Navigating digital disruption is never easy, but U.S. life and health insurers face a particularly rocky road.

As populations age and medicine advances, complex cases are on the rise. At the same time, carriers are dependent on a shrinking pool of highly skilled underwriters to assess these high substandard applications with multiple comorbidities. Surge or staff augmentation programs from third-party underwriters are gaining in popularity. Still, it is important for carriers to ask questions before embarking on any partnership with an external underwriting team.

The Robots Are (Not) Coming

Carriers can start by challenging one of the most persistent myths in underwriting. Too many believe that, in the future, all decisions will be digitized. With the insurance industry awash in data, insurers are under constant pressure to automate – and accelerate – more routine risk assessment and selection processes. Admittedly, rules engines and predictive models can replace labor-intensive back-end processes with convenient, customized, fluid-less underwriting at the point of sale.

Still, there are limits. Many complex cases are too nuanced to leave to an algorithm; they require additional insight and will continue to demand significant human resources. Unfortunately, those resources are in short supply.

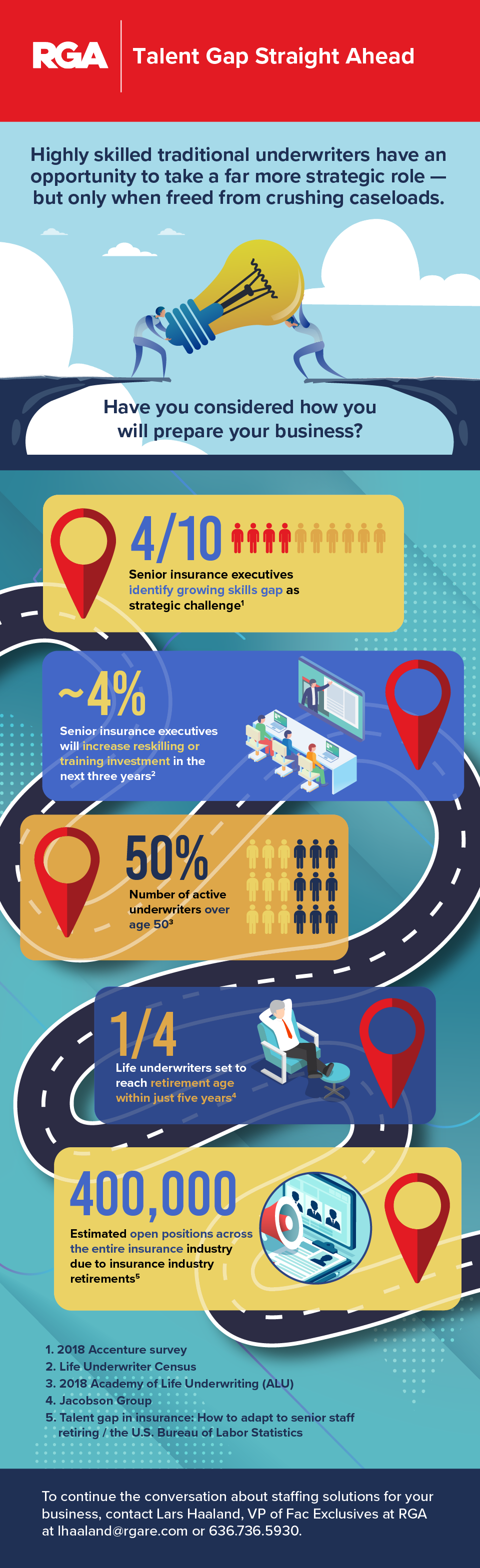

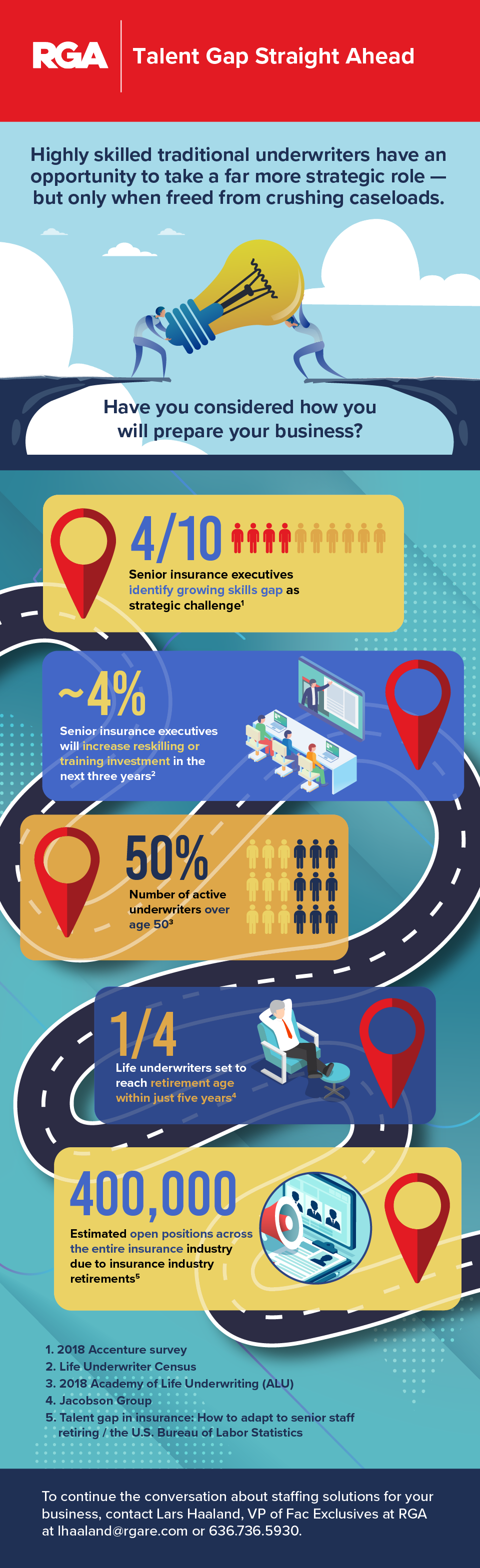

In a global 2018 Accenture survey, four in 10 senior insurance executives identified a growing skills gap as the leading factor influencing their workforce strategies, yet just 4% are making plans to significantly increase reskilling or training investment in the next three years. Recruiting efforts have also stumbled. A 2018 survey by the insurance employment network GreatInsuranceJobs.com found that, with so many positions requiring specific skills, carriers are struggling to fill vacancies in a “job seeker marketplace” for mid-career professionals.

The 2018 Academy of Life Underwriting (ALU) Life Underwriter Census suggests this skills shortage is on track to grow more severe, with nearly 50% of active underwriters over age 50. Indeed, roughly a quarter of life underwriters will reach retirement age within just five years, according to staffing consultancy Jacobson Group.

The result is as predictable as it is unsustainable: a shrinking number of highly skilled professionals are handling growing caseloads. Middle-market insurers have been particularly hard hit – often staffs are so lean that a single vacation or prolonged illness by a key underwriter can place a visible dent in the bottom line.

Surging Ahead with Staffing Augmentation

The good news is that the bad news could be much worse. When cases don’t meet acceleration standards, surge staffing programs offer a vital alternative route. Instead of facing the expense of recruiting and hiring new staff, with the potential for staff reductions in down cycles, the insurer gains access to trained underwriters to process applications during peak periods.

Insurers should ask several questions before entering into any such arrangement:

Are the program’s promises too good to be true?

It’s important to evaluate the reputation of any fee-for-service or reinsurance-based, third-party underwriter. The level of underwriting experience may vary significantly among providers. Some third-party underwritten cases can become lost after the preliminary underwriting is complete as the underwriter may lack sufficient life and health expertise to fully evaluate complex cases and apply the insurer’s guidelines correctly.

