“Precision” has become a popular buzzword in financial services – yet when it comes to life and health insurance, underwriting processes have been challenged to keep pace with medical advances. Is it time for a new approach to calculating risk?

Many underwriters are missing an opportunity to allocate risk more accurately and expand into underserved markets. Research from consultancy Accenture suggests 80%a. of insurance customers are looking for personalized offers, policies, or recommendations tailored to their unique circumstances.

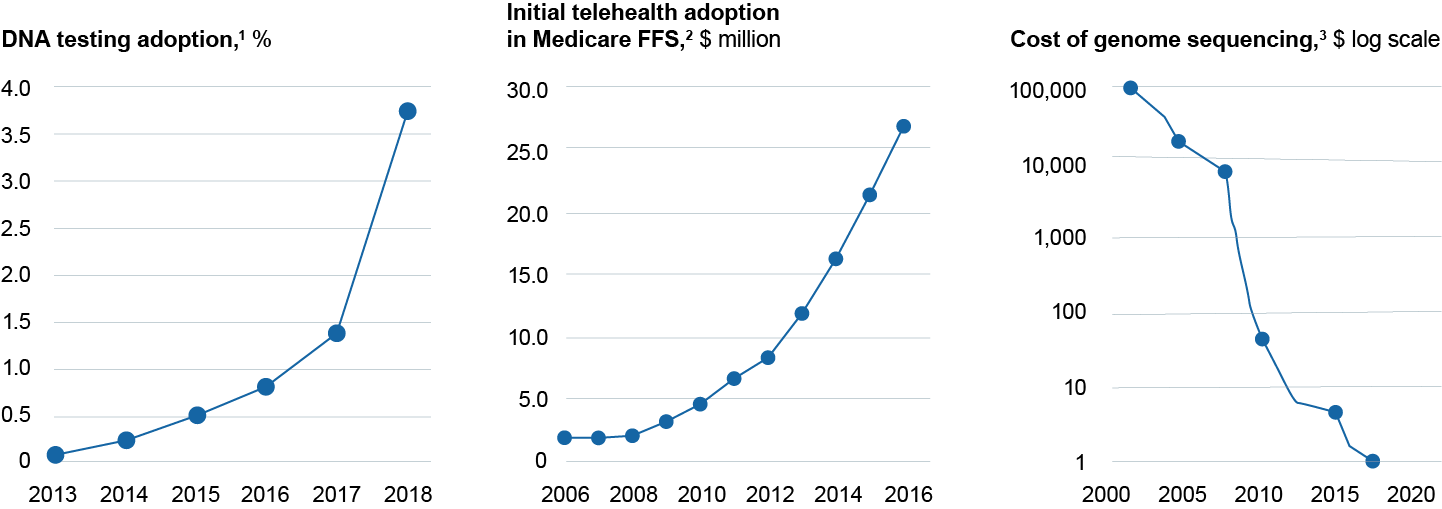

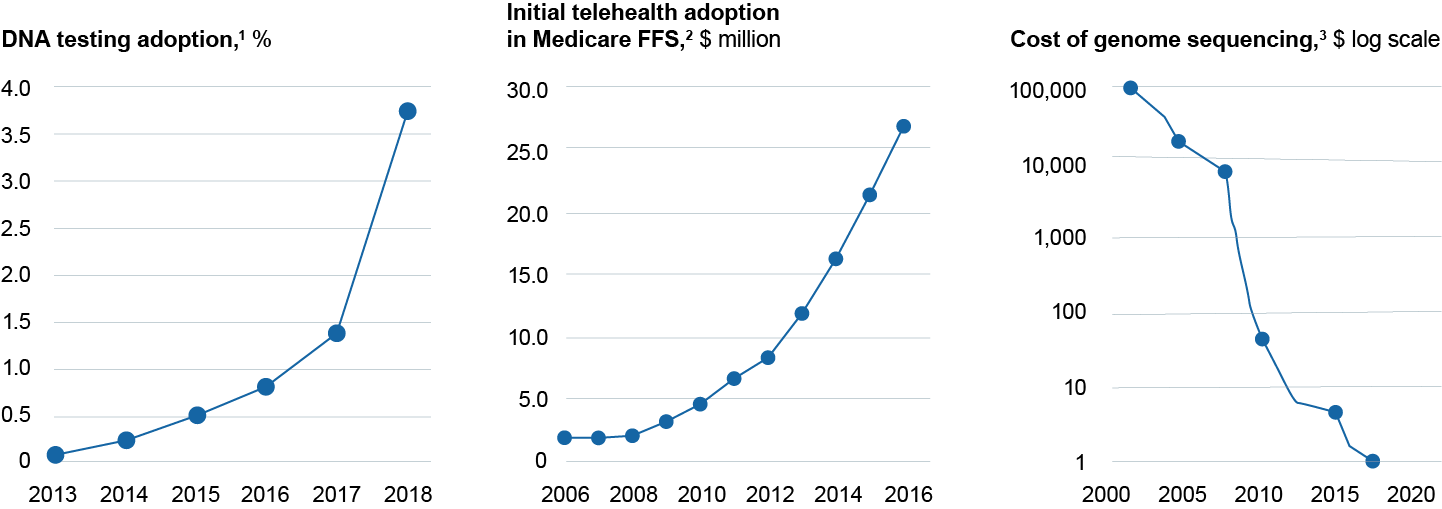

On the other hand, technology-driven innovationb. is fueling exponential improvement in medical advances, from prevention to diagnosis to therapeutics. Life and health underwriting decisions that more closely reflect the latest clinical insights can only strengthen carriers, yet many underwriters still rely on tables and calculators that fail to reflect or connect recent clinical literature and population data to improve underwriting accuracy.

