Reaching a destination requires being equipped for the journey – knowing where to start, having a plan to move forward, and securing the resources and capabilities necessary to achieve success.

For insurers and HMOs looking to enter the self-insurance market, the road ahead may appear daunting, but a new solution from RGA can help pave the way.

A Growing Market

Today over 60% of all the employers in the U.S. self-insure their employee medical benefits. This may come as a surprise to those used to the days – not long ago – when the majority of employers purchased a fully insured product from an insurance company, a Blue Cross Blue Shield organization, or a Health Maintenance Organization (HMO).

And the self-insurance rate is poised to grow even more. Health plans and providers increasingly view self-funding as a viable market opportunity. Many health providers that initially chose to self-fund their own benefit plan, for example, now desire to introduce a self-funded product in their market. It makes good business sense: Self-funding offers an opportunity to drive more patients to provider-owned facilities and capitalize on synergies with employer clients and distribution partners.

With the increased popularity of self-funding, many health plans have become active in the employer stop loss (ESL) business – and many more are seeking to enter. ESL insurance allows employers to self-fund while protecting against catastrophic or unpredictable losses, as the insurer provides coverage for losses that exceed defined limits. Exposure from specialty drugs and continued growth in $1 million+ claims are among the high-cost growth drivers for ESL insurance.

Many regionally based health carriers and several large nationally recognized group life and disability carriers have entered or are looking to enter the ESL market. Since the passage of the Affordable Care Act (ACA) in 2010, the growth in the ESL market has accelerated from a compound annual growth rate (CAGR) of 7% from 2006-2011 to a 12% CAGR from 2011-2015, with annual ESL premiums now totaling $21 billion. At this point, there is no indication that legislation to replace/repeal the ACA will have a significant impact on this sustained growth.

The opportunity is clear; the challenge: how to gain access to the ESL market and build business once there.

Broker Survey Illuminates ESL Landscape

In May 2018, RGA conducted a survey of brokers about the ESL market, the participants and the opportunity. The results reaffirmed the need for solutions to facilitate health plans’ entrance into and success within the ESL space.

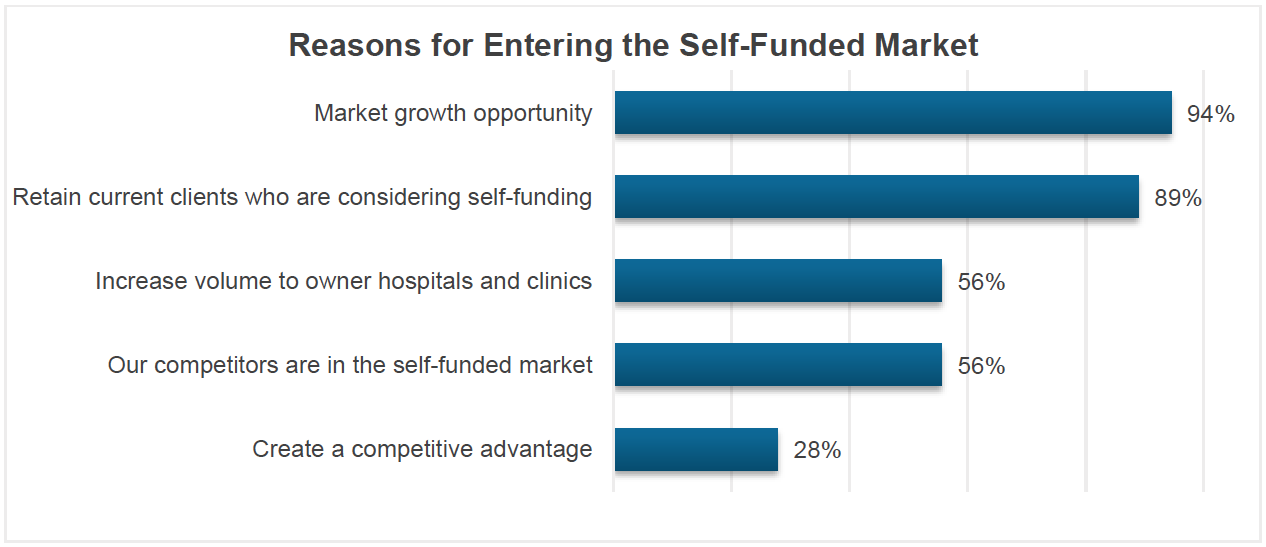

The top two reasons for health plans entering the self-funded market, as cited by brokers, point to a recognition of the significant opportunity presented by this market from both new and existing customers:

