In our previous paper, “ A Changing World – Environmental Factors,” the perception was put forth that several pressures have been increasing on the ability of life insurers worldwide to investigate and validate claims.

To investigate whether this perception was in line with reality, RGA surveyed its claims managers about their thoughts and experiences, and their current and developing challenges.

We hoped gathering this information would help clarify whether these challenges represent global trends or are short-term responses to market conditions. As RGA has offices in 26 countries and does business in more than 70 countries worldwide, we were confident of a truly global assessment.

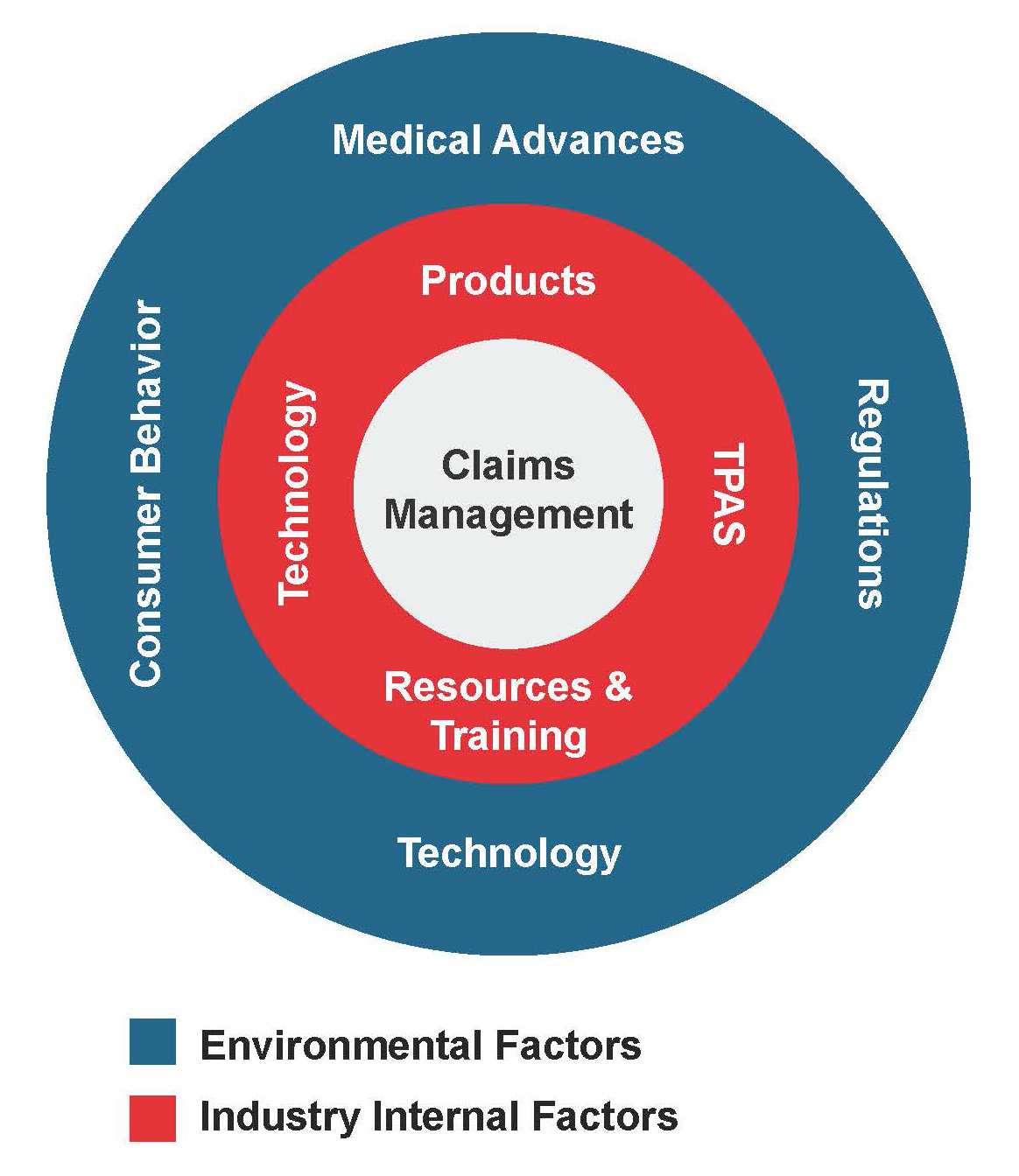

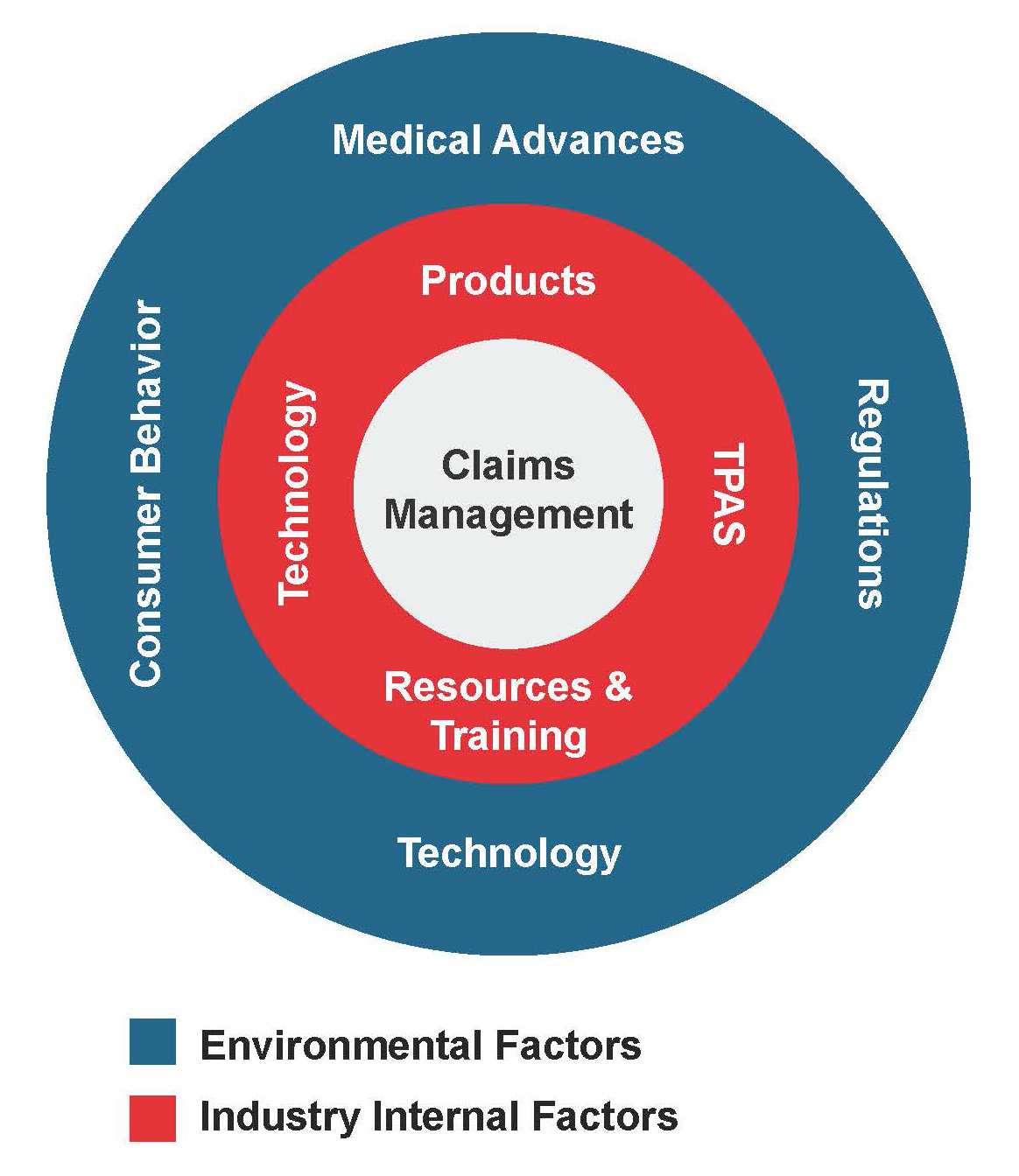

Our survey identified two sets of pressures:

- External pressures, over which insurers have little control

- Internal pressures, over which insurers have some control

In our previous paper, we discussed the external environment factors and pressures identified that are affecting claims assessors in today’s fast-changing worldwide market. In this one, we look at internal pressures and how they are affecting claims practices.

