The history of healthcare is defined by a range of game-changing events and discoveries that have driven an ongoing evolution and formed healthcare as we know it today – from the first smallpox vaccine in 1796 to the discovery of anesthesia in 1846.

Some of these breakthroughs, such as the discovery of penicillin in 1928 and the first medical imaging technology in 1895, happened by accident. This leads us to ask: Could the invention of the mobile phone in 1973 be the latest happy accident in the evolution of medical technology and positively change health outcomes moving forward?

Digital Interventions vs. Health System Challenges

An overwhelming amount of often conflicting materials on the effectiveness of digital health – or even how to define digital health – has flooded the healthcare space. Among the noise, the April 2019 World Health Organization (WHO) guideline, Recommendations on Digital Interventions for Health System Strengthening, provides a helpful, more reliable source of information. The report identifies several challenges that digital healthcare solutions may help overcome:

Geographical inaccessibility, low demand for services, delayed provision of care, low adherence to clinical protocols, and costs to individuals/patients – contribute to accumulated losses in health system performance. These shortfalls limit the ability to close the gaps in coverage, quality and affordability, and undermine the potential to achieve universal health coverage.

The WHO goes on to consider a range of digital interventions that have shown promise for improving health and essential services in a universal healthcare setting – from birth notifications via mobile devices to digital training for health workers. Among the interventions recommended, we have identified those most translatable to health insurance:

Client-to-provider telemedicine | Targeted client communications | Digital tracking of health status and services |

- When used to complement, not replace clinical services

- With the main benefit of greater accessibility and efficiencies derived thereof

- Reduces unnecessary clinical visits

- Health benefits to date observed mostly in mortality improvements for heart-related conditions

| - Help to change behavior in a specific audience through increased knowledge of health and health-seeking behaviors such as treatment compliance

- Measurable results seen in sexual, reproductive, maternal, newborn, and child health

- Coming soon: further study due on effectiveness in preventing and treating non-communicable diseases, which will be of great interest to our industry

| - Only recommended where health system can support implementation

- Typically works alongside and enables telemedicine and communications interventions

- Aims to reduce lapses in continuity of care, executing clinical protocol, follow-ups, etc.

|

The WHO report adds a new level of credibility and legitimacy to digital healthcare and its potential impact moving forward. Meanwhile, a corresponding demand for new and innovative digital health interventions continues to grow.

Modern Solutions for Modern Challenges

The IQVIA Institute for Human Data Science study conducted in the U.S. in November 2017 found approximately 318,000 available mobile health apps, nearly double the total from just two years prior, translating to a rate of 200 health apps added each day. High demand drives this growing market. A range of factors, including dramatic increases in non-communicable diseases (NCDs), gaps in mental health services, and the growing needs of aging populations, has created a consumer base hungry for digital health solutions.

It is important to remember that, despite the growth in the number of health apps, only 85% of them have more than 5,000 installations, and only 41 apps have more than 10 million installations. Amid controversy over persistency and effectiveness of use, the health app marketplace can resemble a minefield for consumers – and a virtual graveyard of failures in apps stores!

And yet, the potential remains real. With clinical evidence on app efficacy having grown substantially, the IQVIA study found that cost savings in acute care utilization for just five patient populations (diabetes prevention, diabetes, asthma, cardiac rehabilitation, and pulmonary rehabilitation) could reach an estimated $7 billion annually in the U.S., representing about 1.4% of total costs among these patients. If extended across all disease areas, yearly cost savings could total $46 billion.

The study also identified a trend toward specific condition management apps. In 2015, 73% of health apps focused on wellness (diet/nutrition, exercise/fitness, and lifestyle/stress) and the remaining 27% focused on condition management (disease-specific, pregnancy, medical reminders, and insurance-related). That ratio shifted to 60% wellness and 40% condition management by 2017, which likely also reflects many health insurers’ consumer health and engagement strategies.

Within the disease-specific sub-category, mental illness ranks as the condition with the largest number of related apps. As mental illness is often excluded by insurance coverages, successful and sustainable digital interventions could represent a potential opportunity for insurers. Next in the rankings are diabetes-related apps, which have already made their way into disease-specific insurance plans.

