Key findings

Level of concern

During our interviews, insurers were asked about their level of concern with churning and stacking and whether this concern had changed over time. Their responses were enlightening.

For example, churning and stacking are of greater concern for insurers writing policies with small to mid-level face amounts than for those focused on policies for high net worth individuals. In addition, as long-established agents retire, and a younger generation takes over, insurers are concerned this may increase churning if the new generation is less familiar with or has lower regard for established norms for ethical business practices.

Overall, our interview findings revealed that insurer concern with anti-selection has increased in the last 10 years. Interviewees acknowledged that anti-selection is increasingly difficult to identify and will likely continue to grow alongside automation.

Impact of accelerated underwriting

Our interviews confirmed that the increased use of accelerated underwriting in life insurance has changed the perceived challenges presented by churning and stacking. As companies become more comfortable with fluidless underwriting, insurers expect greater opportunity for anti-selective behavior to promote higher levels of misrepresentation among applicants.

Faster decisions and ease of applications can also cause applicants to be less invested in the process. If they do not have to undergo exams or bloodwork, applicants may view the process as more ”switchable,” allowing them to easily apply to multiple companies for coverage.

Distribution model

Insurers selling primarily through a captive sales force are generally less concerned with churning and stacking. Greater concern exists among insurers offering brokered sales and direct-to-consumer (D2C) products, especially if the underwriting is fluidless, where, in the words of one interviewee, it is easier for applicants to “sprinkle across the industry to see what they can get through.” Additionally, D2C online questions may not be perceived as ”real” to consumers, who also may not understand the implications of anti-selection on the industry and premium rates.

Churning and stacking experience by age

In our interviews, insurers expressed concern for stacking among different age groups for various reasons. For younger ages, digital medical evidence (e.g., prescription histories) used in accelerated underwriting may not be as rich as compared to older applicants. Furthermore, a higher level of comfort with technology coupled with increasing availability of D2C products that remove the agent altogether may create greater opportunities for misrepresentation. On the other hand, the prevalence of medical impairments increases with age, which provides added motivation for older applicants to acquire sufficient insurance coverage with reduced underwriting scrutiny. More medical impairments also means that a similar level of misrepresentation is more costly at older ages because it is acting on a larger base of impaired lives.

Using the MIB Data Vault, RGA reviewed the experience data by age for both stacking and churning flags, comparing each to the age distribution of the total policies in the dataset, represented by the gray line. For example, on a face amount basis, 34% of the policies with stacking flags are from people aged 50-59; however, only 18% of the full database is aged 50-59. The comparison of these distributions is represented by the stacking bar at 1.90 (calculated as 34%/18%) relative to the line at 1.00 (calculated as 18%/18%) for the full dataset. This analysis allows us to understand how age impacts the likelihood to churn or stack policies.

In this analysis, churning- and stacking-flagged experience exhibits different patterns by issue age. While experience for policies flagged as churning is rather consistent at all ages above 30, noticeable differences by age emerge for potential stacking. Individuals aged 40+ (especially 50-59) disproportionately trigger higher levels of stacking flags relative to the total policies issued within the dataset.

Churning and stacking experience by face amount

Insurer expectations for churning and stacking experience by face amount was nuanced. Because applications with smaller face amounts are often automated or reviewed by junior underwriters, instances of churning and stacking were considered more likely to go unnoticed. Nevertheless, insurers also expected anti-selection to pose a problem at higher face amounts given the clear financial incentive.

