors is also critical, in order to monitor cancer trends in the insured population. Any anti-selection concerns need to be raised.

Healthcare is local, but contentious contractual challenges could arise with the interpretation of some exclusions. For example, the concept of “medically necessary” and which therapies might be deemed “experimental treatments.” The latter category is usually defined as those treatments which have not yet been established as being effective for a particular medical condition. (These are usually in Phase III or earlier clinical trials.) Drug treatments that are later in the trial process have usually undergone appropriate clinical scrutiny, including publication in peer-reviewed medical journals as well as approval by relevant regional drug licensing authorities. While there are contractual definitions in this respect, both medical advancement and the hope that often accompanies newer cancer treatment modalities will need to be carefully managed and monitored at the claim adjudication stage.

Product enhancements and pricing future cancer care

What does the future of cancer care look like? Thoughts along these lines often present more questions than answers. Will there be more home-based care? Will medical advances, including those in the genetic, epigenetic and proteomic space, offset or add complexity to the construction, definitions and associated pricing structures of cancer products? What trends are we likely to expect in terms of cancer screening in the future, and what will their potential impact be?

A recent viewpoint in medical literature challenges current cancer screening trends, arguing that overall mortality should be the benchmark for advocating screening, not diseasespecific mortality (as is currently the case), in order to avoid overdiagnosis and overtreatment.10 While this debate might be academic right now, life insurers need to observe this sentiment as well as the drive towards more comprehensive and less invasive early cancer detection testing. Another ever-important consideration for the insurance industry is the upward trend of a more informed, engaged, and empowered consumer.

Monitoring of the rapidly expanding pipeline of new targeted and customized cancer therapies will need to be vigilant. The first anti-cancer immunotherapy appeared in the mid-1990s and by May 2015, 171 such therapies were in active development.11These new therapies offer tremendous promise, but the research and development of these innovative agents comes at substantial cost.

Another consideration of this expansion in drug therapy options is the earlier incorporation of newer therapies into first-line or initial cancer treatment protocols, as opposed to being used as second-line or as salvage therapy. Cancer vaccines (both preventative and therapeutic), oncolytic virus therapy and gene therapy need to be added to the current list of innovative cancer treatment advances. Additionally, the use of precision genome editing as a therapy, using CRISPRs (Clustered Regularly Interspaced Short Palindromic Repeats) genome editing technology, will certainly be one to watch closely.

It is imperative to explore constantly ways in which both existing preventive strategies as well as new advances in diagnosis and treatment can be harnessed to aid future product development or enhancements.

Cancer: are we still at war?

The analogy of war is often used in the context of fighting against cancer. Public awareness of this enemy continues to increase, as well as knowledge of the lifestyle changes necessary to ward it off. There are also now new recruits in this war, such as enhanced imaging capabilities, targeted prevention and treatment strategies and novel tactical battle plans aided by advances in analytic capabilities. No doubt cancer still is to be feared as many of its aspects continue to defy clear, rational explanation, but there is also a more optimistic outcome trajectory than ever before.

Through new product ideas, vigilant risk assessment with research-based guidelines, careful claims adjudication and ongoing research into the likely future trends of incidence, survival and the impact of comprehensive cancer care, the insurance industry can continue to play a crucial and ongoing supportive role in the battle against cancer, and serve the fight well.