Meeting Expectations for Today’s Healthcare Consumer

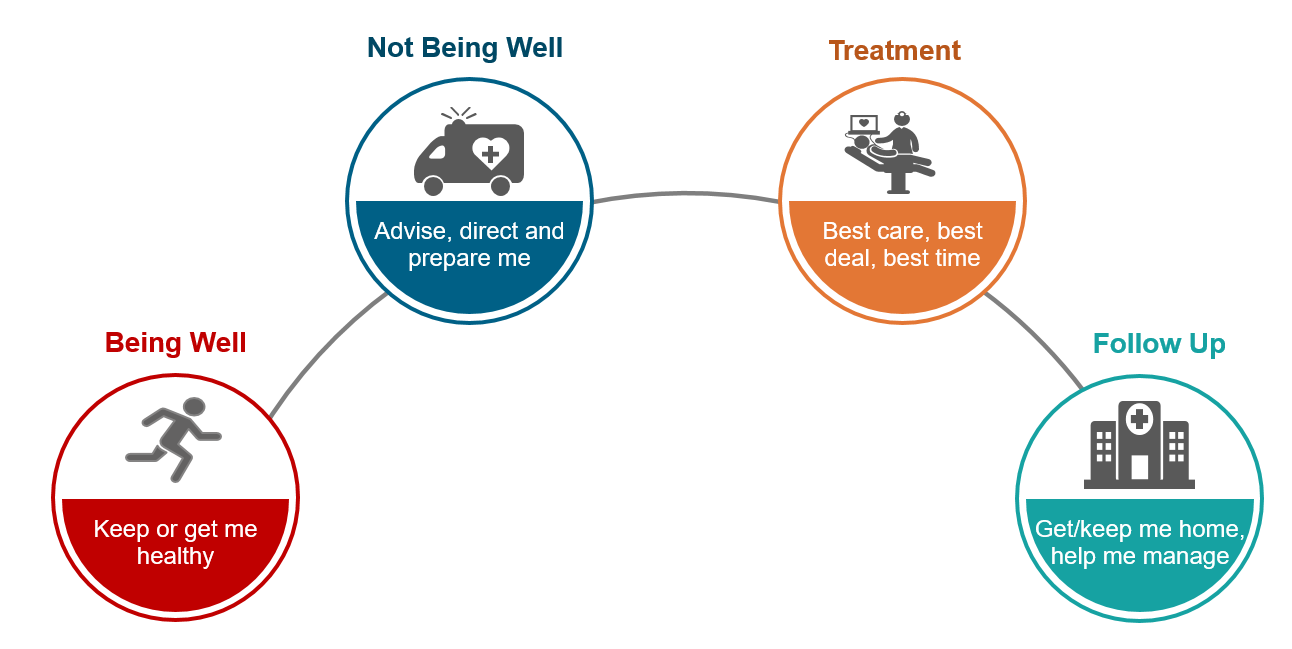

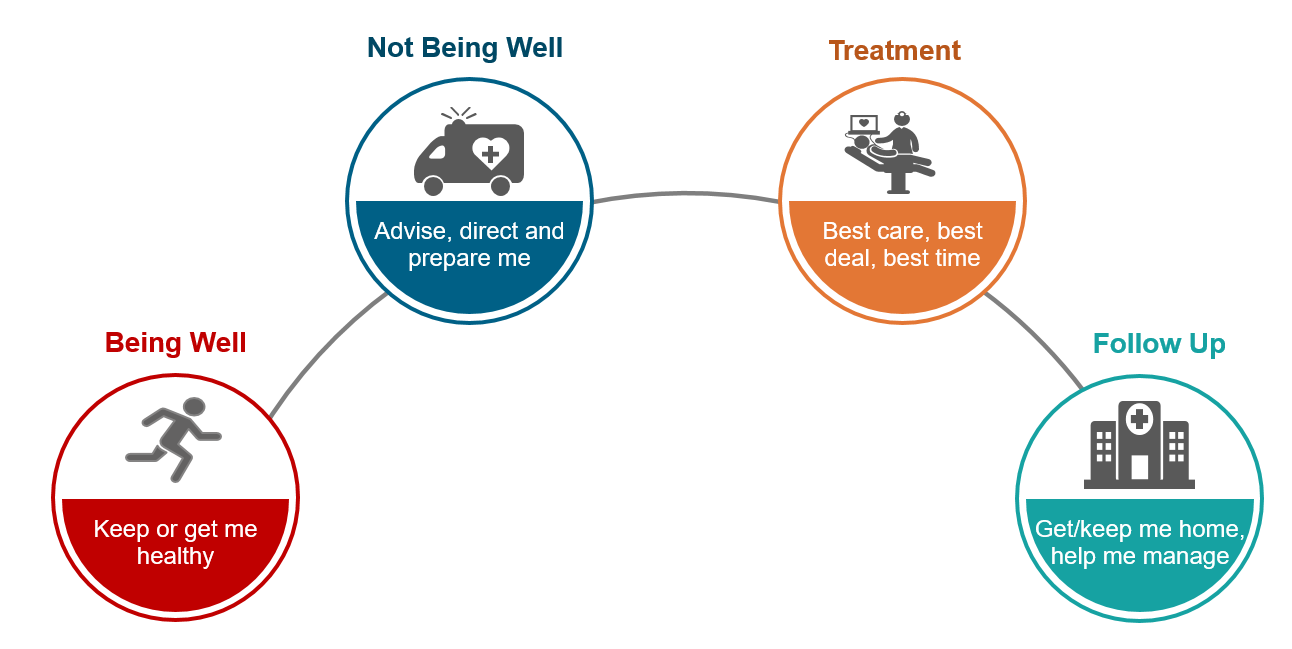

In Part I of this article series, we discussed the impact of higher consumer expectations on the higher cost of care. Consumer demands coupled with the evolution of disease state means the traditional “find it and fix it” model of treating mostly infectious diseases and accidents has given way to the model outlined in the diagram below.

