Let's admit it; we all have preconceived notions about certain insurance products which color our view when it comes to searching out new growth opportunities. Take occupational accident insurance, for example. It's got "accident" in its title but that's about as far as the examination goes for many folks on the life, accident and health side of the business. After all, "occ acc" is just another form of workers compensation insurance - only Texas style, right? Some people recall it's a product purchased by truckers. Truckers? Still others hear occ acc described as "privatized workers compensation" and write it off because it sounds like that casualty product. They assume is has the same long tail risk potential. Who needs that?

Somewhere in there the interest begins to fade because, after all, doesn't occupational accident insurance do the same thing as work comp? The answer is yes, sort of, but it's not work comp! As will be explained in more detail below, occ acc is the life, accident and health industry's version of a workplace injury product that can be just as popular and profitable as its casualty insurance counterpart. Not only that, but occ acc has several built-in competitive features that can make it more appealing to employers, insureds and risk managers.

Why is occ acc considered a viable option in markets where it is permitted? To answer this one must understand that many of the coverage terms and conditions enjoyed by occ acc insurers are not shared by the work comp writers. That's not to say that one product is better or more profitable to write than the other. Such a claim would be inappropriate because the two products approach workplace injury insurance from two completely different directions.

Work comp is a state mandated insurance coverage, purchased by employers, that provides a broad medical expense and income safety net to injured workers while at the same time protecting employers from negligence lawsuits. An occ acc product is designed to provide a safety net as well but in a much more cost-efficient way. Work comp's benefit design is determined by the state government. As a consequence, this insurance product has become institutionalized within a bureaucratic system where eligibility is broadly interpreted and cost management measures are difficult to implement. By comparison, occ acc's cost-efficient design is determined in the free market. It has developed broad appeal in venues that allow it as viable work comp-like option.

While clearly not a product for all employers and contracting arrangements, occ acc has enough appeal to be increasingly debated by state legislatures as an alternative to high cost workers compensation rates. Texas, for example, has always been an occ acc friendly market. Oklahoma recently passed legislation, effective 2/1/14, allowing state employers to "opt out" of the worker compensation system if they replace worker coverage with something of like nature. Other states (CO, KS, LA, MI, TN, SC, NJ) have entertained opt out bills as well. The eventual outcomes of these debates are unknown but it is clear that the prospect of selling occupational accident insurance in a potentially expanding marketplace is cause for excitement among insurers. Let's explore why by looking closer at the two markets where occ acc has been successful for years.

A low frills approach

Texas, as mentioned, until very recently was the only state where all employers are fully allowed by law to "opt out" of the workers compensation system (they are called "nonsubscribers"). In addition, independent truckers who by virtue of their status as sole proprietors or, in some cases, employers of very few employees, have traditionally been exempt from state workers compensation laws. In both cases the insurance industry has responded with a lower cost product that fills the worker protection need without a lot of frills. Why are less frills and lower cost attractive? For independent truckers, lower cost has its obvious advantages, but, there's a compliance component to their purchasing occ acc as well. Shipping customers require proof that the independent trucker has workplace injury coverage. The reason is that workers compensation laws are very broad in terms of who can be eligible for coverage under an employer's policy. The extent to which shipping customer A directs and controls independent trucker B determines the likelihood of trucker B being declared an employee of shipping customer A in the event of a serious injury to B. Shipping customer A's work comp costs would rise in the face of these situations. As a result, trucking companies and general shippers who retain independent truckers are very careful to not engage in behaviors hinting of an employer/employee relationship. This could be as simple an act as conducting a training session. To emphasize the independence theme shippers require completion of contractual documents affirming a trucker's independence. They will also often negotiate favorable occ acc insurance coverage and rates for all of their independent truckers to purchase (as an option to work comp) in an effort to fully realize occ acc's cost advantage.

For Texas nonsubscribing employers, their reasons for buying the fewer frills, lower cost occ acc plan are a little different since they're not required to buy anything to protect their employees. Most do, however, out of concern for their employees' health and welfare and their own legal liability. Therefore, cost is a key driver. For some, buying the lower cost occ acc product is a matter of survival. Others reinvest cost savings to upgrade safety programs and provide additional benefits to their workforce. Still others see opportunity for additional cost savings beyond the lower premiums. They see the customizable coverage, terms and conditions as a perfect backdrop for creating a more comprehensive risk management program that meaningfully drives loss costs lower while at the same time being popular with employees.

