2. Methodology

2.1 Data background

Recognizing the industry’s need for a unified view of in-force and pending coverage, MIB and TAI formed a landmark partnership to construct an unprecedented in-force, applied for, and terminated policy dataset, known as the MIB In Force Data Vault. This joint effort draws on TAI’s leading industry role in reinsured in-force business in the U.S. and MIB’s comprehensive application activity index, offering insurers the most complete picture to date of total coverage exposure. Various solutions have been built off the In Force Data Vault, such as the MIB Jumbo Service and MIB Total Line Service.

This analysis used anonymized policy-level records from the MIB In Force Data Vault for in-force and terminated policies issued between January 2015 and May 2023. The dataset included approximately 9.2 million distinct policies from 8 million individuals across 12 carriers, with more than 2 million eligible lapses (defined as lapses that are not removed due to regular experience study exclusions, such as when a lapse occurs after the last anniversary in the study period). The study includes both permanent (whole life, universal life, and variable universal life) and term products. For this study, we defined lapses as policies with a termination status of either lapse or surrender.

It is important to recognize that lapse behavior can vary significantly across carriers. These variations stem from differences in underwriting practices, product designs, business mix, distribution channels, and other operational factors. The results presented in this report reflect the available data and will naturally vary by carrier.

2.2 Key lapse definitions

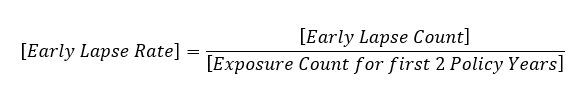

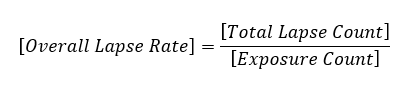

This report focuses on two specific lapse behaviors: multiple lapse propensity and early lapses. RGA and MIB defined these metrics for the purposes of this analysis, although alternative definitions may also be appropriate. Exposure is determined on a count basis for policy years exposed.

Multiple lapse propensity – Individuals are flagged for multiple lapse propensity when they have two or more lapses within five years of each event, across any of the 12 carriers in the dataset. This metric highlights patterns of repeated policy terminations and may indicate underlying behavioral or financial factors affecting policy persistence.

Early lapses – These are defined as lapses occurring within the first two policy years. Early lapses are particularly significant because insurers typically have not recovered initial acquisition expenses during this period.

Overall lapses – These are defined as all lapses associated with a given attribute, regardless of timing or individual lapse history.

2.3 Important terminology

Policy year – The duration since the policy was issued (e.g., policy year 1 covers the first 12 months after issue).

Lapse study year – The study year based on anniversary dates (e.g., the 2020-2021 lapse study year would start from the policy’s anniversary in 2020 and end on the policy’s anniversary in 2021).

3. Findings

3.1 Lapse rates by policy duration

For many life insurers, recovering the initial expenses associated with issuing a life insurance policy can take several years. However, lapse rates are often high during these early durations, creating a mismatch between expense recovery timelines and policy persistence.

As illustrated in Figure 1, policy year 1 lapse rates exceed 9% in this analysis. Lapse rates gradually decline in subsequent policy years as policyholders demonstrate commitment to maintaining coverage. It is worth noting that because the earliest issue dates in the dataset began in 2015, we could not evaluate ultimate or post-level term lapse behaviors. Lapse rates would be expected to rise for certain products, particularly level term policies approaching or beyond the end of their level premium period.

Key insight – The elevated lapse rates in early policy years highlight the importance of understanding early lapse behaviors as they relate to expense recovery.

3.2 Relationship to COVID-19 pandemic

Looking at lapse rates by policy year helps identify when an individual policy is most likely to lapse throughout the policy’s lifetime, but external events can also influence lapse behavior at other points in time. This dataset spans the COVID-19 pandemic, a significant global event that affected mortality awareness and economic conditions.

As shown in Figure 2, lapse rates for both policy years 1 and 2 exhibited a notable dip around the 2020-2021 lapse study year. This reduction may reflect several pandemic-related factors:

- Increased perceived value of life insurance

- Heightened awareness of mortality risk

- Temporary premium grace period extensions offered by insurers

Following this period, lapse rates have risen and returned to earlier patterns.

