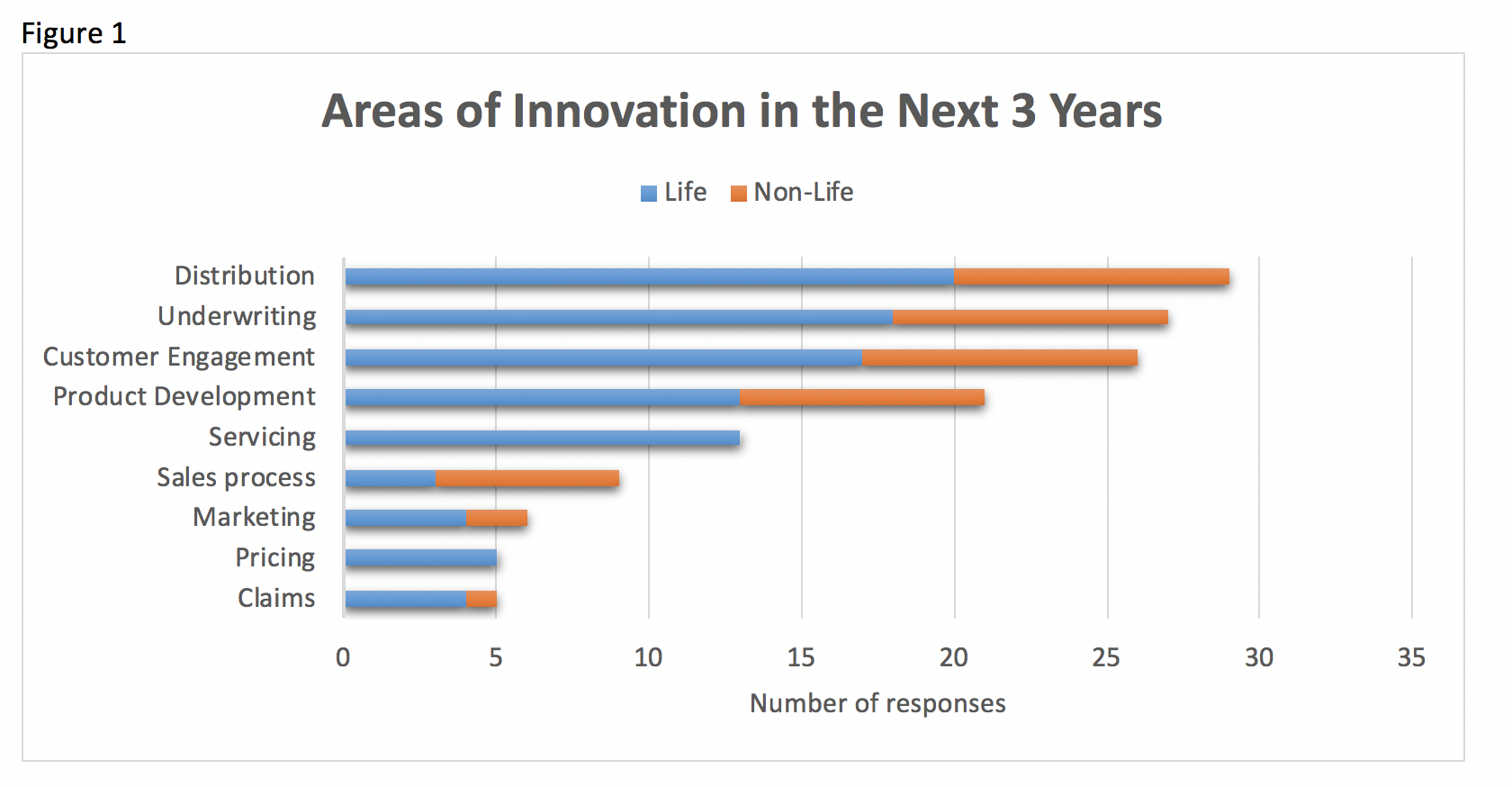

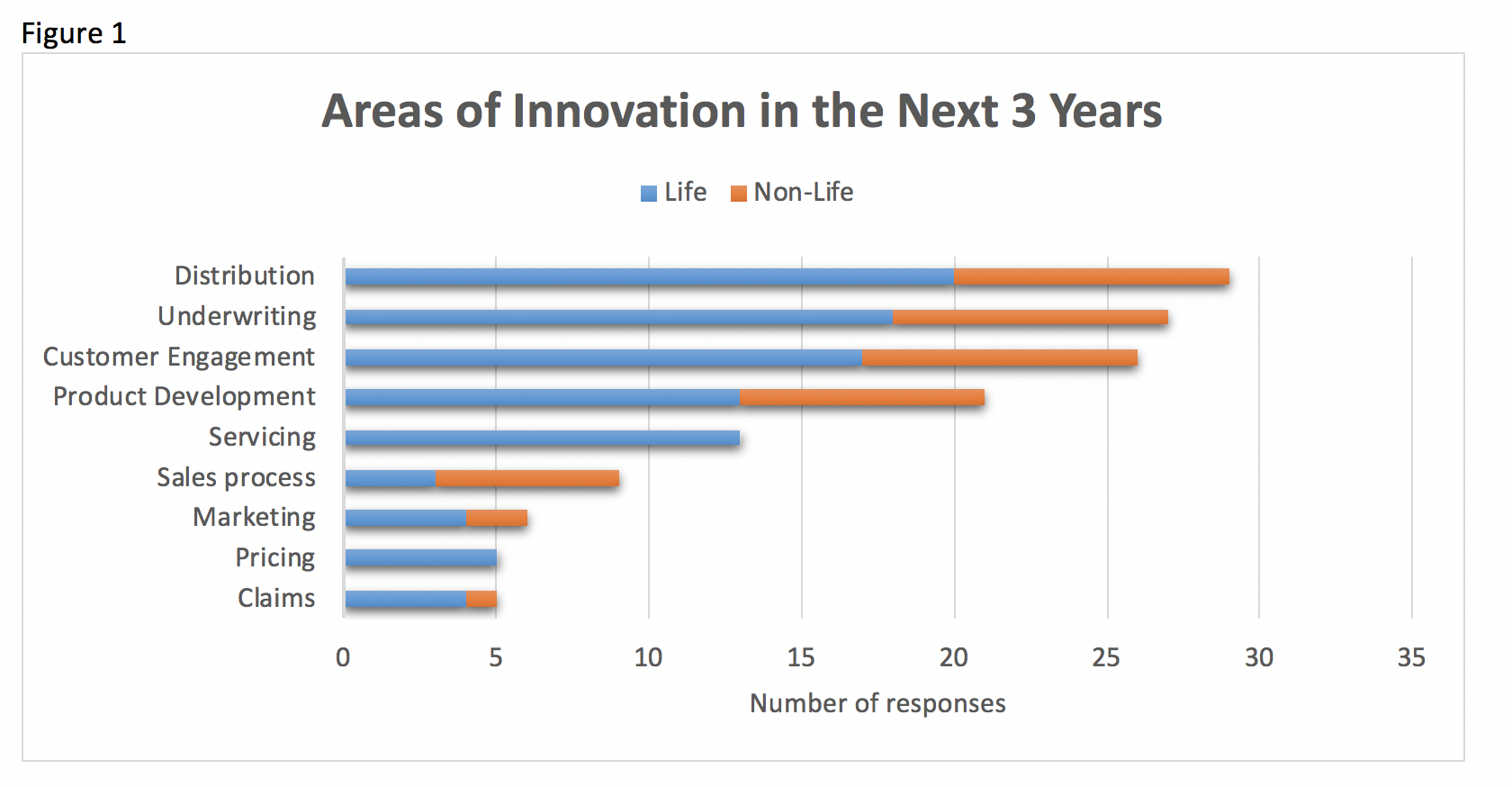

The Actuarial Society of South Africa held its annual conference in October. With a gathering of more than 1,500 actuaries and actuarial students, the RGA South Africa office didn’t miss out on the opportunity to pose a simple question to the visitors at our stand: “Where will we see the most innovation in the life insurance industry in the next three years?”

We divided the possible answers into nine areas across the life insurance value chain. These ranged from marketing and the sales process, to underwriting, product development, and claims, among others. The answers were further categorized depending on whether the respondents worked inside or outside of the life insurance industry.

It was probably unsurprising to note that the results showed the top three areas of anticipated innovation in the life industry are distribution, underwriting and customer engagement. These three categories comprised 58% of all the answers, with a fairly consistent split of two thirds life industry and one third non-life responses across all three categories.

It was also interesting to note in the survey results that the sales process category was the only category where the non-life actuaries outweighed the life actuaries’ responses. This could indicate an area where there is great focus by the non-life industry at the moment, and perhaps somewhere we as a life industry could do more to assist the policyholder. By using smart technology for both the advice and direct channels, we can make it easier to get a suitable life policy in the hands of the policyholder.

Distribution

When it comes to distribution, strategic relationships can unlock avenues to previously underserved market segments. Prudential and Babylist, the fastest-growing baby registry in the United States, have done just that by allowing expecting parents to add life insurance to their wish list of gift ideas from friends and family, thereby allowing them to purchase the policy on the new parents’ behalf. Babylist surveyed 5,000 expecting parents and found that almost two thirds of those surveyed intended to get life insurance in the next year but, given that life insurance penetration stands at less than 20% in that market segment, it was clear the best intentions don’t necessarily translate into policy take-up. This is a great example of reaching the customer at a point where there is a clear need for life insurance, and making it easy to do so through strategic partnering.

