Most, if not all multinational companies’ current growth strategies are centering around expanding and growing their Asian operations.

When sales in Asia for companies such as Apple exceed 30 percent of total sales numbers—more than from Europe and almost the same as the Americas—at growth rates of three to four times that of the other markets, you realize the importance of the Asian markets on the world stage.

The life insurance market is no exception to these rapid growth trends. Indeed, the many and varied dynamics of the market and region have made it, and are continuing to make it, extraordinarily attractive for life insurers and reinsurers alike. In this article, we will explore some of the Asian market’s dynamics and key trends, and how insurers are repositioning for the future.

Snapshot: Asia's Insurance Market

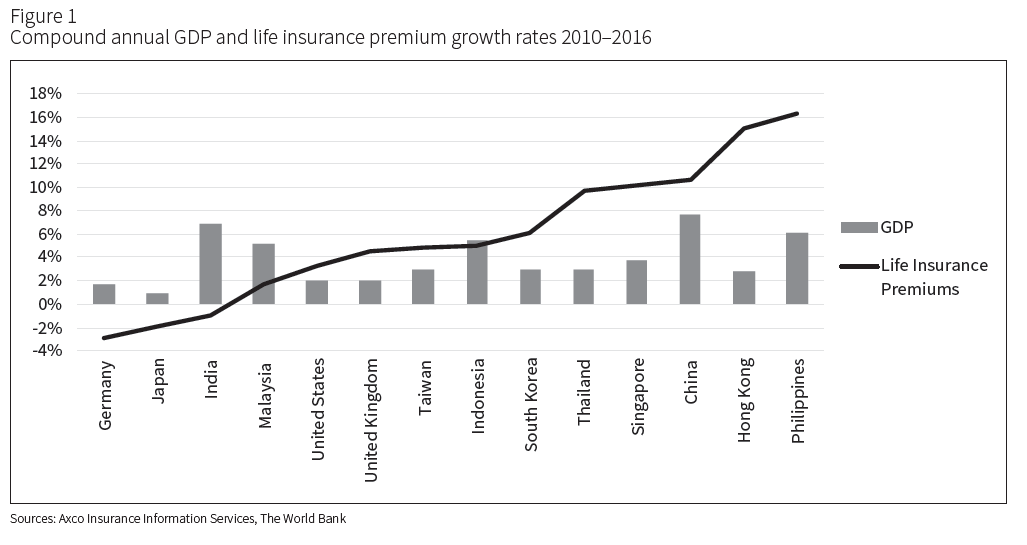

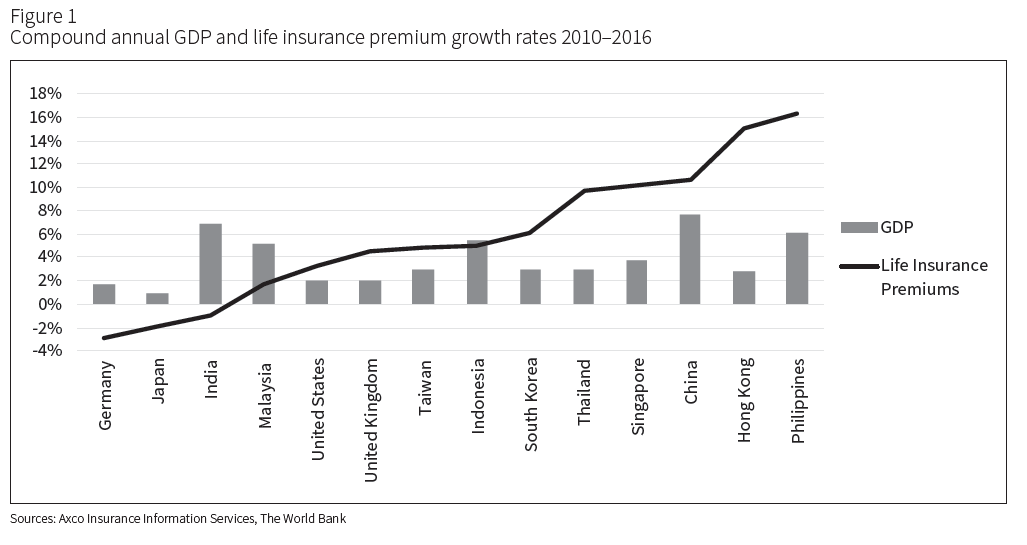

Asian countries comprise five of the top 10 life insurance markets worldwide. As Figure 1 shows, life insurance sales in most of the developing and emerging economies have been outpacing their GDP growth since 2010. In constant 2010 USD terms, GDP growth for these countries has been between 3 percent and 8 percent. Life insurance sales, meanwhile, have been grow-ing at a rate of between 5 percent and 16 percent—much faster than in many developed countries worldwide.

