Insurance company claims managers understand that in order to have compelling offerings, every effort must be made to pay valid claims at the earliest possible opportunity. At the same time, to pay without proper investigations of each claim represents significant risk to the affordability of insurance and to the industry as a whole.

I have taken the view for some time that the ability of life insurers around the world to investigate and validate claims has been coming under increasing pressure. To investigate this view, RGA undertook to survey its claims managers around the world, asking them to share their thoughts and experiences about current and developing changes and challenges in their markets. By gathering this information, we sought to understand whether these changes and challenges might suggest global trends, or perhaps they are short-term reactions to evolving market conditions. RGA has offices in 26 countries, so we were confident of a truly global assessment.

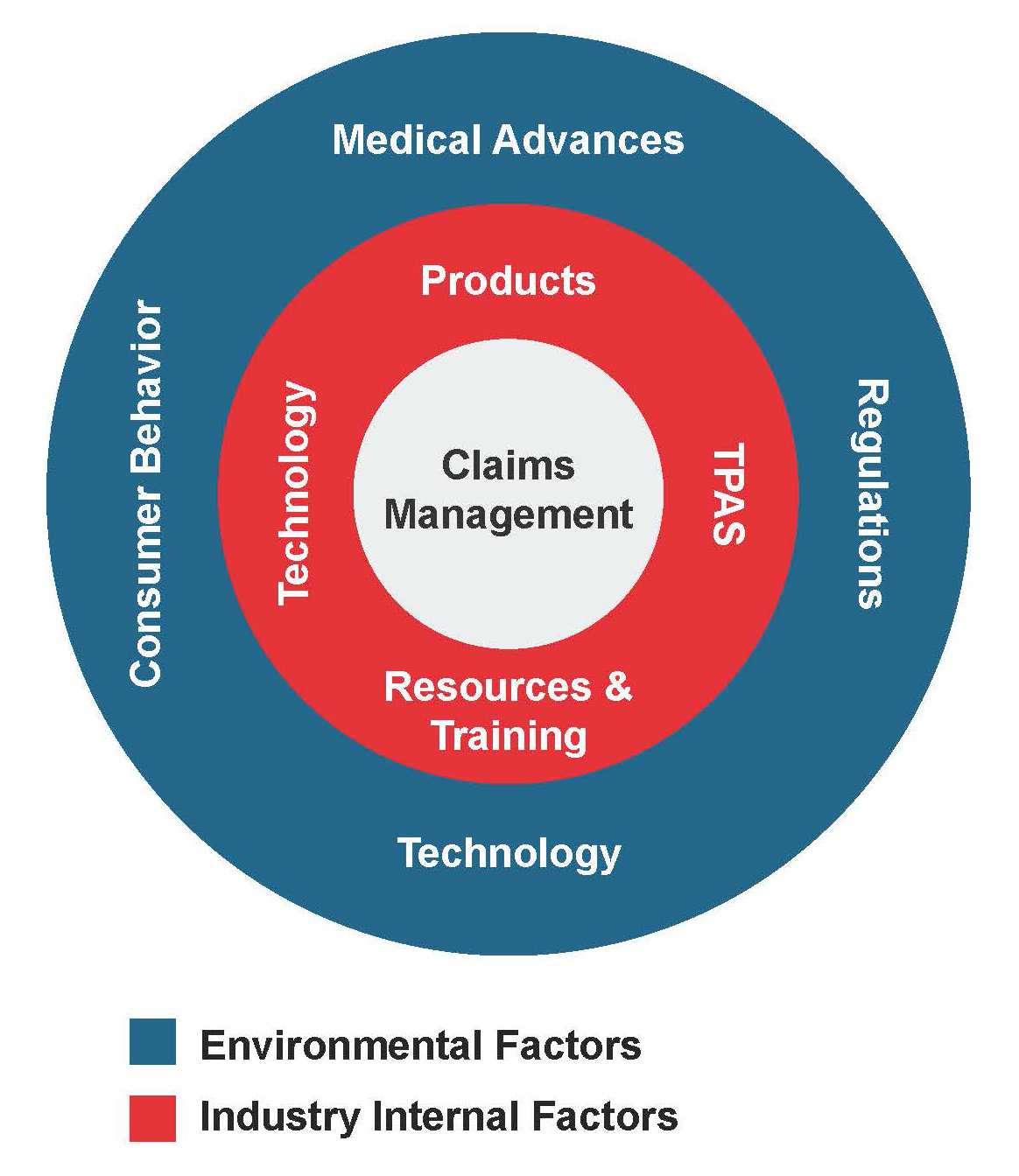

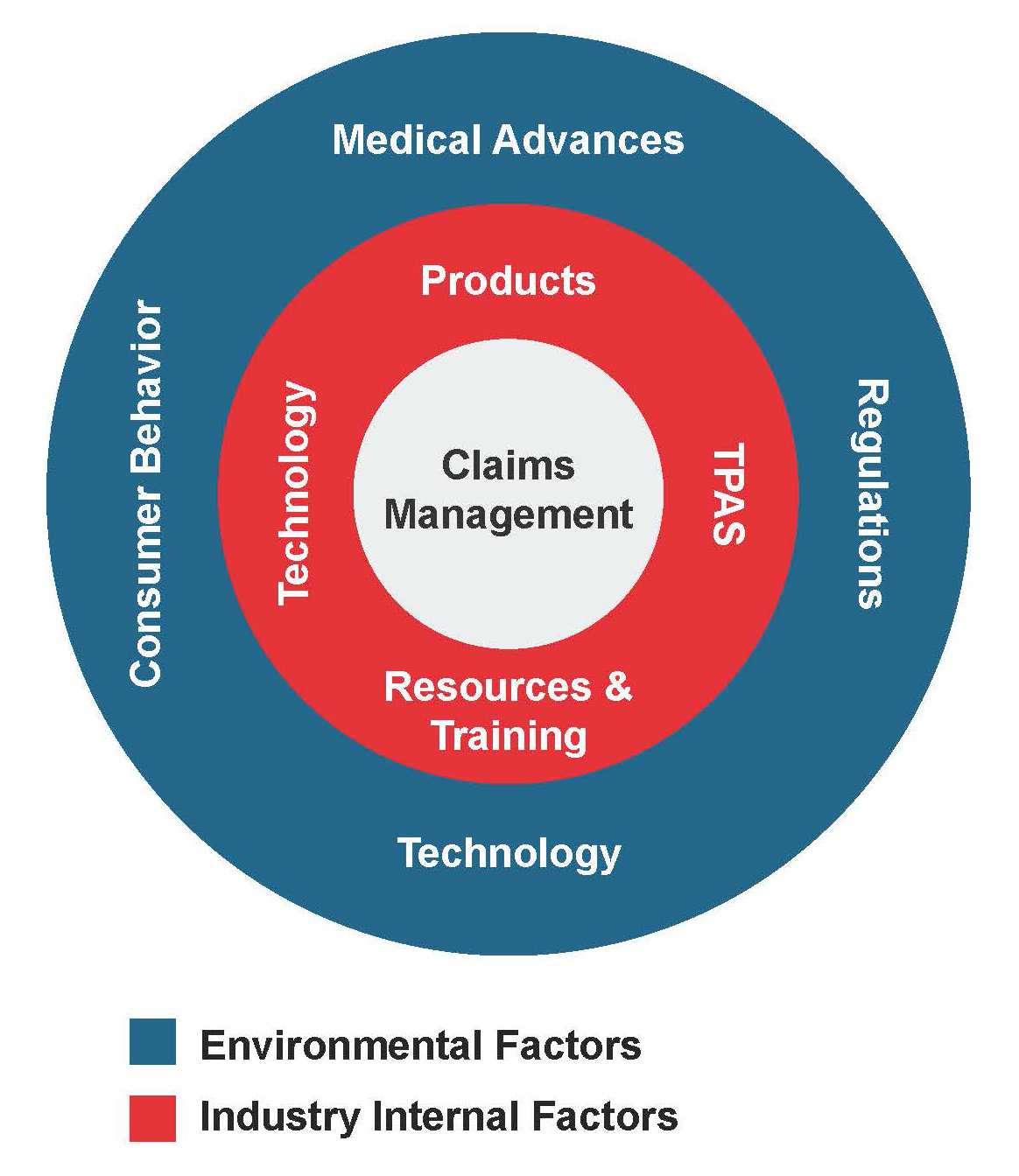

Our survey identified several claims process challenge items, presented in the chart. Those listed in the inner ring are considered to be within the control of insurers, and those in the outer ring are external – that is, items over which insurers have little control but must respond to as needed.

Those listed in the inner ring are considered to be within the control of insurers, and those in the outer ring are external – that is, items over which insurers have little control but must respond to as needed.

This paper – Part I of II – focuses on the external market environment factors that affect and influence insurer claims practices. Part II will consider the items insurers can control – that is, the challenges we insurers impose upon ourselves.