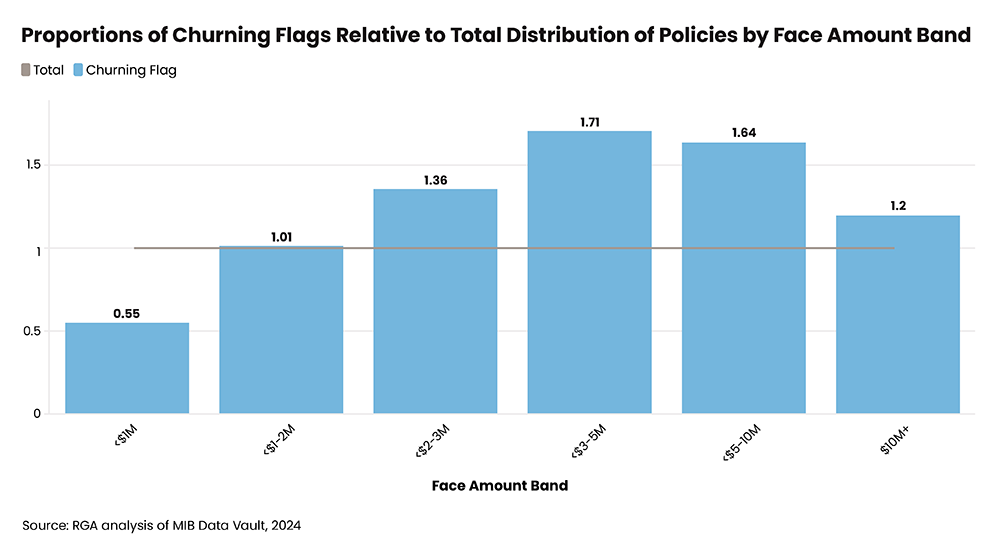

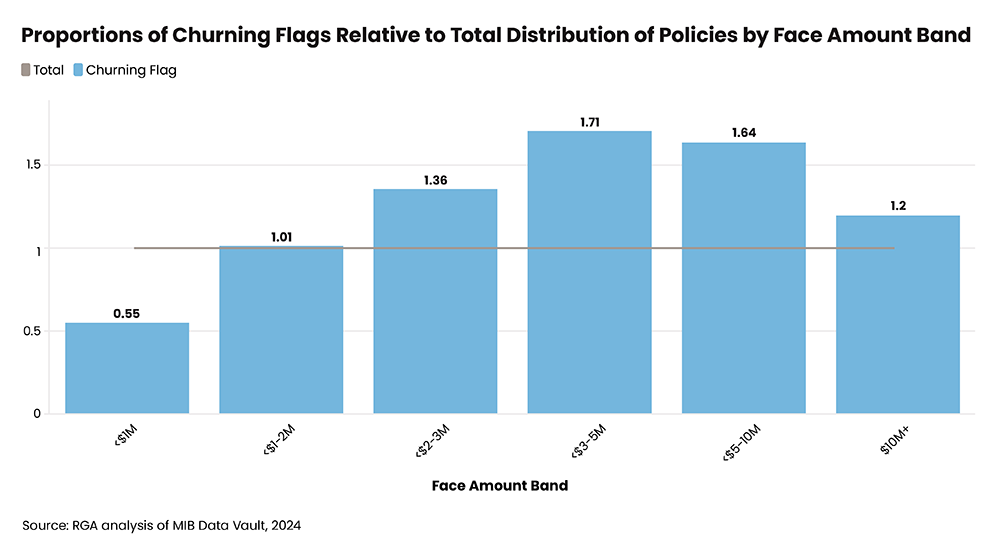

RGA reviewed the experience data in the MIB Data Vault by face amount for both stacking and churning flags, comparing each to the distribution by face amount of the total policies in the dataset, represented by the “1.00” gray lines in the following graphs.

Policies with $2+ million in face amounts produced disproportionately higher levels of churning flags, with the $3-5 million band having the highest level. Since churning is linked to agent behavior, these results could be driven by higher commissions for agents at higher face amounts.

Studying the dataset for stacking flags by face amount, we found that policies with less than $500,000 in face value posed the largest risk of stacking concerns, which may be related to industry underwriting practices. According to the 2022 Accelerated Underwriting Practices Survey Report from the SOA, the most common maximum face amount for accelerated underwriting was $1 million.4 These amounts are even lower under guaranteed or simplified issue products.

Technology and Tools

Technology and tools play an important role in both enabling and combatting anti-selection. Technology makes detection and prevention solutions possible for insurers but can also increase the potential for fraud and misrepresentation compared to the days of paper-driven reviews and decision making. Streamlined digital applications and underwriting processes can make it easier to get insurance coverage to people who need it, but such innovations may also create holes to exploit.

Our interviewees expressed a need for more digital and data-driven tools to help prevent anti-selective behavior as the industry modernizes. The MIB Data Vault used in this analysis provides a good example of such a tool. As more insurers participate in this industry-wide contributory database and scale increases, the database will enable a more robust exploration of anti-selective behavior. Without such tools, an individual insurer has very limited ability to detect policies held with other carriers. Collectively identifying “red flags” can enable insurers to ask more questions of applicants and reduce anti-selection risk.

Looking ahead, insurers we interviewed noted that data and artificial intelligence may enable more efficient ways to flag fraudulent activity in the future. Armed with this information, insurers should be able to more easily identify suspect cases, take appropriate action, and properly price policies.

Conclusion

Anti-selective behavior from only a small subset of insurance customers hurts policyholders. Elevated claims experience is passed on to consumers in the form of higher premiums, and consumer-friendly innovation is stifled when anti-selection cannot be adequately mitigated.

The need for more robust anti-selection detection and prevention tools is apparent. Insurers who can flag potential misrepresentation are better equipped to price policies and reach target consumers. The result: an opportunity for a clear competitive advantage with the ability to charge more attractive rates for the vast majority of policyholders.

Appendix – Data Notes

- The analysis of the MIB Data Vault focused on data from issue years 2015+ due to the lack of termination data prior to 2015.

- Policies marked as “not taken” were removed from the analysis.

- Additionally, we filtered out policies potentially involved in COLI/BOLI, as we consider the experience of these policies not to be representative of the industry.

- It is also worth noting that we conducted the analyses in this report on a face amount basis, meaning that we determined the distributions for stacking, churning, and total policies as a percent of total face within any of those groups.