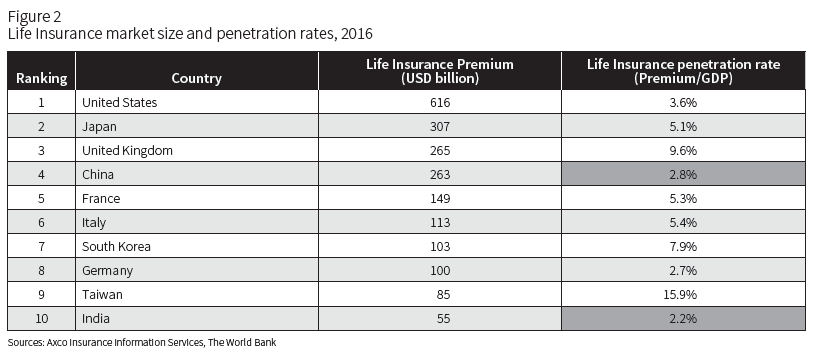

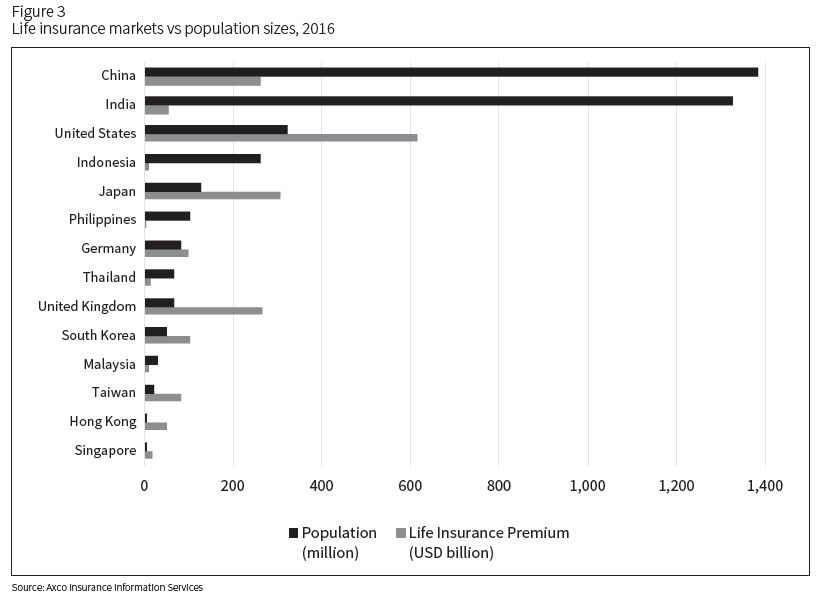

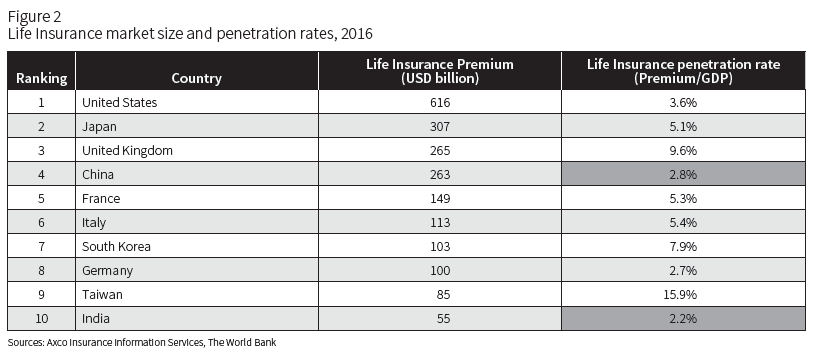

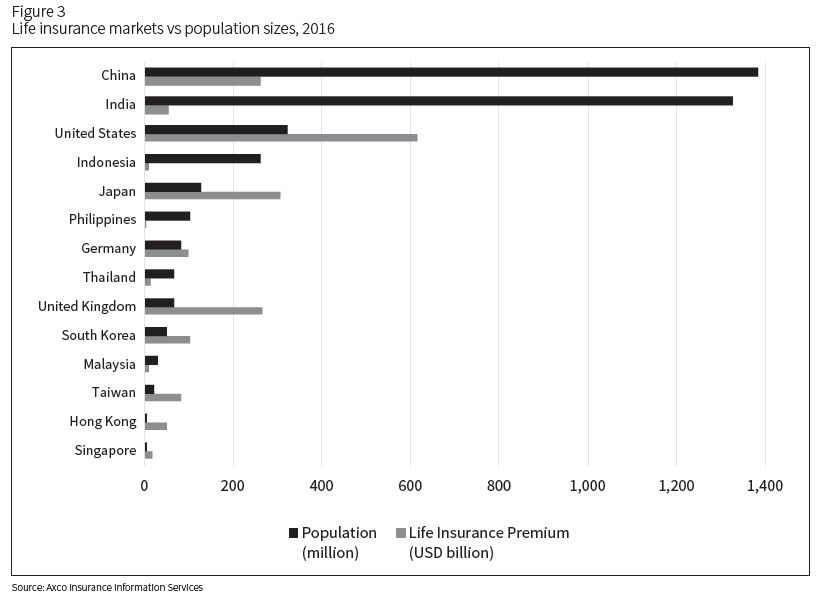

Figure 2 lists the 10 largest life insurance markets by life insurance premium and subsequent life insurance penetration rates. It highlights not only the size of some of the Asian markets (considering also that Hong Kong is currently in 11th place), but also the significant growth opportunities, especially for China and India. Exploring this further by overlaying the size of the life insurance market on population sizes of the respective countries (Figure 3), it further highlights the potential growth for the Asian markets.

The mature and stable markets of Japan, Korea and Taiwan with their aging populations, slower overall economic growth, and plethora of regulations, are presenting unique opportunities for the insurance industry—opportunities to provide innovative protection and cover for elders and families as well as a wide range of financial and capital solutions.

Hong Kong and Singapore, with very favorable market, economic and regulatory environments are sparking significant innovation, as insurers seek new ways to protect individuals who have traditionally lacked cover as well as provide protection to their fast- growing high net worth and elder markets. Meanwhile, Indonesia, Malaysia, Thailand and the Philippines are experiencing very different trends—mainly, rapid population growth and urbanization—which are yielding different sets of protection needs.

Then there is China, currently the most populous country in Asia. Its economic and demographic trends have characteristics in common with many of Asia’s varied markets: rapid aging, urbanization, population growth, and slowing GDP growth . . . and all are advancing at breakneck speed.

Asia’s current economic and demographic dynamics indicate excellent opportunities, especially in developing and emerging markets, for life insurers and reinsurers in the next 10 years. However, like much of the world, Asian countries are facing not just rapidly aging populations and a fast- growing middle class, but also the effects of nearly 10 years of low interest rates and increased regulatory scrutiny stemming from the implementation of International Financial Reporting Standards, and of Solvency II and other risk- based capital regimes. These are presenting Asia with many new financial challenges while opening up the potential for a diversity of new financial and capital solutions.

We are currently observing four key trends in Asia:

- Rapid pace of product development, especially for critical illness and health insurance products, with a focus on aging populations;

- focus on innovative underwriting solutions;

- wellness, with a focus on covering impaired lives; and

- the rise of InsurTech, health care startups and other third- party service providers such as disease management providers.

