Expanding Possibilities Within Distribution Channels

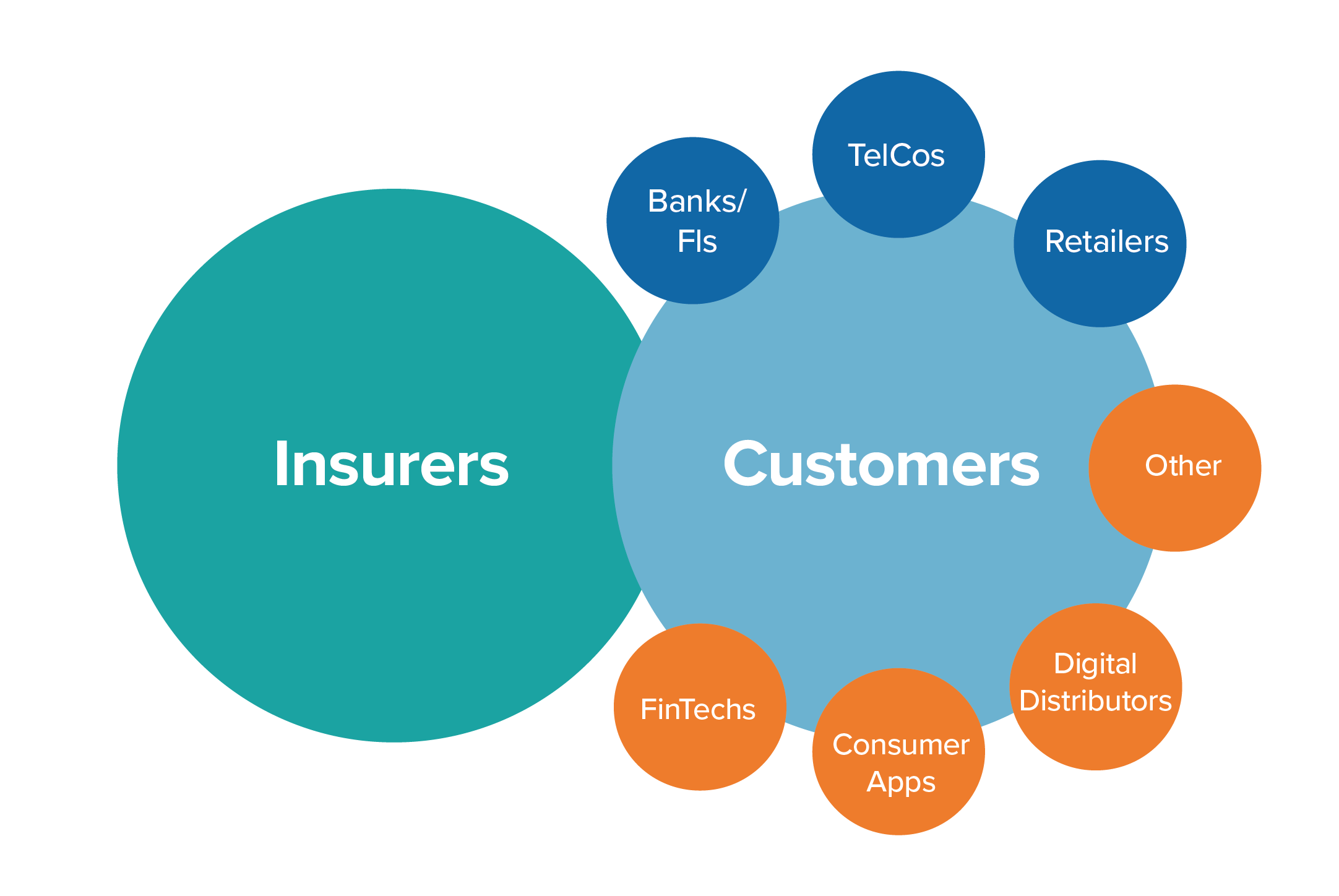

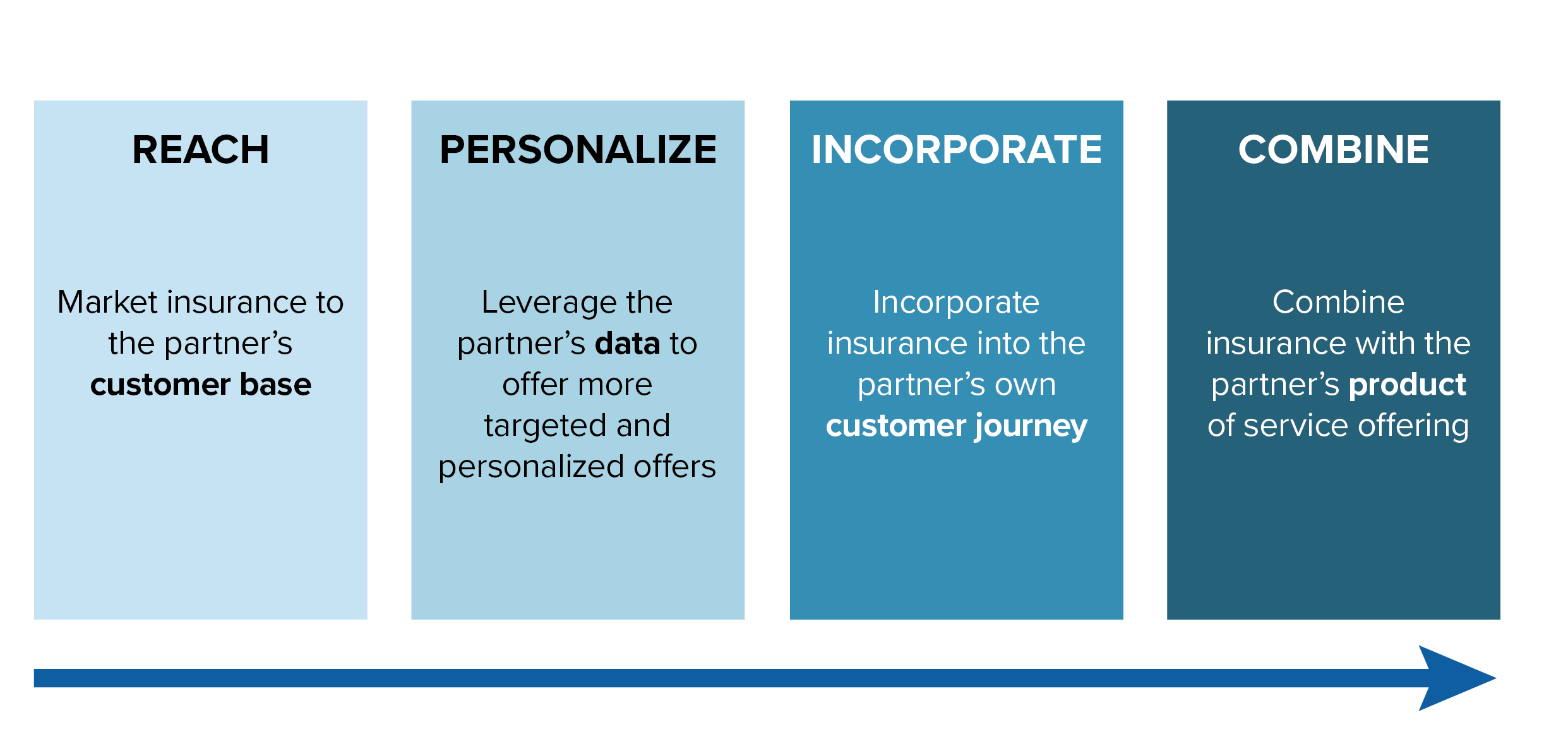

While life insurance distribution channels have been multiplying, so too have opportunities to generate more value from any given distribution partnership, as illustrated by the growing interest in so-called “embedded insurance.” These opportunities can be described along a continuum, differing based on the level of integration and collaboration needed between the insurer and channel partner, and based on the goals and constraints of the respective parties.