Findings

We anticipated that pressures on claims management practices would arise from within our industry and from market environments, as both tend to have a sizable influence on how insurers approach claims validation.

External factors can affect claims practices in many ways. For example, advances in medical science, such as improvements in screening, diagnostic, and treatment techniques, have been steadily changing both the incidence and severity of critical illnesses. Regulations also have an impact on claims practices, and with global consumerism rising, there is an expanding focus on treating customers fairly. Claims managers endeavor to do everything possible to pay claims quickly and fairly. Part of treating customers fairly also encompasses the industry’s responsibility to identify and respond appropriately to incidences of fraud and misrepresentation.

This paper discusses the four principal environmental challenges – regulations, consumer behavior, medical advances, and technology – reported by claims colleagues surveyed, and provides an assessment of the expected outlook for each. Although technology, which was cited as both an external and internal market factor, is not discussed independently, its advancing capabilities play a key role in all of the challenges.

See also: Global Claims Views: Disability: RGA’s Claims Management

Regulations

Main Issues:

- Genetics

- Medical information access

- Contestable periods

Outlook: Significant regulatory change not expected in the medium term

Commentary

Regulators play an important role in shaping market environments, ensuring level playing fields and identifying industry and market actions and trends that might affect consumers as well as the broader market.

The key regulatory issues identified are:

- Genetics. Most countries have rules which place restrictions on insurers requesting and/or using genetic information at Underwriting. Such rules have typically been in place since the early days of genetic testing, when these tests were expensive, typically only available on medical referral, and were limited to individuals whose family histories placed them at high genetic risk of serious future ill health.

Although several genetic tests are now relatively inexpensive and freely available, there seems little appetite from lawmakers to allow insurers greater access to the results.

- Medical Information Access. Some markets have imposed further restrictions on insurers’ ability to access medical evidence to validate claims. In France, for example, a Health Bill adopted in January 2016 updated the definition of the country’s “le droit à l’oubli” or “right to forget” clause for sub-standard credit mortgage applicants. The law, which is linked to the European Union’s data protection legislation, gives consumers with a history of cancer the right not to disclose this history when applying for credit mortgage insurance up to a financial limit, and if treatment ceased at least 10 years ago for adult cancers (diagnosed age 18 or later) and at least five years ago for childhood cancers (diagnosed prior to age 18). In addition, if the condition has been disclosed, the insurer is obliged to accept the applicant at standard rates. The law also incorporates a list of cancers and cancer-related conditions with shortened time-frames from the general age rule cited above, for which carriers must offer standard rates. Consumer groups in France would like this list to include other chronic illnesses, and

this bill would support such an extension.