Key insight – External events can temporarily disrupt typical lapse patterns. Monitoring the external environment can help insurers distinguish between permanent behavioral changes and temporary responses to unusual circumstances.

3.3 Lapse behavior by product type and face amount

MIB's In Force Data Vault contains demographic and policy characteristics – such as issue age, face amount, and product type – that support more granular analysis of lapse behavior across different groups. As mentioned earlier, these results reflect the available data and will naturally vary by carrier due to many underlying circumstances.

The analysis examined product type (term vs. permanent) and face amount bands to understand how these attributes influence lapse behavior. Multiple lapse propensity rates, early lapse rates, and overall lapse rates generally decrease as face amount increases for permanent and term products, as shown in Figure 3. A few notable exceptions were observed, including upticks in multiple lapse propensity at the $2M+ band for both product types and for term products in the $50K-$99K band.

Note – There were some variations in the duration mix by these attributes, particularly at lower face bands, which could impact results.

Across most face amount bands, term products exhibited substantially higher lapse rates than permanent products, particularly at lower face amounts. The gap between term and permanent behavior was most pronounced in the $50K-$99K band and generally narrows as face amounts increase, as indicated by the term-vs.-permanent factor (a factor comparing the term lapse rates to the permanent lapse rates at each face amount band, where a factor above 1.0 indicates term lapse rates are higher than permanent lapse rates). For example, in the $50K-$99K band, term products show approximately 120% higher multiple lapse propensity rates, 128% higher early lapse rates, and 141% higher overall lapse rates compared to permanent products.

To assess whether multiple lapse propensity or early lapse behavior was disproportionately elevated for certain face amount bands, we calculated an additional comparative factor for each metric. Specifically, we divided each lapse rate (multiple lapse propensity, early lapse, and overall lapse) by the corresponding lapse rate in the $2M+ face band (see Figure 4).

This analysis reveals striking patterns: Permanent products with face amounts less than $50K exhibited 1.6 times the multiple lapse propensity rates, 8.3 times the early lapse rates, and 3.9 times the overall lapse rates compared to those in the $2M+ face band. These elevated multiples indicate that lower face amount policies face substantially greater lapse challenges, particularly during the critical early policy years.

These factors also highlight the increased multiple lapse propensity rates at the highest face amount band ($2M+), narrowing the gap between the lowest and highest face bands for multiple lapse propensity compared to early lapses and overall lapses.

Early lapses show the largest differential between low and high face amounts. This pattern indicates that early lapses at lower face amounts are disproportionately high.

Key insight – Lower face amount policies (especially less than $50K) have significantly elevated lapse rates across all three metrics, with higher lapse behavior noted for term products. While early lapse rates are disproportionately higher at low face amounts, there are upticks in multiple lapse propensity rates at higher face amounts ($2M+).

3.4 Interaction of issue age and face amount

Issue age and face amount both influence lapse behavior, but they interact in complex ways. Issue age can reflect life-stage events or shifts in insurable interest (e.g., mortgage changes, child-related needs, or retirement), while face amount can correlate with socioeconomic factors and coverage needs.

As shown in Figure 5, the relationship between multiple lapse propensity rates and face amount varies notably by age. For most age groups, multiple lapse propensity rates are highest at lower face amounts and decline as face amount increases, with the exception of an uptick at face amounts above $2M for all ages. However, a striking pattern emerges for ages 60+: Multiple lapse propensity rates increase with face amount for policies above $100K, with face amounts above $2M having the highest multiple lapse propensity in this age group. This age group and face amount can also be quite costly due to more rigorous underwriting requirements.

Further investigation could be beneficial to detect additional differences and interactions by other attributes, such as product and gender.

Note – Variations in the duration mix by these attributes, particularly at lower face bands, could impact results.

Face amounts less than $50K also consistently show the highest early lapse and overall lapse rates across all ages. These rates generally decrease as face amounts rise, although some increases appear at higher face amounts for older age groups (with such increases less pronounced than those for multiple lapse propensity).

Using a comparative approach similar to Figure 4, the analysis calculated relative factors by dividing each lapse rate by the corresponding rate in the $2M+ face band across each issue age group (see Figure 6). This analysis further exemplifies that multiple lapse propensity was disproportionately higher at larger face amounts, particularly at older ages. Across all ages, early lapse rates were disproportionately elevated at low face amounts relative to the overall lapse rates at the same face bands.