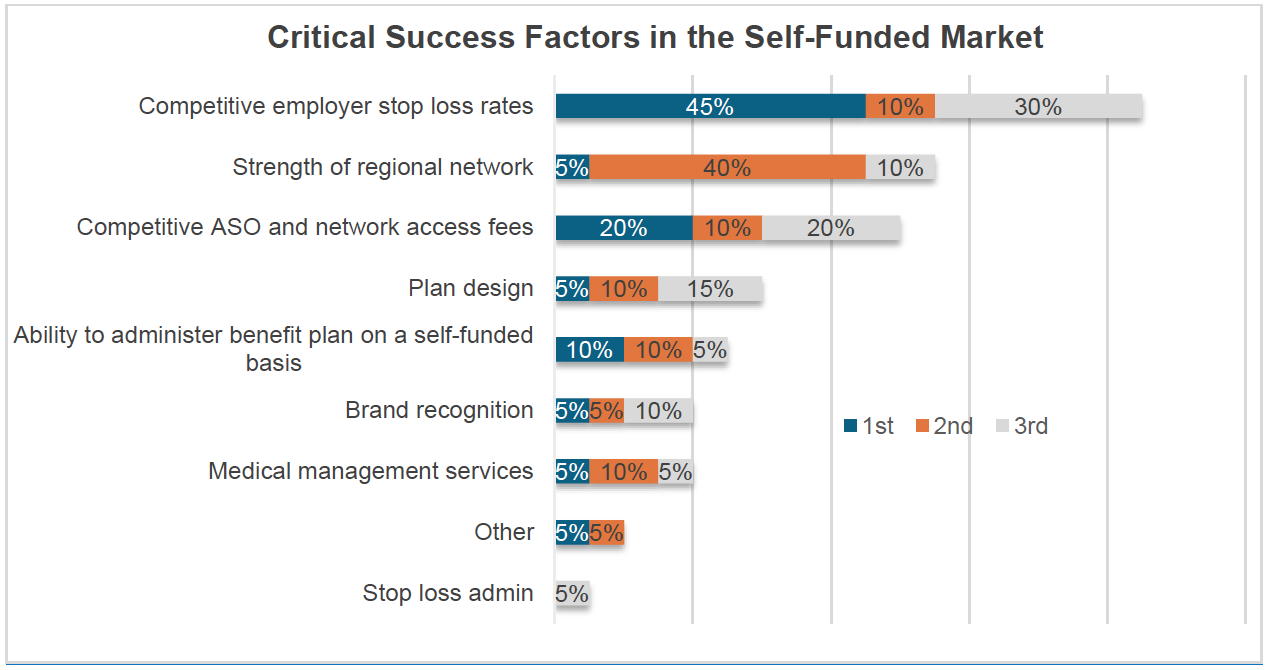

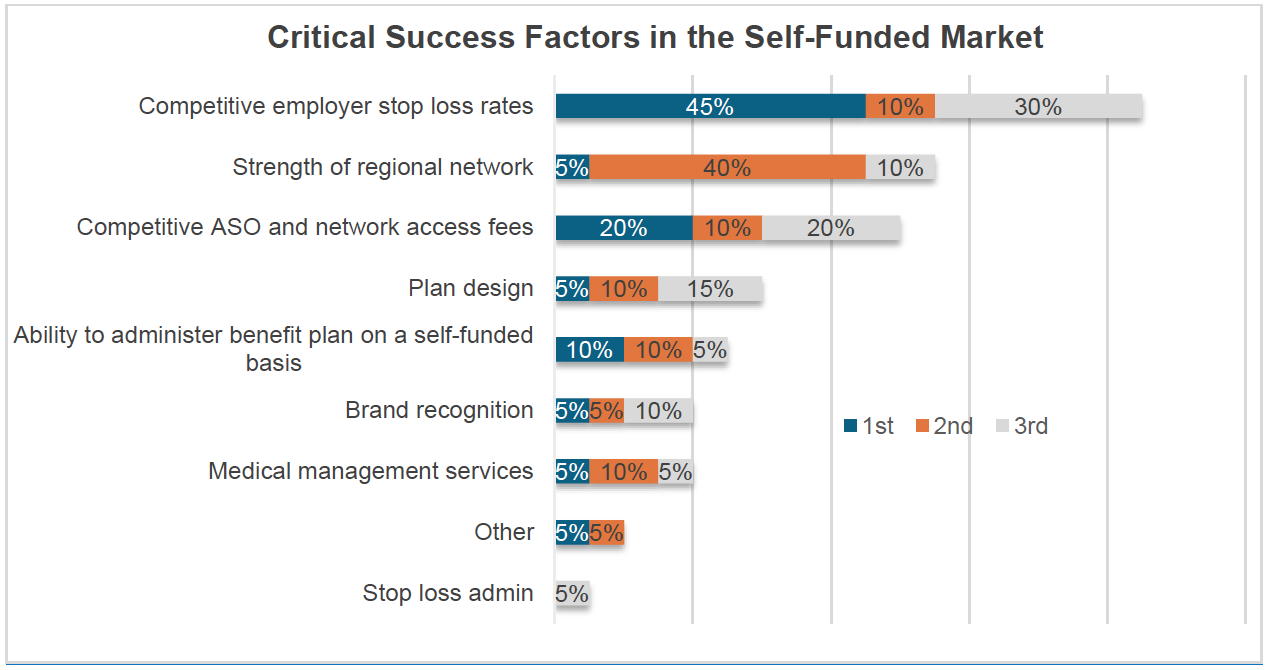

So how do you capitalize on this opportunity? We also asked brokers, having observed their clients’ experiences, what they considered the top three factors for success in the self-funded market. Competitive ESL rates topped the list, cited by 85% of respondents. The strength of the regional network came next, followed closely by competitive ASO (administrative services only) arrangements and network access fees. Other factors indicated by brokers, outside of our list of choices, included strong broker relationships and competitive broker commissions.