Lower cost does not mean less safety, less employee satisfaction

The COSTCO wholesale experience in Texas is a prime example of occ acc's collateral benefits. With 15 warehouses and 4000 employees, they designed a worker injury benefit program in 2007 that drove workplace injury loss costs from 97 cents per $100 of payroll down to 46 cents in the 4 years following their conversion to non-subscription. Some would find it ironic that switching to a low cost workplace injury insurance option improves safety but in fact, research suggests that COSTCO's results are typical of other large non-subscribers (Walmart, Target) who possess similar resources and corporate values.

Clearly, electing to insure their employees outside of the workers compensation system is having some effect on employer behavior. Studies have found that non-subscribing employers are MORE incented to promote workplace safety than work comp policyholders. Apparently, the cost savings afforded by offering the more efficient occ acc coverage combined with the knowledge that they can be sued by workers for negligent acts has given management an attitude adjustment in a way that the no fault work comp system doesn't. Nonsubscribing employers frequently report improved employee relations and higher productivity. Could it be that employees are feeling the love from employers' stepped up safety programs? Does the realization that their occupational injury insurance is limited in scope and time return injured employees back to work quicker?

Cost Savings

How does occupational accident insurance deliver cost savings? To answer this question one must understand that work comp law in general, and Texas in particular, has evolved to create a benefit program with broad conditions, broad coverage and high costs. But do workplace injury insurance programs need to be so broad and costly in order to provide fair and responsible care for injured workers? The evidence would seem to indicate the answer is no.

Effective occ acc programs use a formula of enhanced employer workplace safety programs, more restrictive conditions under which workers can claim benefits, and specific dollar limitations on the coverage provided. It is also common for workers to accept certain coverage conditions in return for agreeing to some form of binding arbitration for disputed claims. In some cases arbitrator picks are pre-determined. Streamlined dispute resolution is another factor that reduces cost. While it's true that nonsubscribers aren't immune to negligence lawsuits (like work comp buyers are), the reality is that they're quite uncommon. This has much to do with employers structuring their work-injury benefit program as an ERISA plan which makes it difficult for employees to transfer disputes to a court, state or federal. Furthermore, insurance policies are available to cover the employer's exposure to ERISA injury benefits.

