Wellness’ Unexplored Potential

The incorporation of wellness, as an initiative and a goal, into life and living benefits insurance first emerged more than 20 years ago. Although it has been an accelerating trend ever since, our industry has yet to either realize the full potential of or understand the limits of wellness initiatives.

Strategically implementing wellness programs and initiatives in our products requires a deep understanding of the associations between lifestyle behaviors and health outcomes. New and more inclusive data sources, ongoing developments in technology, and advanced approaches to integrating biometric information into insurance products are all moving such initiatives beyond mere engagement and marketing schemes. Insurers now see them not only as tools for gathering additional underwriting evidence but also, importantly, as tools that can improve customer health and wellbeing.

In 2021, RGA surveyed more than 100 life and health insurers from around the world about current and future wellness-related products, initiatives, and strategies as well as challenges and potential opportunities.2 The survey found that insurers see great potential for wellness initiatives to support their policyholders’ overall physical, mental, and financial health:

- 85% of insurers globally indicated wellness is a top priority, particularly after the onset of COVID-19.

- Wellness program implementations among insurers are increasing globally, with 57% of respondents offering wellness-related products, digital tools and services, mental health support, and/or financial planning tools.

- Top areas for growth in wellness-related products, strategies, and initiatives are in chronic disease management, mental health, and financial welfare.

Data-driven evidence will be needed to help insurers achieve the full potential of their wellness initiatives.

Why UK Biobank Data?

