Contributing factors

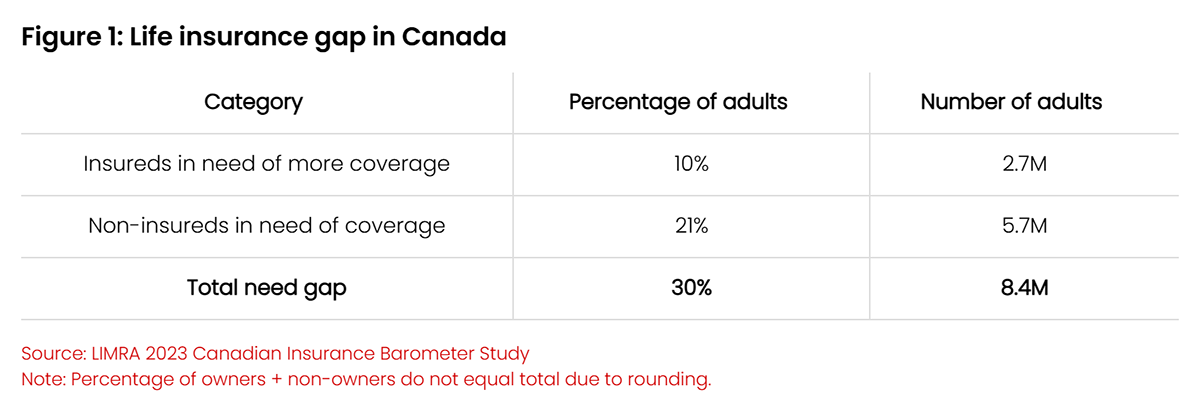

Several interconnected factors contribute to the growing coverage gap.

Within the industry itself, a shift in focus toward high-net-worth clients has led to an emphasis on larger and more sophisticated policies. This trend, coupled with a decline in the number of insurance advisors, has resulted in reduced attention to the mass market and term policies. A lack of young advisors is particularly troubling as many industry veterans near retirement age.

Changing demographics and consumer attitudes also play a crucial role. Immigration, including an estimated 395,000 people coming to Canada in 2025,4 has increased the number of households who may need insurance coverage.

Post-pandemic shifts in consumer priorities and financial strains have further exacerbated the issue, with higher cost of living fueling competing priorities for after-tax dollars and making insurance seem less urgent.

Younger generations are delaying life events – home ownership, marriage, children – that typically trigger insurance purchases. In addition, fallout from the pandemic-triggered “Great Resignation” and accompanying expansion of the gig economy, which saw a 44% surge in the number of digital gig workers in Canada in 20245 has left many without employer-sponsored plans.