Not surprisingly, in these situations growing numbers of incomplete cases can be returned to the carrier’s home office underwriters, adding unwanted delay and burdening understaffed teams. Carriers can avoid this fate with some basic investigative effort, including asking for recommendations and calling those satisfied customers or consulting research and advisory firms.

How fast can the underwriting team react in the case of an unplanned staffing shortage?

Given the realities of a fast-paced business environment, insurers should expect and demand responsiveness and speed from their third-party underwriter. RGA’s Strategic Underwriting Program (SUP), which was designed to help insurers manage particularly heavy workloads and staffing shortfalls, offers an example. SUP deploys underwriting resources quickly upon receipt of cases, providing carriers the assurance their cases will be processed in a timely manner.

What is the experience level of the team’s underwriters?

Too often staffing augmentation programs overly rely on underprepared junior underwriters. Look for a program that takes the opposite approach. For example, SUP underwriters bring two decades of experience, on average, and can draw on highly technical, specialized knowledge in fields as diverse as genetics/genomics and avocations.

Does the program have physicians on staff?

Given rapid medical advances and the increasing complexity of many cases, medical expertise is a clear differentiator. RGA’s SUP underwriters are supported by an industry-leading team of physicians and medical directors with specialties ranging from cardiology to neurology to geriatrics. Whether it be through attending physician statements, EKGs, or other medical information, RGA’s highly skilled doctors apply years of experience and a wealth of resources to regularly evaluate client cases submitted via SUP.

How flexible are these third-party underwriters?

Third-party underwriters affiliated with a staffing program should be prepared to step in and handle underwriting at any stage, from application or requirement screening to supporting documentation reviews and final decisions made and documented. After all, the purpose of such a program is to help a carrier better adapt to often unpredictable underwriting needs. Look for evidence that this underwriter is adaptable enough to engage with the case from beginning to end.

Does this underwriter have a reputation for partnership?

The best fee-for-service underwriters realize their reputations rest on quality and will partner with a carrier to ensure the program is successful. Conversely, other services view the engagement as a series of transactions and will not ensure satisfaction with the quality of the underwriting work. As an extension of RGA’s decades-long commitment to building strong partnerships, SUP is designed to give every client case the attention it deserves. In fact, SUP provides its own auditing services to ensure that all underwriting work meets RGA’s high standards.

SUP partnerships also contribute an added measure of security. As a reinsurer (one of the world’s largest), RGA shares the risk with clients and with “skin in the game” has an ongoing vested interest in ensuring that all cases are evaluated accurately. Existing treaties with RGA can often cover the costs of using SUP.

Results show that this approach is working. Clients that initially turn to SUP to request a limited number of resources or submit a limited number of cases often return to request additional resources, submit more cases, or even extend the duration of the program.

Let’s face it: The underwriting role is changing, and the highly skilled underwriter has the opportunity to take a far more strategic role in the business and add value throughout the insurance process. But this can only happen if carriers can free staff from crushing caseloads. To learn more about surge staffing programs, contact RGA.