Expanding Possibilities within Distribution Channel

To maximize the value of any distribution partnership, both parties should first understand and agree on the objectives to achieve and any applicable constraints.

While life insurance distribution channels have been multiplying, so too have opportunities to generate more value from any given distribution partnership, as illustrated by the growing interest in so-called “embedded insurance.”

Starting on one end of the spectrum, insurers may be motivated to form a distribution agreement with an affinity partner purely to REACH a new pool of customers. In its simplest form, this approach involves marketing insurance products to a list of prospective customers through an outbound campaign, for example using a call center, direct mail, email, or mobile.

However, to realize more value from a distribution partnership, the insurer can PERSONALIZE offers by leveraging a partner’s existing customer insights and relationships. Insurers are already moving in this direction, for example, by leveraging banking data to better understand customer needs as well as to enhance risk assessment and selection, and tailoring offers based on those insights. Such approaches can help increase conversion rates, reduce customer acquisition costs, and improve unit economics. Personalization techniques are subject to data availability, privacy considerations, and regulations. Still, as open banking and open data models continue to grow in popularity, opportunities for data-driven personalization in channel partnerships seem likely to proliferate in ways that are mutually beneficial to the customer, the distributor, and the insurer.

To understand the value of personalization, simply observe a typical shopping mall or High Street. Shoppers slip in and out of stores, peering at displays and examining merchandise. Occasionally, a salesperson approaches, tentatively, to ask if a customer needs help. Now imagine that same attendant not only knows what customers need, but also what type of offers they would be most receptive to, and their likelihood of accepting an offer. With such superpowers, how much more effective would that salesperson be at targeting customers and closing sales? Personalization using partner data promises to empower life insurers in just this way, providing the insights and opportunities necessary to reach the right customers at the right times, and with the right offers.

Diving deeper, there may be opportunities to INCORPORATE the life insurance offer directly into the partner’s customer journey. The idea? Identify natural connection points, moments when a prospect can be presented with life insurance offers in a way that is as frictionless as possible, perhaps even expected. For example, a home buyer obtaining a mortgage, or a parent preparing a digital will, may be offered the option to easily purchase life cover at the same time.

Finally, it can make sense to COMBINE insurance with the partner’s product or service, such that the customer does not have to take any additional action because life insurance is already included in their purchase. In some cases, the cost of such cover may be subsidized by the insurer, the distributor, or a combination of the two. Typically, the level of coverage provided is limited, but still enhances the value the customer receives from the purchase. This technique helps create awareness about life insurance and an opportunity to establish new customer relationships. The insurer can engage the policyholder to discuss any coverage gaps, which can then lead to up-sell and cross-sell of other products to satisfy those needs. For example, some TelCos offer a basic level of insurance cover with their mobile plans.15 Also, some bank accounts16 or credit cards17 include basic levels of life insurance cover as customer perks and provide customers the option to purchase additional cover, if needed. A similar approach could be applied to combine complementary insurance offerings, for example life insurance with travel or home cover.

Conclusion

The alternative distribution landscape for life insurance is rapidly evolving, presenting growth opportunities across at least two dimensions:

- First, the breadth of potential alternative distribution partners available is growing and includes both established and emerging players. Insurers should identify which relationships are good fits and offer strong untapped potential. All else being equal, companies and organizations with established customer bases, strong brand recognition, or high customer engagement tend to be better candidates.

- Second, insurers should think about how to make the most of any given distribution partnership. Beyond simply reaching a new customer base, insurers can explore different ways to leverage the partner’s strengths to deliver a more compelling customer proposition and lower customer acquisition costs.

By fully capitalizing on partnerships, alternative distribution and embedded insurance can be efficient growth engines for life insurance, help expand its reach into underserved markets, and contribute to closing the global protection gap.