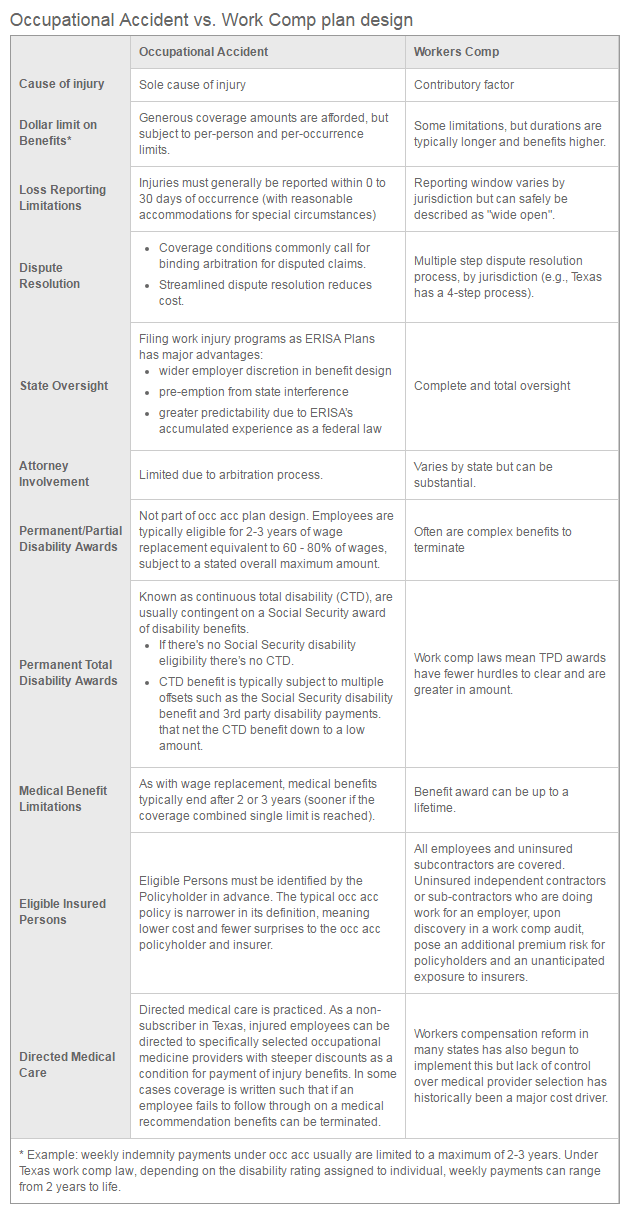

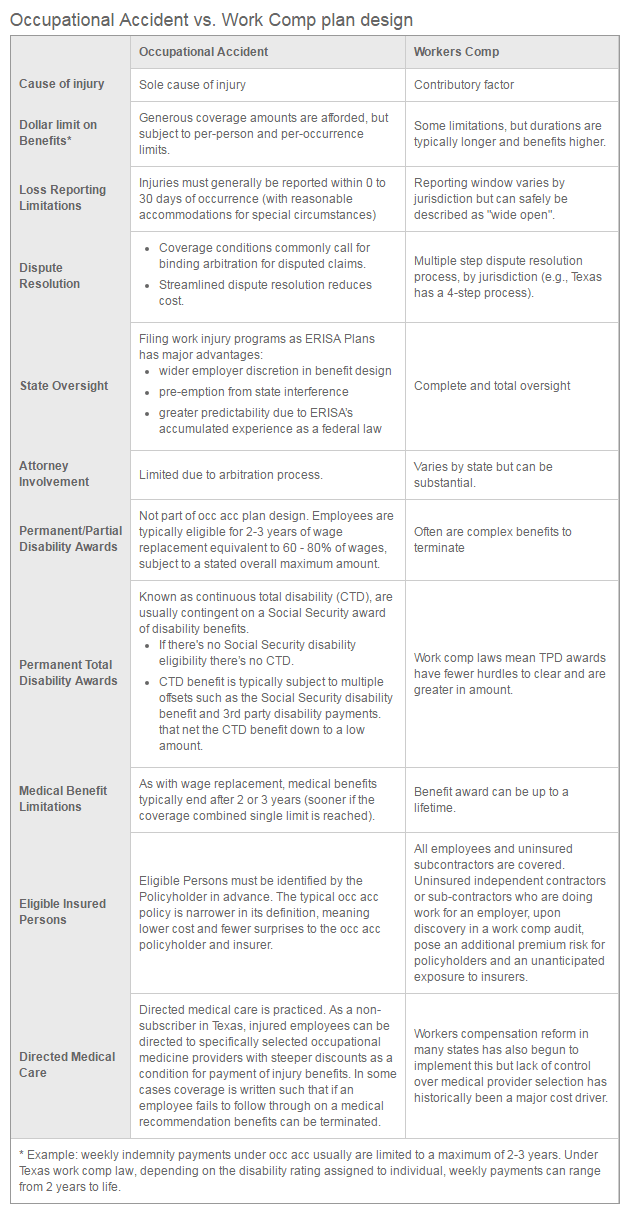

A summary of the differences in plan design between occ acc and work comp is in the table below.

Occ acc Opportunity

Also worth noting is widespread acceptance of occ acc in the independent trucking community. To be sure, its cost trumps the more comprehensive nature of workers compensation insurance. Also, the independent trucker's mind set more closely matches a business owner's than a worker. Business expenses such as the monthly payment on their rig need to be paid. These workers are incented to work and anticipate a prompt return from any injury. Why pay for work comp's longer duration of coverage when they never expect to use it? Moreover, shippers are persuaded to recommend and accept occ acc from their independents in lieu of work comp because it keeps their shipping costs lower.

By now it should be clear that not all workplace accident insurances are created equal. Life, accident and health insurers have a viable product avenue open to them that carries a lower caliber of coverage conditions, amounts and durations when compared against the casualty version, work comp. Moreover, a small but reliable market exists for this product now. Current developments, such as in Oklahoma, and legislative trends in other states only point to that market expanding further. Managing an occupational accident book of business does require additional skill sets in the underwriting, claims and marketing distribution areas. For those life, accident and health companies that have the program management resources and connections to distribution networks, it can be a stable and rewarding growth opportunity.