See also: Global Claims Views: Disability: RGA’s Claims Management

Findings

Survey respondents identified these three internal pressures as the most important:

- Products: Increasing complexity and shrinking lifecycles

- Resources: The ability to attract and retain good claims assessors, and the ramifications of outsourcing key claims tasks to third-party administrators (TPAs)

- Technology: The need to incorporate it to improve claims processes

Products

Main Issues:

- Increasing complexity

- Policy lifecycles

- Simplified underwriting

Outlook: Mature and developing markets will experience divergent trends: mature markets anticipate a drive to simplification while developing markets expect further complexity.

The most striking example of an insurance product experiencing increasing complexity is that of critical Illness. When introduced in 1983, CI covered just four conditions: heart attack, stroke, cancer, and coronary artery disease requiring surgery.

In the first paper, we discussed how medical advances were changing claims incidence and the industry’s need to respond to maintain a viable product. Other factors also influenced CI’s evolution: its popularity, especially in Asia; insurers’ need to differentiate products competitively; and the desire to enhance coverage as broadly as possible.

Today’s CI products provide far more. In some markets, there are CI products that cover more than 100 medical conditions. There are also CI products that provide partial payments for less serious or earlier stages of an illness, and products that have multi-pay options permitting benefit payouts for up to seven claims.

This rapidly changing market environment and its resulting competitive pressures are yielding fast-shrinking product lifecycles as companies compete to offer better, more extensive and more up-to-date coverage.

With product designers and marketing teams driving to differentiate their products from competitors and from their own previous iterations, it is easy to see how product complexity develops. And these issues are not exclusive to critical illness. Examples can easily be provided for health, disability income, and permanent disability as well.

An interesting divergence in the outlook for product development is emerging between developing and mature markets. Consumers in mature markets are demanding clarity, which claims managers believe will drive products to become simpler over the next decade. Emerging and developing markets, however, have strong competitive pressures and the outlook is for product complexity to continue to increase as insurers try to differentiate offerings by adding more features and benefits.

Product complexity can have two main challenges for claims assessors and insureds:

- A product can be so complex that insureds might not know when to make a valid claim or even what might constitute a valid claim, which could delay claim filing and bring additional challenges in obtaining evidence and verification.

- Claims assessors might also have difficulty knowing and identifying all benefits for which a covered individual is eligible, which could result in elevated decline rates.

The concurrent push to simplify underwriting has its positives and negatives as well. Underwriting and claims processes should both be in balance and complementary, but a principal issue for simplified and guaranteed issue products, which are available in most markets, is that simplification has reduced the number and scope of underwriting questions. This is increasingly requiring that claims assessors investigate pre-existing conditions at claim time – a recipe that is likely to yield unhappy claimants and bad publicity. A forensic claims process might also be unrealistic if contestable periods continue to shorten or if other regulations further restrict the ability of claims assessors to look at historical illness.

Resources

Main Issues:

- Lack of experienced assessors

- Lack of formal training

- Widespread use of TPAs

Outlook: No change expected

Respondents suggested that finding and keeping claims assessor specialists is a problem in most countries around the world (although Japan and Spain appear to be exceptions).

Typical claims assessors tend to have backgrounds in other insurance industry areas or in the medical profession (nurses, occupational therapists, etc.). In the U.S., a stronger effort has emerged recently to attract college graduates in order to upgrade and professionalize the function.

Organized industry-wide training for claims assessors is currently available in about half of the countries surveyed, with trade associations and industry-focused educational institutions the main providers. In some markets neither is available, and training is provided on the job and by the company’s reinsurers.