Now is the time to deliver greater precision, which is why RGA has harnessed its global research and data science capabilities and partnered with clients to develop a new solution – the Precision Calculator.

Break from the Past

Rising expectations have a way of throwing current deficits into sharp relief. Underwriting today remains reliant on an age-and-policy-face-amounts table that has not changed substantially in decades. This approach often fails to factor in subtle differences in risk factors, from regional variations to interrelationships. For example, it is not uncommon for an underwriter to “table hop” or shift between standard and more specialized ratings tables and calculators on a complex case, evaluating risk factors independently as a matter of course.

And yet this technique fails to reflect the complex interplay between risk-factors, from build and blood pressure to high-density lipoprotein cholesterol and triglycerides, and the evolving scientific understanding of the ways these measures can take on different meanings over the length of a policy term. Could a system of credits and debits in a single ratings table better account for the interactions between risk factors, whether they are confounding, additive, or even multiplicative?

Falling Behind? Underwriters Must Keep Pace with Exponential Medical Progress

FFS, fee-for-service.

Source: Adapted from McKinsey Insights: Medicare Payment Advisory Committee, Report to the Congress: Medicare Payment Policy, March 2018; National Human Genome Research Institute, DNA sequencing costs: Data, April 25,2018; Regaldo A, “2017 was the year consumer DNA testing blew up," MIT Technology Review, February 12, 2018.

Local Risk, Global Rating?

Similarly, many underwriting tables are global, yet risk is not. Evidence suggests there are significant regional, and even inter-regional, differences in disease patterns. Consider the relationship between the body mass index and all-cause mortality, which varies markedly among never-smokers within European, North American, Australian, and Asian cohorts. The same is true of the risk of certain cancers, which can vary not only among genders but by location. Would it not make more sense to consider the effect of regional differences in disease patterns to develop a risk factor profile for insured events?

Time and product line may also merit more attention in risk assessment. Consider diabetes and glucose metabolism measures, where duration of exposure to the disease throughout the policy term could influence the assessment of standard versus substandard risk. For example, mortality and morbidity have significantly improved for well-controlled Type 1 and Type 2 diabetes mellitus in recent years, but risk ratings may not fully reflect factors such as disease duration and differences in treatment, from diet and oral medication to insulin. Underwriters may ask how much of any improvement is due to better glycemic and cardiovascular disease risk-factor control, which are already rated, versus other factors.

A New Type of Calculator

A new type of calculator – built for accuracy, flexibility, and convenience – is the answer. Online and application-based calculators that measure everything from build to blood pressure are nothing new in hospital systems and doctors’ offices. However, above and beyond those well-established tools, RGA has created a Precision Calculator for its Global Underwriting Manual. Designed to parallel tools from clinical settings, the Precision Calculator eliminates many of the disadvantages of fixed rating tables. By consolidating all information in a single, convenient stop, the calculator negates the need for table hopping and independent analysis.

Unlike other tables and calculators, the Precision Calculator can cope with far greater complexity, including interacting and contingent factors. By using a system of debits and credits, users can evaluate variables independently or in combination. The calculator can manage categorical (e.g. presence of diabetes mellitus, treatment for hypertension) and continuous (e.g. serum cholesterol, systolic blood pressure, BMI) variables. And these can be modified by the other inputs, reflecting the proportional and interactive nature of risk assessment.

RGA’s Precision Calculator reflects regional and inter-regional variations in rating factors and tracks risk over the policy term rather than in a single snapshot, mirroring the current clinical understanding of how diseases progress over time. The resulting ratings are consistent, regionalized, comprehensive, and can be rounded based on in-house underwriting systems and needs. Plus, the Precision Calculator returns a breakdown of each rating so that the underwriter can retrace how each input contributed to the outcome.

Perhaps most importantly, the ratings are research-based and constantly updated. This honors RGA’s underwriting philosophy, which relies on a rigorous methodology that encompasses clinical research from renowned peer-reviewed scientific and medical journals, statistical information, and current intelligence on avocations and occupations for a more realistic and holistic view of the many dimensions of risk.

Medicine never stands still, so neither can underwriting. Insurers must continue to introduce innovations like the Precision Calculator, if only to recognize the industry’s growing understanding that all medicine is personal and so risk assessment must consider the health of the whole person.