Ages 30-39 showed the greatest contrast between the lowest and highest face amount bands, with 3.9 times the multiple lapse propensity rates, 9.2 times the early lapse rates, and 5.8 times the overall lapse rates relative to those in the $2M+ band.

Key insight – Lapse patterns differ substantially across issue ages and face amount bands. While younger ages generally show higher lapses at lower face amounts for all three metrics, multiple lapse propensity rates are particularly high at high face bands for older ages.

3.5 Lapse behavior among individuals with multiple policies

The MIB In Force Data Vault enabled the study of data from 12 carriers at the time of this analysis, making it more feasible to identify individuals holding multiple policies, sometimes across different carriers. To examine lapse behavior among these individuals, we created two additional flags:

- Total policy count per individual (entire dataset) – A static flag (1, 2, or 3+) representing the total number of policies an individual holds across the full dataset. Every policy record for that individual receives the same flag.

- Policy count per individual at time of issue – A dynamic flag (1, 2, or 3+) representing the number of policies an individual had in force at the time each policy was issued (including the latest policy). Policy records for the same individual may therefore show different flags.

An illustrative example reflecting the difference between these two flags is provided below.

Regardless of which flag was used, individuals with more policies consistently showed higher overall lapse rates compared to those with a single policy. This difference was most pronounced when using the total number of policies across the entire dataset: Relative to individuals with only one policy, lapse rates were approximately 30% higher for those with two policies and nearly 40% higher for those with three or more (see Figure 7).

This pattern suggests that individuals who own multiple policies may have different characteristics or behaviors that correlate with higher lapse behavior.

Note – Because the MIB In Force Data Vault reflects a growing portion of the overall life insurance industry, some individuals may hold additional policies not captured in this dataset (e.g., policies from carriers not included in this database or policies issued outside the study period). As more comprehensive data becomes available, further insights into multiple policy behavior are expected to emerge.

Key insight – Individuals holding multiple policies represent a distinct segment with elevated lapse risk.

4. Conclusion

Lapse behavior takes many forms, and it consistently carries costs for both insurers and policyholders. By leveraging policy data in the MIB In Force Data Vault, this report provides deeper insights into nuanced lapse behaviors, specifically multiple lapse propensity and early lapsation. The analysis demonstrates how lapse behavior varies significantly across policy durations, product types, face amounts, issue ages, and individuals with multiple policies.

Key findings reveal that:

- Policy attributes and demographics can show varying likelihood of multiple lapse propensity and/or early lapsation.

- Lapse rates are highest in early policy years (exceeding 9% in policy year 1) and declined temporarily during the COVID-19 pandemic period before rising again.

- Age-based patterns vary significantly: Across all issue ages, the lowest face bands demonstrate the highest early and overall lapse rates; however, older ages (60+) show disproportionately heightened multiple lapse propensity for higher face amounts.

- At a product-level, term products show substantially higher multiple lapse propensity, early lapse, and overall lapse rates than permanent products at lower face amounts.

- Individuals with multiple policies show up to 30%-40% higher lapse rates than single-policy holders.

Together, these insights emphasize why understanding specific lapse behaviors provides added value beyond traditional aggregate lapse studies. Future research could explore additional dimensions, such as regional differences, additional interactions by policy attributes, and further tracking of multiple lapse propensity over extended time periods.

Looking ahead, the continued expansion of the MIB In Force Data Vault will create opportunities to deepen understanding of lapse behavior and identify emerging patterns that provide meaningful insights related to pricing, profitability, and risk assessment. Subscribers to the MIB Total Line Service are uniquely positioned to identify and prevent costly, anti-selective, or even fraudulent behavior that can have negative impacts to both insurers and insureds.

To learn more about the MIB In Force Data Vault and the benefits of subscribing to the MIB Total Line Service, contact MIB.

Contact RGA to learn more on how to put these insights into action.

Special thanks to RGA's Taylor Pickett and Minyu Cao, as well as MIB's Scott Fritsche, Tom Rhodes, and Trey Reynolds.