Key takeaways

- Amid an expanding annuities market in the US, VM-22 guidelines take effect January 1, 2026, bringing a transformative new framework for statutory reserving.

- By taking key steps now, insurers will be better equipped to navigate VM-22’s many potential impacts and position themselves for long-term growth.

- Reinsurance provides critical support for insurers navigating VM-22 complexities, and the right reinsurer can provide added value at every stage of the process.

The long wait is almost over. First conceived more than three years ago, the National Association of Insurance Commissioners (NAIC) Valuation Manual (VM)-22 is set to take effect January 1, 2026, with mandatory compliance required by January 1, 2029.

Amid an expanding annuities market in the US, the rollout of the guidelines and initial testing promise to finally settle the long-standing debate over whether VM-22 will reduce the need for reinsurance, which plays such a central role in addressing current Commissioners Annuity Reserve Valuation Method (CARVM) reserving burdens. However, much like VM-22’s rules, its implications for reinsurance will likely prove to be more nuanced.

VM-22 Guidelines: A brief overview

The new framework applies to non-variable annuities across accumulation products (fixed indexed annuities, deferred annuities, multi-year guarantee annuities) and payout products (single premium immediate annuities, pension risk transfers, structured settlements) as early as January 1, 2026.

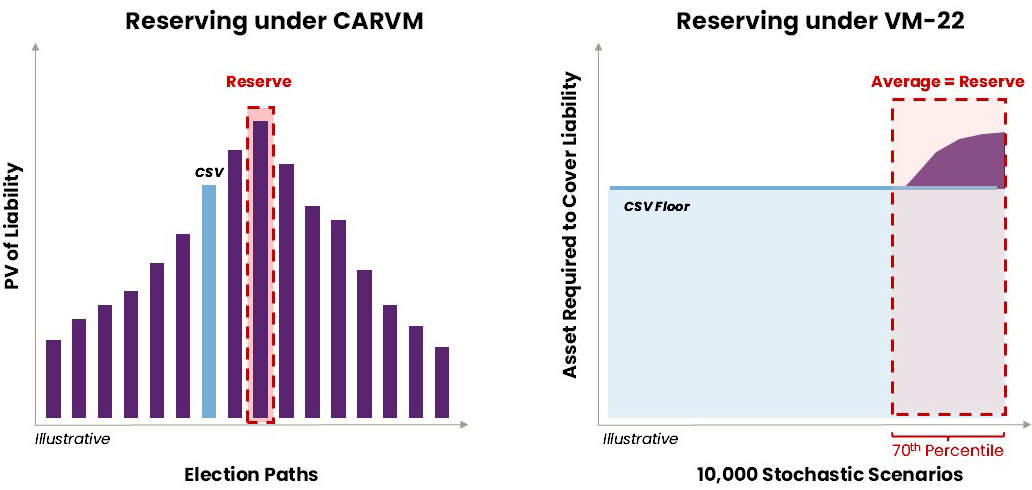

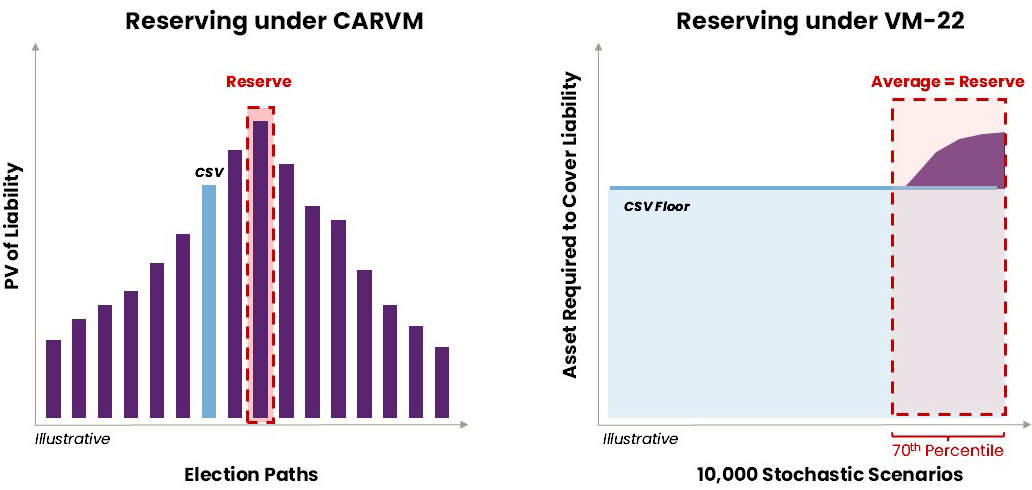

VM-22 transforms statutory reserving by replacing rigid CARVM formulas with principle-based methodologies that better capture economic realities. The framework offers two compliance paths: Companies meeting Single Scenario Test criteria use simpler Deterministic Reserves, while others employ complex Stochastic Reserves that capture tail risks through multiple economic scenarios. Both require Standard Projection Amount disclosures using prescribed assumptions.