Budgets and time are the main obstacles to the ability of claims assessors to attend industry events and obtain training. Recent pressures on expense budgets is squeezing the ability to provide training. Seniority also appears to play a role, with key industry events often reserved for only the most senior claims executives.

Senior executives at insurers, especially in claims departments, need to look at how best to attract and retain good claims assessors. This presently appears to be an industry-wide issue, and one that will most likely add to the challenges due to today’s changing environment.

To fill this skills gap, claims departments have become increasingly reliant on TPAs for claims management. Given the nature of the claims function and the impact a process failure can have on an insurer’s brand and reputation, it might be surprising that claims departments are becoming so dependent on TPAs.

With a TPA, effective control of the claims process is ceded by the insurer, which assumes a primarily oversight and reactive role, focusing on maintenance of the insurer’s claims philosophy and ensuring the delivery of agreed-upon service standards.

Use of TPAs tends to vary by line of business. Specialist providers in health claims and more generalist end-to-end TPAs in life and living benefits are relatively common throughout the world.

Experience with TPAs will differ from insurer to insurer, as each company will have a specific reason for using one. Smaller-scale direct writers, for example, can benefit from the high-quality bespoke services offered by some TPAs – services they might find difficult to replicate independently.

TPAs do not themselves create challenges to claims management practices, but reliance on them by direct writers might reduce an insurer’s incentive to resolve other issues faced. Going forward, this issue may be one insurers might want to bring into sharper focus.

Technology

Main Issue: Limited use of technology in the claims process

Outlook: No indication that technology solutions being investigated

In the previous article, we discussed how technology is impacting claims through medical advances and consumer behavior. Insurers, however, seem reluctant to invest in technology solutions that might address some of the challenges faced in claims. Most continue to rely on manual solutions, which can be a challenge when linked with rising product complexity.

Respondents indicated that technology is being used in claims, but only to a limited extent. In some countries technology is being used to obtain medical evidence, and in others, to scour social media in order to investigate policyholder activity.

E-claims solutions are an area of some interest, but there is no indication such solutions are being investigated, let alone developed. There was also little indication that apps or wearables have become part of the claims process, whether to improve customer experience or claims outcomes.

At this point, insurers truly must invest in the opportunities technology affords. If the industry does not, serving our millennial consumers, who use technology for almost every transaction that they perform today, will be at best challenging, and at worst, nearly impossible.

Conclusions

In this paper as well as the previous one, we looked at the challenges facing claims management practices and sought to identify whether pressure truly does exist on the ability of life insurers to properly investigate and validate claims. Survey responses very much suggest the pressures are both real and global.

Regulations are being introduced in some markets that might limit an insurer’s ability to investigate ill health at claims time. With one or two exceptions, these regulations appear to be reasonable and balanced compromises as they allow consumers to buy insurance with a degree of certainty that they will receive benefits should a claim arise, and do not offer carte blanche for misrepresentation.

Medical advances in particular are changing the mortality and morbidity associated previously with chronic or life-threatening diseases. One key issue is the speed at which policy definitions are changing. As life insurance is a long-term business, multiple definitions of the same illness or treatment can exist simultaneously at a company. As definitions evolve, there is risk if policies retain older definitions. If policyholders do not have the option to upgrade when definitions are updated, they could be left with outdated coverage.

A skills gap also appears to be developing in claims. Surveyed claims managers noted a growing inability to attract and keep good claims assessors as well as increased moves toward contracting with TPAs to facilitate claims processes. There is surely a question of whether this position is sustainable, given the challenges posed by technology, consumer expectations and medical advances.

Finally, speaking of technology, life insurance, like every other business, has to adapt to a world where technology is advancing at increasing speeds. Technology is giving consumers better insight into their health and more control over their well-being. This knowledge may have a major impact on mortality and morbidity, allowing people to live longer and more fulfilling lives, but from a life claims perspective there is risk that an asymmetry of knowledge might increase anti-selection at a time when the industry’s ability to investigate it is constrained.

Additionally, the opportunities offered by technology do not appear to have been embraced by our industry’s claims sector. They will surely need to be if we are to keep up with the challenges of the changing world. Look out for a related article in the New Year, in which will consider what the claims function might look like 10 to 20 years from now.