Worldwide, cancer is the second leading cause of death after heart disease. It killed 8.8 million people in 2015, and accounts for about 1 in every 7 deaths worldwide. New cases are expected to increase by 50% over the next 20 years.

- Worldwide Cancer Cases Are Projected to Increase By 50%

From 14 million to 21 million - Worldwide Cancer Deaths Are Projected to Increase by 60%

From 8 million to 13 million

Source: American Cancer Society; Global Cancer Facts & Figures, Second Edition, Cancer.gov

The good news is that advances in genetic reengineering, gene sequencing, diagnostics and immunotherapy have all made cancer more survivable. Globally the trends in five-year survival rates are encouraging, and vary by illness, as you will note from the illustrations below.

% of Cancer patients who survive 5 years after diagnosis |

Liver | 10-20% |

Leukemia - Adult | 50-60% |

| Lung | 10-20% |

| Ovary | 30-40% |

| Stomach | 25-30% |

| Rectum | 50-59% |

Source: CON CORD - 2 Study, Lancet 26 Nov 2014.

However, all these advances come at a price: significant investment is needed to develop and test new drugs, and many potential drugs in development fail at some point in the process and are never introduced. Drug companies have an interest in improving the health of the population, but also in meeting their ROI (return on investment) objectives. In turn, this affects the cost of cancer care.

Pharmaceutical company investments continue to remain high, and cancer therapies account for more than 30% of all products under development. On average, it takes 10-15 years and more than $1.2 billion to bring a new cancer drug to market. Getting FDA approval is an incredibly rigorous and time-consuming process. Between 1998 and 2014, 167 potential lung cancer medicines failed in clinical testing, while only 10 were approved. There are currently about 600 drugs under development.

An insight into the global cost trends for cancer care is as follows:

- The world spent an all-time high of $100 billion on cancer medicines in 2014, up 33% from $75 billion just five years ago. In 2014 alone global spending on cancer drugs rose at an annual rate of 10.3% as compared to 6.5% for the five-year period 2008-2013.

- The average cost per month for a branded cancer drug is now approximately $10,000, up from an average of $5,000 a decade ago, while the average cost of all treatments that a cancer patient undergoes over the course of a month has risen by 39% in the past 10 years.

- Genome-editing treatments could cost in excess of $400,000 per patient.

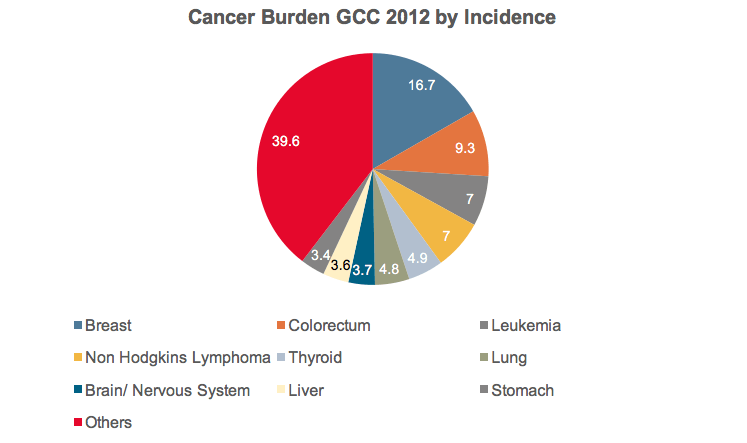

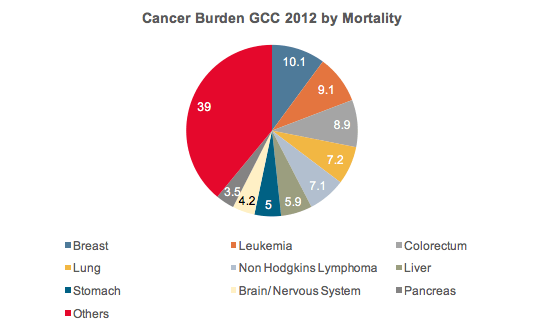

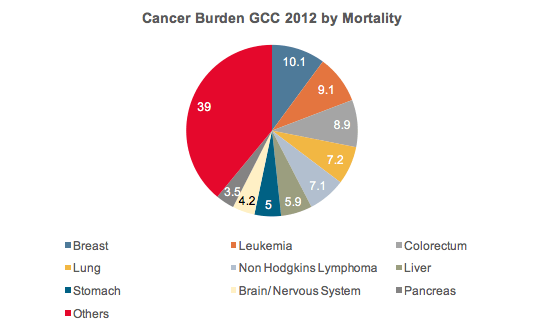

Cancer burden in GCC countries

Cancer is the third leading cause of death in the Gulf Cooperation Council (GCC) countries as reported by the Global Health Observatory Data Repository of the World Health Organization. Breast cancer leads the incidence and mortality tables, closely followed by leukemia and colorectal neoplasms.