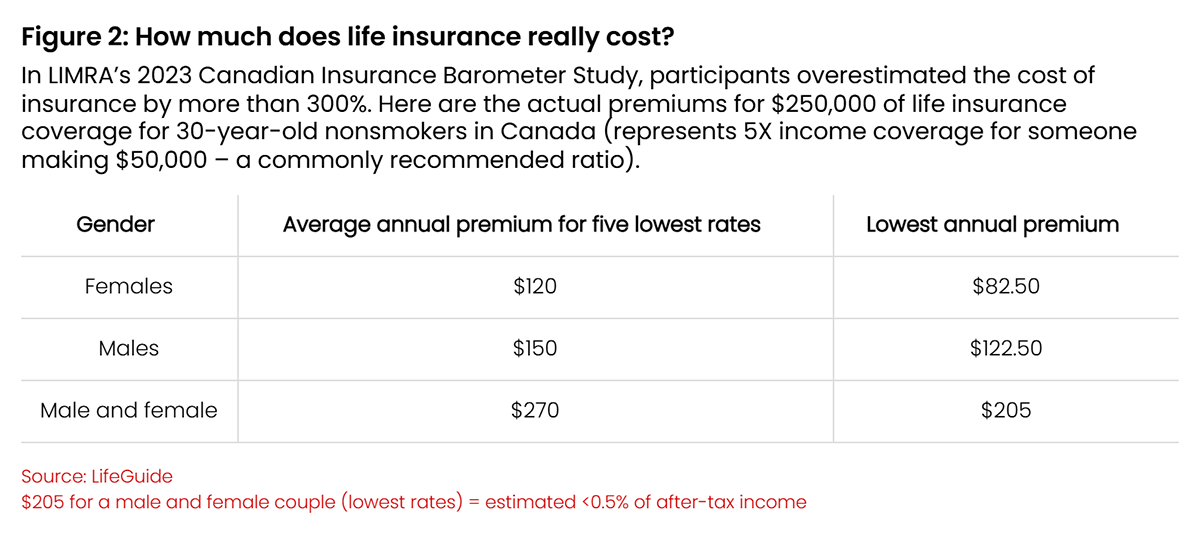

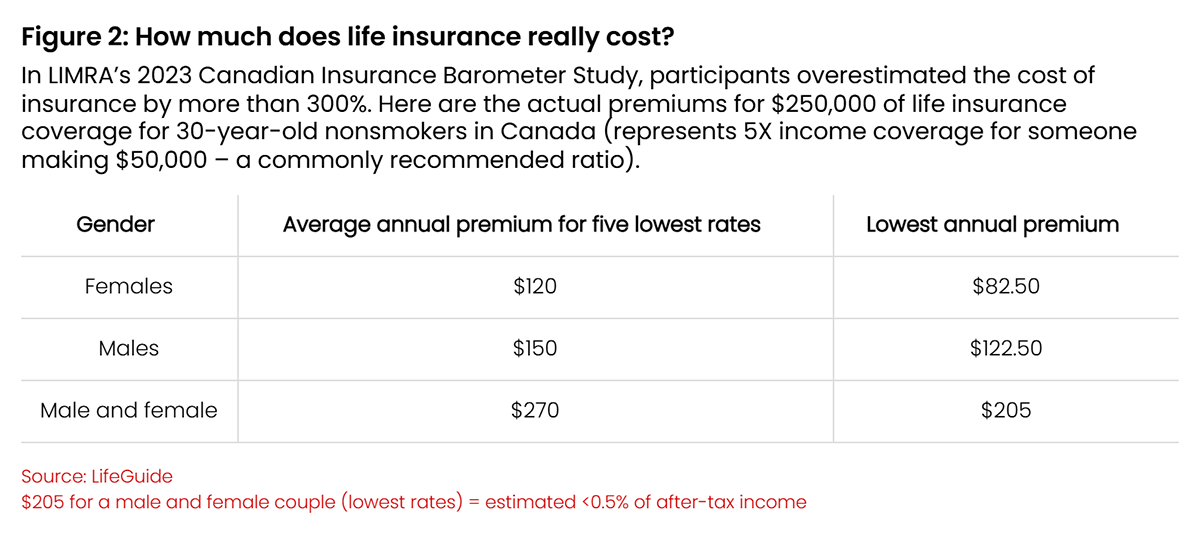

Misperceptions about insurance remain prevalent. Only 32% of Canadians trust their insurer, according to Statistica Canada. Additionally, a general lack of awareness about life insurance benefits and costs reduces perceived value. Complex product offerings and jargon-filled communication can magnify this issue and create added barriers to insurance adoption.

5 keys to future growth

Addressing the life insurance coverage gap in Canada requires a multi-faceted approach.

1. Education and awareness

This tactic should be at the forefront, with efforts to simplify insurance language, highlight affordable premiums, and emphasize the universal benefits of life insurance – such as income replacement, debt protection, and legacy planning.

2. Digital engagement

Expanding marketing efforts to platforms like TikTok, Instagram, and YouTube; developing user-friendly interfaces for needs analysis and applications; and implementing hybrid advice channels that combine online tools with advisor support can make insurance more accessible and appealing, especially for younger people. In LIMRA’s Insurance Barometer Study, 46% of respondents indicated, “I would research life insurance online, but ultimately buy in person.” Companies embedding immediate contact support with online tools are having success, and accelerated underwriting processes can remove additional barriers to entry.

3. Targeted strategies

Innovation in products and services tailored to changing life stages and demographics can make insurance more relevant and attractive to a broader range of Canadians. This includes developing “bite-sized” entry-level products for underserved markets, such as new Canadians and gig economy workers.

4. Advisor recruitment

The industry must focus on advisor recruitment and training, particularly from underserved communities. Promoting insurance advisor as a viable career path and conducting outreach through job fairs and community events can help address the shortage of advisors serving the mass market.

5. Industry collaboration

Partnerships with financial planners to include insurance in overall financial literacy efforts, collaborations with "finfluencers" in investment and banking sectors, and industry-wide initiatives to improve accessibility and trust, can create a more robust and inclusive insurance ecosystem.

A call to action

The opportunities are there – but only if we take collective action as an industry to seize them.

As the insurance landscape evolves, we must ensure we are meeting the needs of all customers. And the time to act is now. For example, protection for a mortgage is a common reason people acquire term insurance, and more than 1.2 million mortgages are renewing in 2025.6 This significant opportunity is just one of many.

Despite the urgent need for sufficient coverage and the continued advances in direct digital sales, insurance remains primarily a sold-not-bought product. Awareness of need without advice does not result in action; awareness with advice does result in action. To serve a broader population, the industry must reimagine distribution models and design innovative products that bridge the gap between awareness and action.

By diversifying the customer base and making financial protection accessible to all Canadians, the industry can fulfill its social responsibility while enhancing its resilience. Together, we can bridge the gap and create a more financially secure Canada for generations to come.

Want to learn more about RGA's capabilities, resources, and solutions? Let's talk.