As this regulation is linked to EU law, it could potentially spread to other countries within the European Union. The risk here is that the less information is available to underwriters to assess a risk, the less defined an assessment process is likely to be. If this spread occurs, premium rates are likely to increase to protect insurers from the uncertainty.

Meanwhile, in the U.K., The Association of British Insurers (ABI) guidance in relation to misrepresentation and fair customer treatment (under the Treating Customers Fairly regulation) has for some years restricted the medical evidence insurers can obtain in order to adjudicate a claim. Only evidence items directly relevant to the cause of the claim may be obtained. Should medical information not directly relevant be provided, the claims manager is duty-bound to ignore that information even if it might be material.

- Contestable Periods. In some markets, contestable periods are imposed by regulators. In others, they are part of a policy’s terms and conditions language, even when not required or governed by regulations. Typically, contestable periods mean insurers can only contest a claim for misrepresentation during specific set periods, which normally range between one and three years from policy commencement. After this period, claims can only be challenged for fraud.

Regulations, however, can sometimes be challenging. A recent change to Section 45 of India’s Insurance Ordinance of 2014, for example, states: ‘No policy of life insurance shall be called in question on any ground whatsoever after the expiry of three years from the date of the policy’. There are questions about how to interpret and apply this statement, as it could lead some to argue that even a fraudulent claim may not be contested once three years have passed from policy commencement. With time, as the regulation is tested, greater clarity should emerge. A similar regulatory condition is also present in China.

More restrictive contestable periods – that is, shorter and with wider scope – combined with constraints on obtaining medical evidence and growth in genetic testing, could further intensify the asymmetry of material information that exists between the consumer and the insurer. This could ultimately increase the likelihood of anti-selection and restrict options available to insurers if certain material information were to be discovered.

Insurers would prefer to pay more claims, as denying claims tends to be negative for both insurers and claimants. Unless some validation in the claims process remains, the only way for insurers to mitigate the risk at claims time will be through the level of premium paid.

Claims managers surveyed were uncertain as to possible future changes or trends in their regulatory environments. Looking back over the last 10 years, regulatory changes typically restricted insurers’ ability to collect and use evidence and narrowed the grounds upon which a claim could be challenged. However, no significant regulatory changes, either imminent or in the pipeline, were seen by claims managers that might further restrict the industry’s ability to contest claims.

Consumer Behavior

Main Issues:

- Availability of information

- Challenging declines

- Social media

Outlook: Increasingly aware of and in control of health

Commentary

As consumers adapt to a rapidly changing world, claims managers may expect to see an increase in anti-selection driven by an asymmetry in knowledge, and increased disputes around claimant entitlement under living benefit definitions.

- Availability of information. As touched on in the Regulations section above, the ability for consumers to gain knowledge about their own health, particularly knowledge to which medical professionals or insurers do not have open access, is increasing. At-home genetic tests, data from wearable devices, and drop-in medical screening programs that refer individuals but do share information with medical practitioners or insurers, all permit consumers exclusive knowledge about various potential health risks. As such, an insured may have both the means and motivation to anti-select with little risk of industry discovery or remedy.

- Challenging declines. Today’s consumers are well informed about their health – far more so now than ever before. Doctors have little choice but to provide detailed explanations about medical conditions lest patients do their own research on the internet and reach their own conclusions. This wider availability of health knowledge has the potential to drive disputes about claims decisions, especially in terms of definitions of illness and disability – something claims managers are already starting to see.

In many countries, insurers have worked hard to reduce the number of claims disputes, especially in countries that have had high claims rejection levels. Any reversing of this positive trend may prove damaging to the long-term success of the industry.

Dispute resolution tends to be conducted mainly by mediators. Litigation, however, remains the norm in a few markets, such as the Americas (North, Central, and South) and Australia. Claims managers view most mediators as fair and reasonable, but in some countries, mediators are seen as weighted toward consumers.