Rapid Product Development

Although life insurance in Asia is still dominated by savings and investments products, protection benefits are increasingly becoming an even more integral part of all insurance portfolios and solutions. Providing more flexible and reliable solutions to address the challenges and opportunities presented by aging populations is becoming imperative.

Product development, especially in critical illness, is occurring at a blistering pace. Hong Kong insurers alone have launched more than 30 new critical illness products in the last two years, ranging from simpler policies that cover only the four tradi-tional critical illnesses (heart attack, cancer, stroke and coronary artery bypass surgery) to complex multi- pay products that cover more than 100 conditions.

Several factors are creating the financial pressures driving this rapid development:

- Better screening tests, diagnostics, treatments and other medical advances are lengthening lives, which is resulting both in higher populations and more older Asians living with age- related chronic and critical illnesses.

- Government- driven wellness initiatives, such as Singapore’s diabetes awareness campaign and Korea’s thyroid screening program, are yielding both more discovery of disease conditions and greater health awareness.

- More adults are caring for their parents, which is showing them the financial impact of critical illnesses and making them more inclined to buy critical illness for themselves.

- High and rising long- term care costs of diseases such as stroke and cancer, coupled with the impact of loss of income on survivors and their spouses, are generating severe consequences:

- Non- direct medical and non- medical needs costs are much higher than medical costs;

- cancer survival rates are high and rising (five- and 10-year rates are now 70 percent and almost 50 percent, respectively); and

- stroke is a leading cause of long- term disability, especially in survivors over age 65, and up to 80 percent of its long- term costs are non- direct medical and non- medical

All of these factors are significantly raising the financial pressures associated with dealing with critical illnesses and protecting individual’s current and future standard of living, both in terms of direct and indirect medical costs and the lifestyle impact of loss of income. Some new treatments and tests are still expensive but reducing quickly, but as novel treatments emerge and lifespans continue to increase, overall costs are unlikely to drop soon.

Asian insurers are introducing critical illness policies as well as riders on savings policies that offer greater flexibility for comprehensive protection and wealth management. New policy features and options include cover for continuous cancer, reimbursement of medical costs for diabetes, cancer and stroke, and a whole life long- term care benefit that does not require medical underwriting.