This is a significant shift from CARVM’s simpler factor-based approach, adding a high degree of complexity to the valuation process. In some cases, for example, guidelines will require insurers to run thousands of stochastic scenarios to determine reserves. And prescribed assumptions are not yet fully defined, bringing another layer of uncertainty.

On the positive side, VM-22 delivers enhanced flexibility through company-specific assumptions, enhanced risk sensitivity, integrated asset-liability modeling, and scenario-based calculations. Unlike current methods, reserves now dynamically respond to interest rate changes, credit spreads, and market volatility, creating closer alignment between statutory and economic values.

Nevertheless, similar to VM-20 and VM-21, VM-22 contains many “divergences” from a true economic principles-based approach, which is expected to result in over-conservative reserves with redundancies – in some cases with resulting reserves higher than those required by the outgoing CARVM methodology. An example of such conservatism is the cash surrender floor applied to each stochastic scenario, which is essentially equivalent to requiring an insurance company to reserve for a 100% mass-lapse scenario. In addition, reserve impacts vary significantly across insurers due to product design differences, embedded guarantees, and assumption choices. Field testing shows mixed results – some companies experience reserve increases while others see decreases.

Figure 1: Comparison of reserving techniques

A broad range of implementation challenges include heightened economic sensitivity, volatile capital ratios, and complex governance requirements. Impacts reach beyond reserving to affect product design, pricing strategies, capital management, and risk assessment, fundamentally reshaping how insurers approach annuity business. For companies not previously dealing with VM-20 or VM-21, the very task of reporting finances correctly to avoid regulatory issues poses significant challenges – and even potential financial losses initially.

How should insurers prepare?

VM-22 is nearly here; now is the time for insurers to begin planning for its many potential implications. Key steps include:

- Establish cross-functional collaboration – Effective adaptation starts with aligning all necessary stakeholders at all levels of the organization around a comprehensive strategy. Teams affected by VM-22 range from pricing and valuation to finance and compliance, and all have a role to play in successful execution.

- Evaluate model and system readiness – VM-22’s principles-based framework requires adapting to increased model complexity, especially for those companies without models already in place for life and variable annuity blocks under VM-20 and VM-21. With significant spikes in data volume and stochastic simulations on the way, insurers should proactively engage with capital markets and technology teams to assess infrastructure and processes.

- Adjust assumption-setting and pricing – Unlike CARVM’s prescribed assumptions, the VM-22 framework demands company-specific assumption-setting, which must be transparent and based on well-documented experience data and methodologies. Pricing assumptions need to be aligned with those used to determine VM-22 reserves, and pricing actuaries must consider impacts on the profitability of current and future products.

- Embrace change as an opportunity – Business reverberations from VM-22 will echo across product development, pricing, capital management, and overall business strategy. Insurers that proactively address emerging issues by modernizing processes stand to create new levers for competitive advantage.

- Practice patience – Although the time to prepare for VM-22 is now, mandatory compliance is not required until January 1, 2029. Taking advantage of this adoption window will enable insurers to monitor market reaction and take in further guidance to inform strategy, approach, and reinsurance usage.

The role of reinsurance

Reinsurance provides critical support for insurers navigating VM-22 complexities. In fact, the right reinsurer can provide added value at every stage of the process, even for insurers yet to embark on initial preparations. By leveraging deep expertise and capacity, as well as experience working with insurers across various compliance regimes, reinsurers can assist with a range of VM-22 essentials, from basic reporting requirements to sophisticated stochastic projections.

Most importantly, companies with significant tail risk exposure can leverage reinsurance to stabilize reserves and optimize capital, particularly when stochastic modeling reveals volatile outcomes across economic scenarios. Reinsurance becomes especially valuable for such blocks, allowing insurers to transfer modeling complexity while maintaining compliance. In addition, reinsurance may be able to reduce redundancies so that an insurer’s statutory reserves are more closely aligned with economic value. A strong, highly rated reinsurance counterparty is crucial for regulatory approval and ensuring that commitments to policyholders are met, especially under stress scenarios.

The company-specific nature of VM-22 guidelines requires that any reinsurance solution be customized for each insurer. In choosing a reinsurance partner, insurers should consider their reinsurer's ability to create specialized structures that address unique combinations of VM-22 challenges, such as volatility management for market-sensitive products.

Key benefits of successful solutions include more optimal pricing, improved risk-based capital ratios, and predictable reserve patterns. By optimizing capital allocation across business lines, reinsurance can ensure successful VM-22 compliance and position insurers for long-term growth.

Put your business ahead

At RGA, our expert teams are partnering with insurers to develop sophisticated reinsurance solutions tailored to meet their specific VM-22 compliance needs. We understand the range of implications of VM-22 for different insurer profiles – including yours – and are ready to harness our decades of experience, financial strength, and proven capabilities to give your company a competitive edge. Ready to get started?

Contact RGA