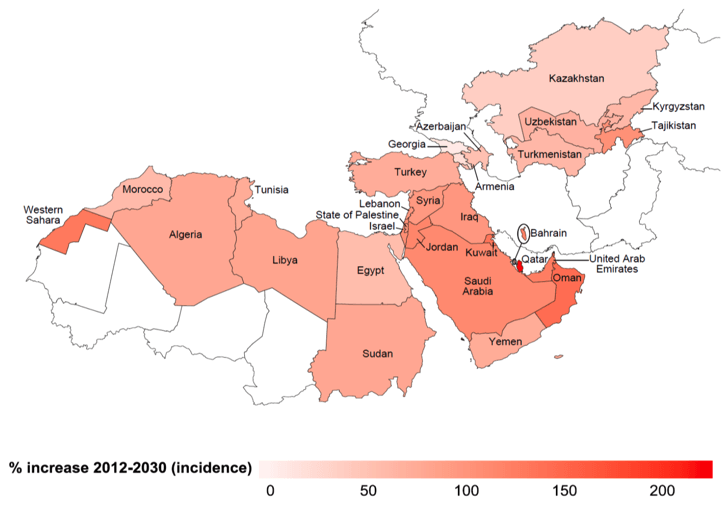

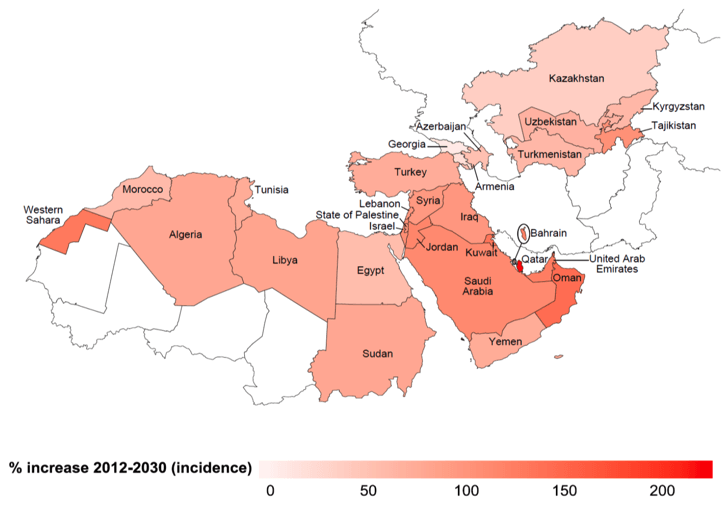

GCC countries are also among those countries for whom the WHO has projected an increased incidence of 100-150% by 2030, with an aging population, high incidence of obesity, bad diet habits and smoking as key triggering contributors.

Challenges for underwriters are plentiful. Volatility is affected by many factors: inflation, medical innovations, costs of new products, new age limits and terms of coverage, the stage of coverage, etc., to list a few. Additionally, early intervention that could save lives and money is often prevented or neutralized due to the insured's poor awareness, procrastination, aging, poor dietary habits, sedentary lifestyles, alcohol abuse and smoking. As such, in the majority of cases, the point of intervention is not until the cancer becomes acute.

In an era of improved diagnostics, increasing social media influence, higher survival rates, and rising costs of care, our responsibilities as non-clinical stakeholders are to contribute and add value to the pre-cancer and post-cancer stage.

Collaborative initiatives to raise awareness, not just about the illness, but about new developments in prevention, screening and early detection, need stronger dissemination to all segments of the population.

The key area of focus in post-cancer care, other than palliative care, is to develop capacity and solutions for survivorship planning. These should include financial protection and income replacement solutions/products that alleviate the fear of being exposed to such a high risk that could wipe out a lifetime of savings. Today being told that “you have cancer” is no longer as fearful as it was five years ago. The fear today, however, is, “Do I have the resources to access and afford the available care to treat, survive and maintain a certain degree of quality of life?”

Cancer has established itself as a fast mover to the top of the list of non-communicable diseases, but initiatives may, if effectively implemented, ease the physical, as well as financial, suffering.