Within this interactive and proactive health journey, what role will digital interventions play? To begin with, given the prevalence of mental health apps noted above, “being well” might be better termed “well-being,” as digital tools facilitate a more holistic approach to health and wellness. Here and at every step on the journey, a range of digital interventions can help meet increasingly demanding consumer expectations:

| | | | |

Process Step |

Being well (now well-being) |

Not being well |

Treatment |

Follow-Up |

Expectation | Keep or get me healthy | Advise, direct and prepare me | Best care, best deal, best time | Get me home, help me manage |

Digital Interventions | - Lifestyle and risk assessment

- Fitness trackers

- Weight and nutrition

- Mindfulness

- Personalized health goals/coaches

- Health alerts

- Family health

| - Symptom checking

- Self-triage/ education

- Chatbots/ telehealth

- Mental health

- Provider locator

- Concierge

| - Pre-habilitation advice

- Personalized health (genetics)

- Remote monitoring

- Cost calculators

- E-health records

| - Rehabilitation advice

- Chronic disease management

- E-prescription

- In-home monitoring

- Home sensors

- Counselling and support

|

Next question: How can these and other digital interventions help reduce medical costs?

Artificial intelligence (AI) symptom checkers provide a good example to consider. While there are multiple claims that they reduce health cost through avoiding unnecessary consultations, one study found only 55% of eligible patients for this service utilized it and those that did went on to see a general practitioner (GP) for second opinion.[i] This may in part be due to reservations (notably expressed by Elizabeth Murray, Professor of eHealth and Primary Care at University College London, among other leaders in the field) regarding the effectiveness of such apps at this time, given they are predominantly developed by technology companies focused on producing tools quickly with an emphasis on marketing and lacking robust clinical peer reviews. With further development, these tools may become more efficient and effective at following clinical protocols.

Despite current shortcomings, the potential for significant cost savings via digital in this area remains clear. Consider this: 80% of people already tend to google symptoms prior to seeing a doctor, and 20% of a general practitioner’s time is focused on minor ailments suitable for self-care.[ii] All efforts to reduce such waste should be supported by our industry.

Telehealth consultations present a further interesting debate. A BMJ report found that where tele-consults were offered as an alternative to a traditional consultation, face-to-face consults dropped by a significant 38%. And yet, the overall combined volumes of consultation increased 12-fold. However, the average face-to-face consultation time dropped 8%, which allows more time for those in need and provides a valuable lesson in projecting utilization of such services based on past experience.[iii]

Remote monitoring for chronic diseases offers a more complex solution. A study of heart failure patients in Singapore identified a 42% reduction in cost of care with combined remote monitoring and telehealth consultations, and an overall reduced length of stay from readmissions of 62%.[iv]

Insurers Can Help Lead the Way

So what role can insurers play in reducing medical costs?

Already efforts are underway to integrate care and change the way providers are paid and rewarded by looking at behaviors and incentives. On the digital side, the emergence of insurance-linked wellness programs – and the accompanying belief that insurers can make the world a healthier place – has produced a growing desire to engage consumers at a deeper, health-management level. Insurers have the opportunity to move from simply mitigating risk to serving consumers as trusted and proactive health partners, applying expertise in health and risk to digital interventions and helping prevent or reduce the frequency or severity of claim events.

Our Diagnosis: Digital can be PART of the solution

For insurers, a pragmatic approach to digitalization includes key considerations:

- Consumer focus – empower consumers and give them the reassurance and tools they can trust, especially in the pre-primary care stage when they first consider consulting a doctor

- Ease of use – follow in WHO’s footsteps and use digital interventions to improve overall efficiencies and develop digital touchpoints to create a positive consumer experience

- Utilization – create valuable, trusted tools that will be used and acted on, reducing the need to make a claim and steering consumers toward healthier lifestyles and more cost-effective, yet effective care options

Perhaps above all, insurers and healthcare providers must be realistic. We cannot cure cancer with a zap from our phone, but we can use digital technology to incrementally improve the overall customer experience and engagement with health insurers, while at the same time seek to prevent and manage chronic disease. And with global healthcare costs rocketing higher every year, we have to start somewhere.