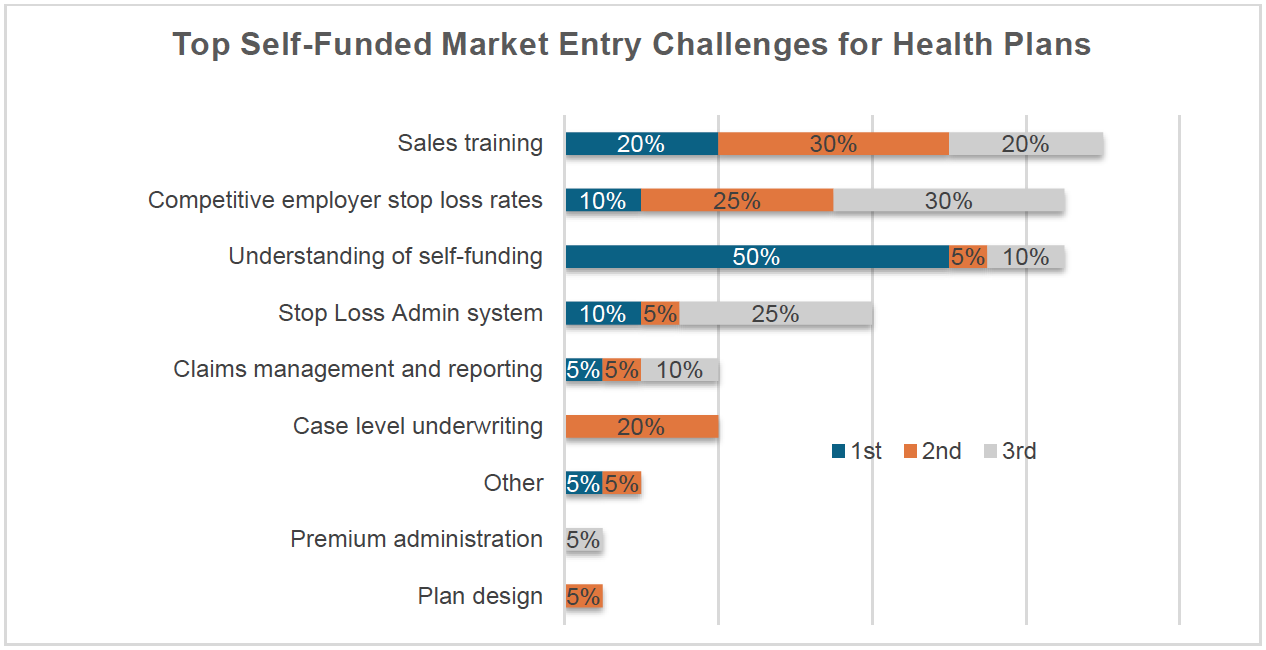

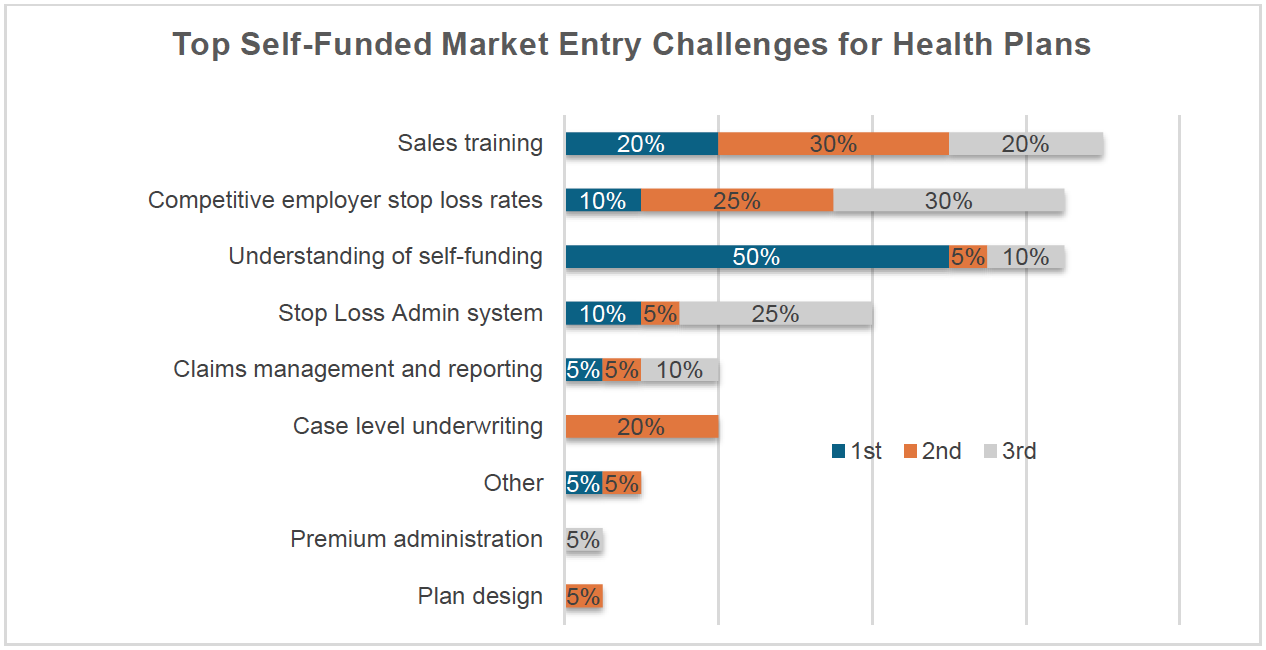

Interestingly, while competitive ESL rates ranks number one as a critical factor for success, this is not considered the top market challenge. That spot belongs to sales training, which was listed as a top-three market challenge by 70% of respondents. Having an understanding of the self-funded market may be even more important, as 50% of respondents ranked it highest. Potential sales channel conflict and uncertainty as to whether it would be best to build, buy or outsource required capabilities were other possible market challenges raised by participants.

RGA’s Turnkey Solution

As a reinsurer with extensive employer stop loss and medical reinsurance experience, RGA saw an opportunity to leverage this expertise with our HMO clients and prospects to help them enter the self-funded market. Our strategy: provide the services necessary to help them both overcome obstacles to market entry and develop their own capabilities to achieve long-term success.

Launched in 2018, RGA’s Managed Care Stop Loss Turnkey solution offers clients a variety of ways to enter the ESL market, including access to a comprehensive suite of Managing General Underwriter (MGU) services – from handling RFPs and quoting rates and terms to policy administration and claims processing. RGA is not directly entering the ESL market; rather, we are offering an ESL product on our fronting carrier partner’s A-rated paper, with a complete reinsurance program backing it up. In other words, this unique turnkey solution provides both the capabilities and capacity to enable market entry at the client’s own level of comfort.

That’s just the start. Over time, RGA will provide training to clients to develop their own MGU services. Simultaneously, as a reinsurer RGA has the ability to retrocede the business so clients can take on risk if they wish to. Ultimately, we believe our clients will want to own the brand and take the risk so that RGA’s role eventually becomes solely that of a traditional reinsurer. RGA will fully support moving the established block of business to the client’s own insurance organization.

The Managed Care Stop Loss Turnkey solution functions as a full-service vehicle for HMOs to enter the self-funded market, regardless of their perceived ability to do so, and over time empower themselves to achieve self-sufficiency. In other words, we equip clients for the journey.