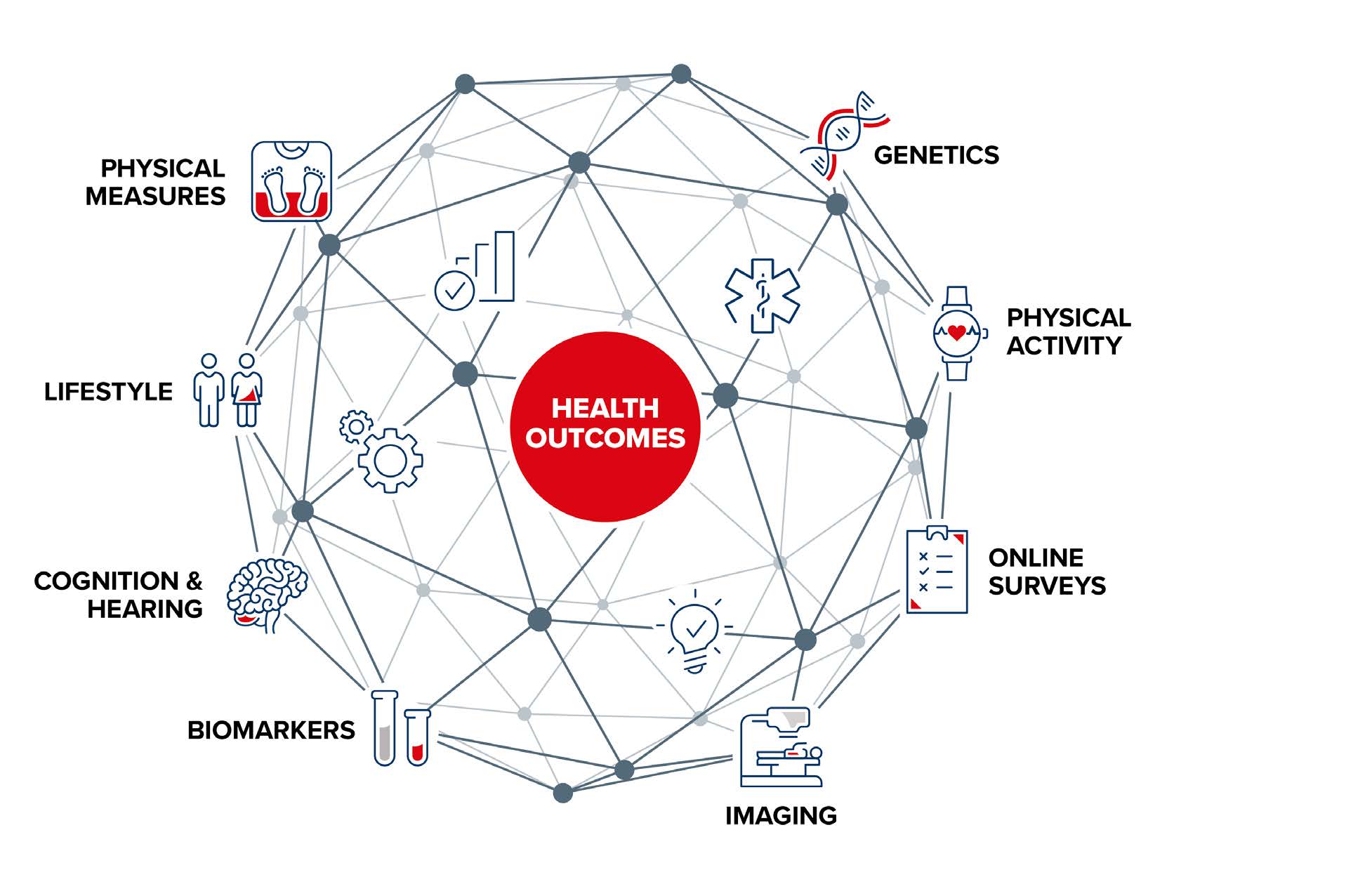

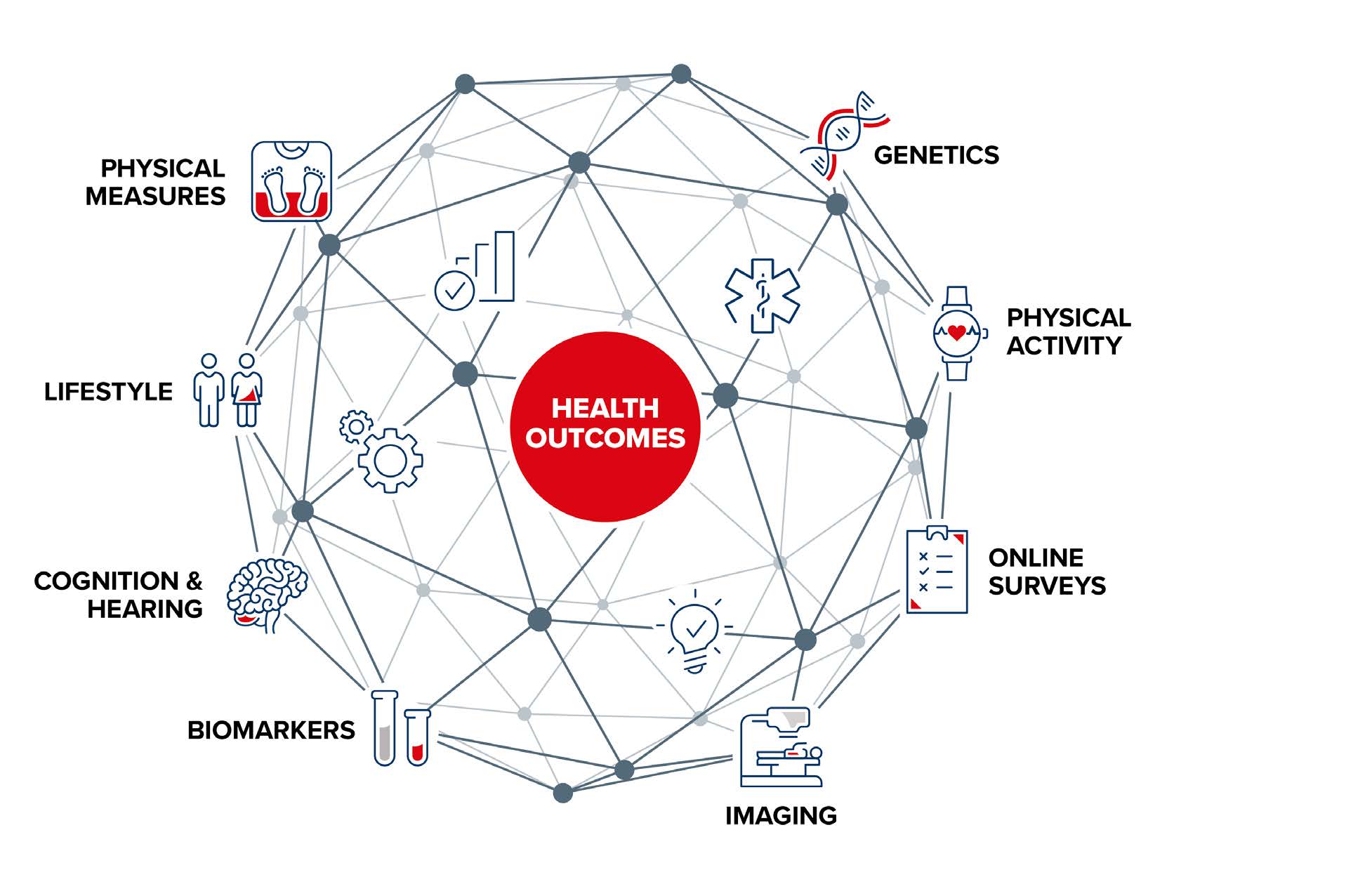

The UK Biobank is a large biomedical database containing both broad and in-depth information about the health of its participants, which comprise more than half a million U.K. adults between ages 37 and 73 at baseline (2006 to 2010). The database includes not only participant routinely linked mortality and morbidity outcome data, but also comprehensive lifestyle and wellness metrics. Participants provided a broad range of biological, cognitive, demographic, health, lifestyle, mental, social, and wellbeing data, and continue to do so today (Figure 1).

Figure 1: Breadth and Depth of UK Biobank

Adapted from UK Biobank

When compiling the database, several steps were taken to ensure ethnic, geographical, and socioeconomic heterogeneity, as well as broad distribution across as many exposures as possible. This was done to allow reliable detection of generalizable relationships between demographic characteristics and health outcomes. Participant recruitment was via invitations mailed to people in the targeted age cohort – those registered with the U.K.’s National Health Service (NHS) who lived within 25 miles of one of the 22 study assessment centers located throughout England, Scotland, and Wales.

Although the UK Biobank is not necessarily representative of the general population, as it has already been shown to have “healthy volunteer” selection bias – that is, participants, who are self-selected from the overall database, are healthier than the general U.K. population.3 Still, it is sufficiently illustrative of standard insured lives, making studies of this population of particular interest and relevance to insurers.

Research Goals

Life and health underwriting philosophies typically contain criteria relating to several different aspects of health, including biological, physical, mental, and lifestyle. As the UK Biobank is a sizable data resource that permits research into many of these aspects of human health, this has given RGA’s underwriters, with input from our chief medical officers, the opportunity to formulate a broad range of research questions they considered to be of highest importance for the UK Biobank to be used to investigate.

Tackling these questions will help strengthen and expand RGA’s underwriting philosophies and wellness strategies. A baseline normative wellness dataset, as well as other easily measured attributes within the conventional standard risk pool, is a prerequisite for assessing substandard risks. Table 1 shows some examples of how the deliverables from this study may impact the different functions of RGA’s underwriting methodology.

