You’re often eloquent about the sweeping changes in life insurance that you’ve witnessed in your distinguished career, but I’d like to zero in on the opportunity you’re pursuing now, to exploit the extraordinary progress in understanding the human genome.

You—and I—think genomics will have a profound effect on life insurance, among many areas, and I’m hoping to explore the opportunities.

Greig Woodring:

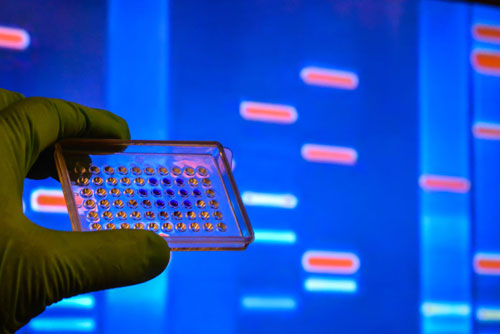

Our increasingly detailed understanding of genetics and how it affects our health will turn a lot of the life insurance selection process on its head. The change will accelerate when the cost of sequencing a person’s genome drops from $1,000—roughly where it is today—to $100, which will be so cheap that pretty much everybody can have a copy of their genetic information. And the drop in cost isn’t that far off.

Many have gotten some information from some of the consumer tests, the 23andMe-type tests, and there's going to be a time in the near future where you get all the information about your genome from advanced genomic sequencing.

Life insurers can also use genetic information to improve the health of existing, in-force policyholders, for the benefit of all. The interests are perfectly aligned. Life insurers want their policyholders to live longer, just as they themselves do.

Our increasingly detailed understanding of genetics and how it affects our health will turn a lot of the life insurance selection process on its head.

Many researchers believe, and are intensively investing money and effort, in the pursuit to extend the maximum human lifespan beyond the 100-year or 115-year mark to maybe 120 to 150. But who wants to live to 150 unless they're healthy? So, life insurers may be well-positioned to extend the “healthspan” of their policyholders. Life insurers should be concerned about the health of their policyholders more actively.

Life insurers will have to get up a genomics learning curve. They haven't really begun that yet. And I think the understanding and usage of genetic information will separate companies that are successful in this next wave from the ones that fall behind a bit.

Life insurers will have to get up a genomics learning curve. They haven't really begun that yet.

ITL:

I can imagine an adverse selection problem. I mean, if I'm the one who pays $200 to have my genome sequenced and interpreted, I’m going to know much more about my likely lifespan than an insurer can, without access to that information. Does that seem to be a big problem, or do you see ways around the adverse selection issue?

Woodring:

I think that is a serious problem. Insurers will have to deal with that whether they want to or not. When consumers know their genetic information and can decide whether to buy life insurance, and how much, based on that information, the underwriting process needs to adapt. In the near future, clinical grade genomic information will be inexpensive and widely available.

ITL:

Tell us a bit about Genomic Life, a company that you’ve been involved with for several years now and that I think illustrates the kind of opportunity that genomics will create, whether for insurers or for others.

Woodring:

Genomic Life is a service company, not a life insurer. A product that we're offering first and have been for a couple of years now with good success is a cancer product. If someone gets cancer, we'll sequence the cancer to help inform precision treatment, and we will provide a cancer support specialist and concierge navigation services that help them get through the disease and its emotional body blows. We'll get our members into clinical trials at a much higher rate than they would if left to their own devices and steer them to the best cancer centers.

It's very difficult to navigate through the labyrinth of a disease like cancer in the environment that we have for healthcare delivery in the U.S. market. So, we help people get through that.

ITL:

And, at least as I see it, that sequencing of the cancer’s genome is just the start. AI will kick in, in terms of the analysis of people’s genomes and what they say about, among other things, propensity for certain diseases, as well as in terms of possible treatments for diseases. A business owned by Google showed earlier this year that its AI could determine how proteins fold, more accurately than the chemical process that had been used up until now—and that cost hundreds of thousands of dollars and required more than a year just to determine the shape of a single protein. The final shape of a protein—and not just the string of amino acids that compose it—determines so much about how that protein acts. And once you can do this kind of analysis, about the shape, in a computer rather than in a lab, the pace of analysis kicks into an exponentially faster gear.

Woodring:

I agree. That was a really big deal, even if it was little-noticed outside of the world that follows those sorts of things. If you think about the rapidity of the development of COVID vaccines, the same mRNA technology that was used for that could be used to develop cancer vaccines.

If you think about the rapidity of the development of COVID vaccines, the same mRNA technology that was used for that could be used to develop cancer vaccines.

That is extremely possible and a logical next step. There are people working on it right now. So, don't be surprised if there's a whole host of cancer vaccines coming in the next couple of decades.

ITL:

Are all these developments in genomics a separate stream that branches off from what you've done in life insurance or do they then feed back into life insurance?

Woodring:

It all feeds back into life insurance. Think about a life insurance company with a million policies. Those million policies are going to get 50,000 cancer cases a year. Now imagine we can keep each of those 50,000 people alive for an extra two years. What is the value of that to the insurance company? And we think that is doable, today.

We're just touching the surface of dealing with cancer today compared with when you have liquid biopsies [blood tests that can detect a broad array of cancers] and other genetic-based tests coming along that will lower the death rates.

We'd like to get to the point of helping insurance companies largely eliminate cancer among their policyholders as cause of death. And right now, for most of them it’s a leading cause of death; underwriters don't screen out cancers as well as they do, for example, cardiovascular deaths.

You’ll be able to tell your policyholder base that, look, we’ll help you increase your health lifespan, at least partially, as best we can. This is a good message for a life insurance company.

ITL:

Fascinating. That feels like a reasonable place to end things. But do you have any parting words?

Woodring:

As you said, artificial intelligence has a big role to play. As you begin to use artificial intelligence in combination with genetic information, I think we'll find doors to rooms we didn't know existed. So, I'm really excited about the future of life insurance, and in a different way than it's been in the past. Not only protecting you and your family from the adverse effects of premature death but helping maintain you in the best position to live a healthy, long life.

If that's what a life insurance company becomes, I think that everybody will be excited.