They are also investigating ways to expand the ability to sell critical illness to impaired individuals who, in the past, might have been turned down due to health status, age or past claims history. For example, in Singapore, diagnosed pre- diabetics and Type 2 diabetics between ages 30 and 65 can now buy targeted critical illness policies that replace medical examinations with five questions, simplifying their access to cover.

Innovative Underwriting Solutions

Approximately 15 years ago, innovations around financial underwriting led to the creation of one of the most successful new markets in the region, i.e., the high net worth customer markets in Hong Kong and Singapore. Similarly, the focus in all the Asian markets is on enhancing the customer journey and value proposition through new and innovative underwriting solutions and looking to create similar and just as successful business and customer solutions.

Although the current market distribution model is still dominated by the agency channel, companies are making significant moves to expand distribution into other channels, such as bancassurance and digital. Bancassurance solutions, specifically, are gaining significant traction and importance. Some of the more traditional distribution and business models are costly and sometimes inefficient, especially in emerging Southeast Asian countries, given their large populations and geographical dispersions. Leveraging off banking and other distribution relationships, the focus is on making the underwriting process as simple as possible, resulting in the increasing use of banking, financial and lifestyle behavioral factors to simplify underwriting processes and enhancing the customer journey even further.

Innovative thinking is also being applied to combating fraud. In India especially, fraud has been a severe challenge. The Indian fraud research firm Indiaforensic Research estimates that India’s insurance sector loses US$4.5 billion annually due to fraud. India recently went live with a new risk- scoring model integrated with an e- underwriting platform developed specifically to identify potentially fraudulent applicant behavior based on historical industry claim experience. This solution is expected to generate significant savings for the Indian insurance industry in the future.

Wellness, Impaired Lives and Other Lifestyle Solutions

The challenges presented by populations of all ages have placed more emphasis on health insurance protection. As in the West, Asians are increasingly subject to the deleterious health impact of high- stress work environments and sedentary lifestyles, and much of the health care focus is still primarily on “sick care”—finding and fixing illnesses—rather than on prediction and prevention.

Many Asians are entering their senior years without sufficient cover, and several insurers in the region are integrating wellness concepts into their policies. Developing innovative wellness solutions that specifically address impaired lives is also gaining significant traction. Many insurers are currently looking at ways to leverage medical advances, new data sources, and new technologies for this market, developing unique underwriting rules for products that can reduce the risk of covering impaired lives, and designing pre-approved life, health and critical illness solutions targeted for customers who in the past might have been uninsurable due to past health and claims experience.

Still, innovations that expand insurance coverage to customers who previously could not purchase insurance may no longer be enough. We, as an insurance industry, have to ensure that insurance solutions can both protect and improve customer health as well as financial and emotional wellness. Combining insurance solutions with traditional wellness programs, dis-ease management protocols, third- party service providers and InsurTech could permit holistic solutions in the impaired lives wellness space.

Disruption is Not a Dirty Word: InsurTech, Health Care Startups and Other Third-Party Service Providers

InsurTech is bringing new, more innovative and more customer-focused insurance, service and business solutions. FinTech investment in Asia, like the rest of the world, has been growing by leaps and bounds: in 2016 it reached $5.4 billion, just shy of the U.S.’s $5.5 billion, and today accounts for nearly one- fourth of all global financing activity (up from just 6 percent in 2010). In the 12 months ending June 2017, health care startups alone in Asia totaled 240 deals and $3.8 billion raised.

India was No. 1 in the number of health care startup deals in 2015, and many of those entities are successfully raising higher amounts in their current funding rounds as they become more mature. They are also actively seeking opportunities to col-laborate with enterprises in order to scale further. Instead of seeing them as planning to embrace InsurTech in order to seize opportunities and challenges.

In China, technology, social media and consumer product companies are coming together with insurers to leverage their vast customer bases for product marketing. Tencent Holdings, for example, owner of WeChat, recently received approval from regulators to permit its 58 percent owned Weimin Insurance unit to sell policies to WeChat’s 900 million users.

Given the populations of both China and India, the current relatively low insurance penetration rates and the role InsurTech and other innovative insurance solutions are starting to play, an explosion in these markets may not be far away.

Conclusion

From both an economic and demographic perspective, Asia’s insurance markets present significant opportunity for growth and innovation. Innovative critical illness and medical insurance products are still center stage in Asia, but insurers are focusing more and more on holistic insurance solutions combining traditional products with wellness programs, disease management protocols, and third-party service providers, to provide for the changing needs of the different segments of the population, including the previously uninsured and ageing populations.

Embracing InsurTech, data analytics and other technological advances to improve protection and underwriting solutions will increase engagement and enhance the customer journey. This is where insurers in Asia are focused. Stay tuned . . .