Wider Value

This collaborative research will enable insurers to focus on the utility of current and future underwriting factors such as lifestyle (including physical activity) and easily measured variables such as heart rate. The hope and expectations are that these items can complement more traditional rating factors such as age and sex, and comorbidities such as high blood pressure, to predict mortality and morbidity outcomes. There is even the potential for incorporating lifestyle factors in underwriting in ways that can supplement traditional approaches to risk.

Data-driven research can help insurers identify and segment risk more effectively, calculate the impact wellness factors can have on life and health experience, and potentially optimize underwriting decisions. It will also enable us to justify, through trusted data, our approaches to risk assessment.

Summary

Can new evidence from the UK Biobank make an impact on insurance underwriting? The answer, we trust, will be yes. The goals of this research are:

- Improve the underwriting philosophy and best-estimates for pricing

- Enhance wellness product development

- Generate additional critical insights into health and wellness, further supporting the results of the recent RGA & RGAX Global Wellness Survey Report

- Publish peer-reviewed articles on this research in medical, actuarial, and insurance journals for public interest and benefit

- Create a pool of knowledge that has sizable benefit to clinical researchers that could lead to better interventions in primary care (e.g., support healthcare providers in encouraging people to engage in healthier lifestyle choices) and significant public health implications

- Make a positive impact on society

Conclusion

As people are living longer, more will assuredly live with multiple diseases and conditions that impair health, making a deeper understanding of how combinations of risk factors affect mortality and morbidity extremely valuable. With interest in wellness rising rapidly across the insurance industry, the output from this project has the potential to create and provide critical insights to enhance underwriting and pricing for wellness products, as well as to inform consumers on ways to improve their health and longevity.