Throughout the Americas, for example, the courts are viewed as likely to favor the insured. Some U.S. states are seen as particularly consumer-friendly. It is difficult, however, to be objective in this area, as claims managers are seeing their own decisions challenged. What is not in doubt is that consumers are increasingly ready and prepared to challenge insurers if a claim is declined.

- Social media. In addition to the traditional methods used to challenge the insurer’s decision, it is also becoming increasingly common for claimants to use social media to publicize their complaints, as well as to “name and shame” their insurers. Mainstream media tends to see insurance disputes as fertile ground for news coverage, and such stories, regardless of the facts, rarely paint the accused insurer in a positive light.

The use of social media and the availability of information is likely to continue to grow, with consumers becoming more sophisticated in their use of this knowledge and technology. Insurers need to understand how this will affect their approach to assessing risk and resolving claims disputes when they arise.

Medical Advances

Main Issue:

Impact on Health and Living Benefits Insurance

Outlook:

Potential to change the insurance landscape completely

Commentary

Medical science is advancing at great speed, bringing with it questions about the sustainability of product design. The main question before insurers is whether health and living benefits products sold today will still offer valid protection in 20, or even 10 years. Will medical advances cause claims to increase, or might incidence decrease if covered diseases can be treated at earlier stages – i.e. before they advance to the point that a claim would need to be filed?

For example: How should insurers respond if a medical advance makes obsolete a form of surgery for which cover was provided? Should insurers automatically approve the claim for the new treatment method, or reject the claim, maintaining that only the older approach is warranted? If insurers choose to respond to medical advances by updating policy definitions, how should in-force policies be treated? Should those policies maintain their older definitions, or should insurers have an agreed-upon procedure whereby definitions for these policies can be upgraded – a procedure that would incorporate policyholders paying an adjusted premium?

To keep pace, benefit wordings do need to be updated and amended regularly – something many insurers already undertake. This could shorten product lifecycles as products with older definitions would need to be retired.

How will claims assessors keep up with the constant wording changes due to these updates? Additionally, how will they know which definitions and wordings to apply when standard treatments have fundamentally changed since the policy’s issuance?

When insurers update policy definitions today, existing in-force policies usually retain the definitions with which they were issued. On a purely legal basis, insurers are correct to do so as premiums were calculated relevant to the cover provided. However, given medical science’s increasing pace of change, it might be more appropriate to give these existing policyholders the option of upgrading their policies by updating with the new definitions, with an appropriate amendment to the premium.

Health insurance could be particularly affected by medical advances. Wearables, for example, are allowing consumers to adopt healthier lifestyles, thereby avoiding illness events and increased healthcare expenses. Alternatively, treatments and therapies are now available for a number of previously untreatable conditions. These treatments, however, are usually very expensive, and the likelihood is that health claims will continue to see significant cost inflation.

Keeping abreast of these changes, and ensuring claims are paid in line with underlying contracts, will continue to be challenging. However, if insurers are able to adopt a more flexible approach, perhaps allowing all policyholders to upgrade terms, conditions, and definitions as needed, the industry could pay more claims, avoid negative publicity, and generate additional premium revenue.

Summary

The insurance industry today is operating in a rapidly changing environment, with technological and medical advances acting as substantial drivers. These advances are increasingly requiring well-thought-out responses from insurers, to keep pace and to price products appropriately. Meanwhile, regulators are reacting to these changes, which is adding a further layer of complication.

A look at how the industry has responded to environmental factors and how the responses have affected claims assessment will be in Part II of this report – A Changing World – Industry Response – to be published in December.

Those listed in the inner ring are considered to be within the control of insurers, and those in the outer ring are external – that is, items over which insurers have little control but must respond to as needed.

Those listed in the inner ring are considered to be within the control of insurers, and those in the outer ring are external – that is, items over which insurers have little control but must respond to as needed.