Underwriting

Insurers are continually searching for policyholder information in alternative data sources to supplement or replace part of the usual underwriting process, questions or medical tests for qualifying policyholders. Accelerating the underwriting process in this way can result in more effective pricing and better placing of risks, as well as offering the policyholder a more streamlined onboarding process.

In the U.S., RGA has developed data-supported underwriting tools enabling our clients to get a better and faster understanding of mortality, longevity and persistence of the life policy, especially if combined with further sources of policyholder information such as electronic health records. This allows the insurer to ‘triage’ the policies coming onto the book, into different underwriting process pathways, thereby better matching the amount of underwriting for the expected risk. This is a direct benefit to both the policyholder, who doesn’t undergo unnecessary underwriting measures, and the insurer who saves on time and resource expense.

See also: No Really … Underwriting Is Undergoing An Actual "Paradigm Shift"

Customer Engagement

The industry is engaging with policyholders more frequently through rewards programmes, and the really good examples take customer interaction to the next level with gamification. Companies such as the U.K.-based YuLife strive to use the addictive properties of gaming to motivate employees and policyholders towards healthier living – sleeping right, eating more healthily, and getting enough exercise. They understand the behavioural science behind gamification and use it to make happier, healthier customers via their app, all the while improving insurers’ persistency.

The above three examples are just snippets of where actuaries see the industry evolving and innovating along the value chain. This survey was one way of taking a snapshot of some key stakeholders’ views on where the market is headed with innovation, but I wonder – which areas would the policyholder identify if they were faced with the same question?