The data analytics revolution has reached the life and health insurance industry, introducing new challenges as well as fresh opportunities to refine underwriting, marketing, and distribution models, according to RGA’s 2019 Global Life and Health Data Analytics Survey.

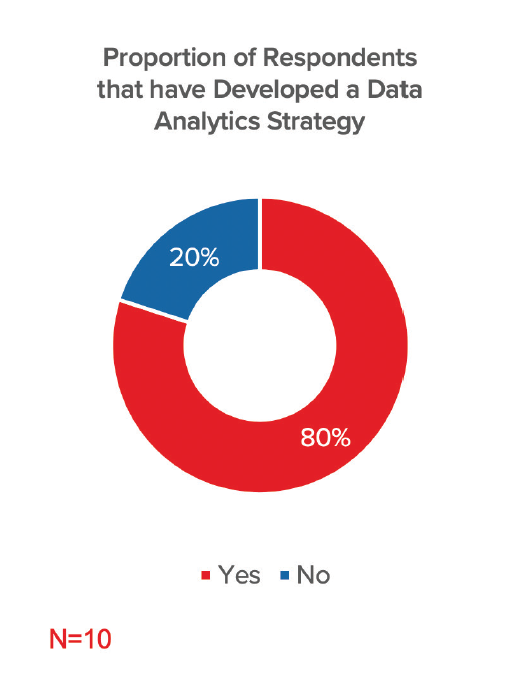

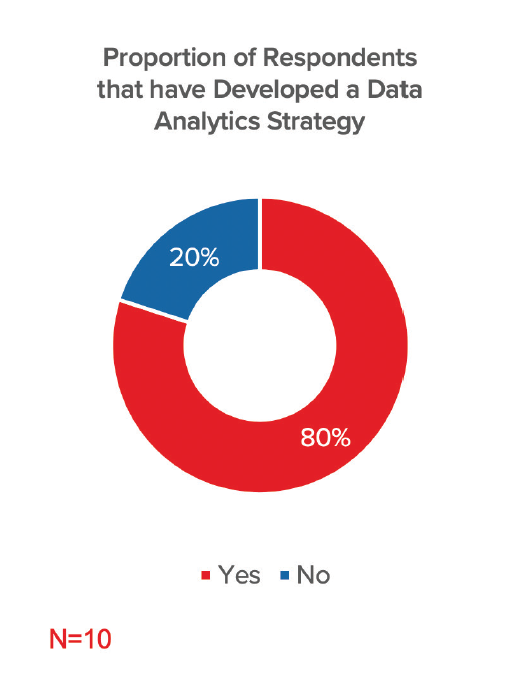

RGA surveyed 10 major multinational life and health insurers to learn how they are developing and implementing data analytics. Most – 8 out of 10 – finalized a strategy at the time of the survey, but only half of those with a strategic direction had moved beyond the early stages or pilot phases of implementation.

Despite tentative execution, survey participants largely embrace the promise of data and analytics. Responding insurers indicated that senior executives recognize data analytics as either "important" or "somewhat important". At the same time, data analytics functions are being challenged to deliver more immediate results, as well as to drive business process transformation.

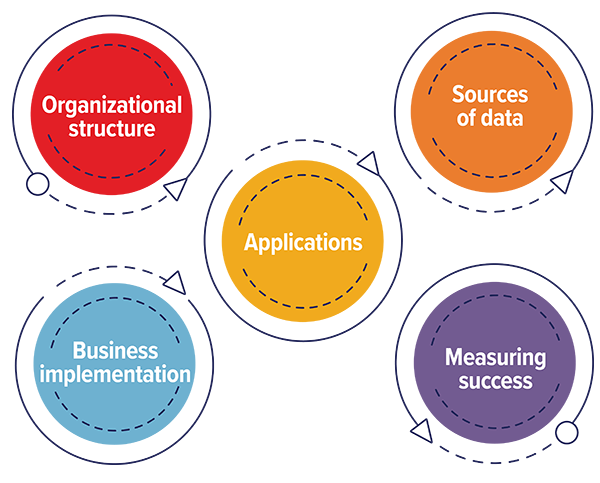

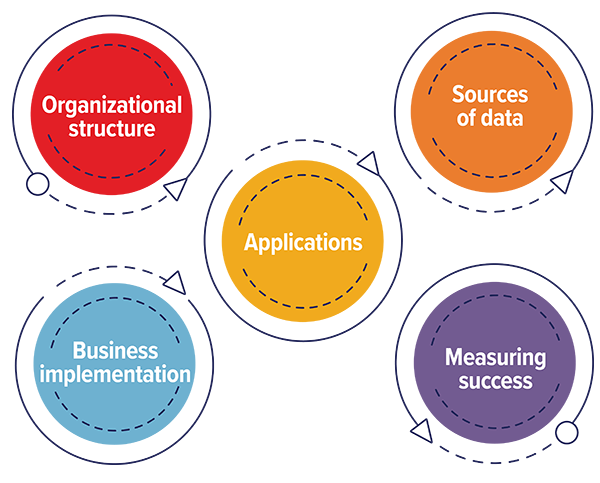

The survey assessed the progress that large life and health insurers have made across five key strategic building blocks.

Five Building Blocks of Change

View our Infographic for More Findings: Pathways to Success: Establishing a Data Analytics Strategy

Organizational Structure

More insurers are designating data analytics leadership within their respective organizations, with 40% of participating carriers naming a head of a data and analytics function. At the same time, governance practices around data analytics management remain relatively immature.

Applications

The survey suggests life and health insurers’ current total investment in data operations lags behind that of property and casualty units. Within life and health businesses, participating insurers reported applying data and analytics to distribution, marketing, underwriting, and claims management, in rank-order of importance. The survey revealed a widespread focus on using data analytics to accelerate underwriting and improve underwriting risk assessment. Asked to anticipate where investment dollars were likely to flow next, most insurers shared plans to make significant investments in customer prospecting.

Sources of Data

To fully implement any data analytics operation, it is critical to access and apply data. Asked which data sources are currently in use in underwriting, participating insurers indicated claims history, prescription data, lab/exam information, and motor vehicle data, but also shared interest in non-traditional sources such as wearables and "digital fingerprint" metadata culled from social media and other non-traditional sources.

Business Implementation

Survey participants also shared a diverse range of perspectives on the most significant, large-scale risks confronting those organizations seeking to implement data analytics strategies, from the need to ensure responsible data use to data protection and regulatory compliance. Companies also identified several significant barriers: chief among these were outdated legacy infrastructure and a lack of agility among information technology teams.

Measuring Success

With increased success comes growing scrutiny. Of the insurers surveyed, most identified growing calls for accountability and viewed their organization as placing high importance on demonstrating a quantifiable return on investment in data analytics initiatives. While most responding organizations could demonstrate early success, only a minority had a metrics framework developed and in place.

Looking Ahead

RGA’s 2019 survey reveals that the foundations of enterprise-wide data analytics approaches are in place in one form or another at responding insurers. Undeniably, insurers are allocating more mindshare to data analytics and are beginning to design and implement strategies to be more impactful and effective across five major building blocks. The findings further demonstrate that now is the time to evaluate data analytics approaches and begin building for the future. Conducting a review of strengths and weaknesses can help insurers prioritize next steps and focus areas.

5d8a64c4-40be-43b0-a692-a38f20063213.png?sfvrsn=c848acc3_3)